Compare Pasupati Spinng. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Capital Employed (ROCE) of 4.25%

- Poor long term growth as Net Sales has grown by an annual rate of 7.45% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 14.55 times

Flat results in Dec 25

Stock DNA

Garments & Apparels

INR 29 Cr (Micro Cap)

31.00

52

0.00%

1.64

2.96%

0.92

Total Returns (Price + Dividend)

Pasupati Spinng. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Pasupati Spinning & Weaving Mills Ltd is Rated Sell

Pasupati Spinning & Weaving Mills Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 07 February 2026, reflecting a change from a previous 'Strong Sell' grade. However, all fundamentals, returns, and financial metrics discussed here are current as of 11 February 2026, providing investors with the latest assessment of the stock's position.

Read full news article

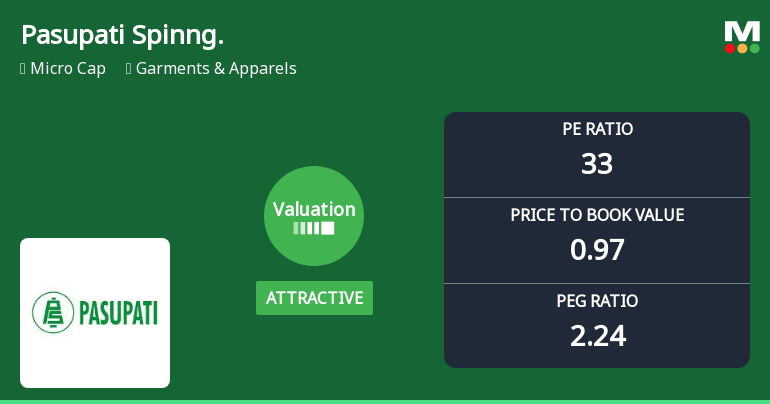

Pasupati Spinning & Weaving Mills Ltd: Valuation Shifts Signal Renewed Price Attractiveness

Pasupati Spinning & Weaving Mills Ltd has witnessed a notable improvement in its valuation parameters, shifting from a very attractive to an attractive rating. This change reflects evolving market perceptions amid a mixed performance backdrop, with the stock showing a significant day gain and outperforming the Sensex over the medium term despite recent volatility.

Read full news article

Pasupati Spinning Q3 FY26: Marginal Growth Masks Deeper Profitability Concerns

Pasupati Spinning & Weaving Mills Ltd., a Haryana-based synthetic blended yarn manufacturer with a market capitalisation of ₹29.00 crores, reported net profit of ₹0.27 crores for Q3 FY26, marking a sequential improvement of 58.82% from Q2 FY26's ₹0.17 crores but representing a 44.90% decline year-on-year from ₹0.49 crores in Q3 FY25. The micro-cap textile company's shares surged 9.84% following the results announcement, closing at ₹33.83, though the stock remains 25.65% below its 52-week high of ₹45.50.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

09-Feb-2026 | Source : BSEPlease find attached herewith copy of newspaper publication in respect of Unaudited financial results for quarter ended 31/12/2025.

Results-Financial Results For 31/12/2025

07-Feb-2026 | Source : BSEPlease find attached herewith financial results for period ended 31/12/2025

Board Meeting Outcome for Outcome Of Board Meeting Held On 07/02/2026

07-Feb-2026 | Source : BSEPursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 this is to inform you that Board of Directors of the Company at its meeting held on 07-02-2026 has inter-alia considered and approved the following business: 1. Standalone Un-audited Financial Results of the Company for the quarter ended December 31 2025; 2. Took note of Review Report received from Statutory Auditor of the company for the quarter ended on 31/12/2025. 3. Review of related party transactions for the quarter ended on 31/12/2025. You are requested to take the same on your records and oblige.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Pasupati Spinning & Weaving Mills Ltd has announced 10:4 stock split, ex-date: 15 Mar 12

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

9.996

Held by 6 Schemes (0.03%)

Held by 0 FIIs

Pasupati Olefin Ltd. (0.44%)

Jm Financial Asset Reconstruction Company Limited (0.107%)

7.59%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 3.93% vs 18.76% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 58.82% vs 1,600.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -3.93% vs -14.39% in Sep 2024

Growth in half year ended Sep 2025 is 280.00% vs -176.92% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -2.08% vs -10.77% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 15.38% vs 143.75% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -6.88% vs -21.47% in Mar 2024

YoY Growth in year ended Mar 2025 is 49.15% vs -46.36% in Mar 2024