Compare Privi Speci. with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.53 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 3.53 times

With a growth in Net Profit of 56.75%, the company declared Very Positive results in Sep 25

With ROCE of 18.5, it has a Very Expensive valuation with a 5.2 Enterprise value to Capital Employed

Reducing Promoter Confidence

Stock DNA

Specialty Chemicals

INR 10,901 Cr (Small Cap)

40.00

39

0.17%

0.84

21.52%

8.91

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Jul-24-2025

Risk Adjusted Returns v/s

Returns Beta

News

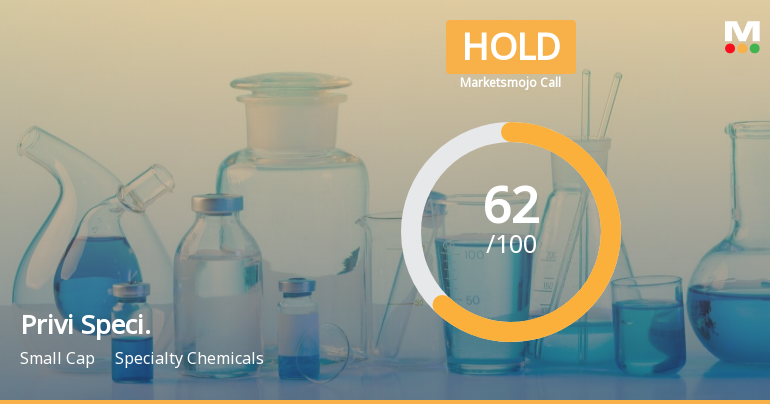

Privi Speciality Chemicals Ltd is Rated Hold

Privi Speciality Chemicals Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 31 December 2025. However, the analysis and financial metrics discussed below reflect the company’s current position as of 03 February 2026, providing investors with an up-to-date perspective on the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news articleWhen is the next results date for Privi Speciality Chemicals Ltd?

The next results date for Privi Speciality Chemicals Ltd is scheduled for 09 February 2026....

Read full news article

Privi Speciality Chemicals Ltd is Rated Hold

Privi Speciality Chemicals Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 31 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 23 January 2026, providing investors with an up-to-date view of the company's performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

02-Feb-2026 | Source : BSEInvestor Call Intimation scheduled to be held on Tuesday February 102026.

Board Meeting Intimation for Intimation Of Board Meeting Dated February 092025

29-Jan-2026 | Source : BSEPrivi Speciality Chemicals Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/02/2026 inter alia to consider and approve Intimation of Board Meeting to be held on Monday February 092026 to consider and approve the un-audited standalone and consolidated financials results.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSECertificate under Regulation 74(5) of SEBI (D&P) Regulations 2018 for the quarter ended December 31 2025.

Corporate Actions

(09 Feb 2026)

Privi Speciality Chemicals Ltd has declared 50% dividend, ex-date: 24 Jul 25

No Splits history available

Privi Speciality Chemicals Ltd has announced 1:10 bonus issue, ex-date: 09 Jul 14

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 8 Schemes (9.64%)

Held by 72 FIIs (1.64%)

Vivira Investment & Trading Pvt Ltd (29.74%)

Sbi Multi Asset Allocation Fund (9.38%)

15.41%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 21.46% vs -8.92% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 51.64% vs -6.90% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 24.15% vs 15.36% in Sep 2024

Growth in half year ended Sep 2025 is 104.97% vs 116.49% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 17.33% vs 4.86% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 88.59% vs 77.94% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 19.92% vs 8.98% in Mar 2024

YoY Growth in year ended Mar 2025 is 97.03% vs 327.33% in Mar 2024