Compare Prozone Realty with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 7.00 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 7.00 times

- The company has been able to generate a Return on Equity (avg) of 1.41% signifying low profitability per unit of shareholders funds

Healthy long term growth as Net Sales has grown by an annual rate of 32.93%

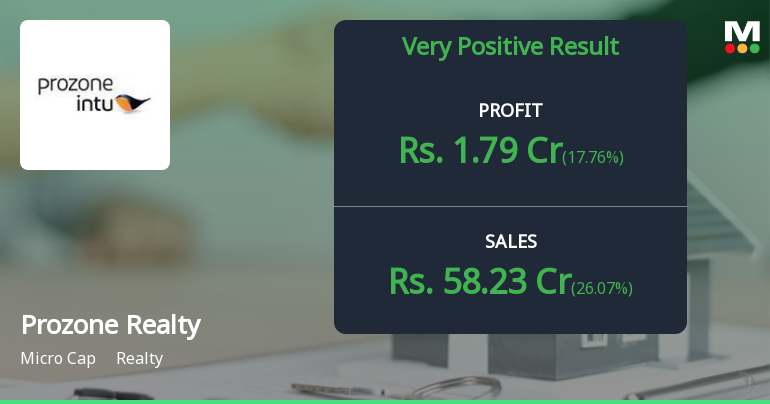

Positive results in Sep 25

With ROCE of 4.7, it has a Very Expensive valuation with a 1.4 Enterprise value to Capital Employed

Rising Promoter Confidence

Stock DNA

Realty

INR 755 Cr (Micro Cap)

NA (Loss Making)

37

0.00%

0.61

-6.31%

1.57

Total Returns (Price + Dividend)

Prozone Realty for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Prozone Realty Q3 FY26: Return to Profitability Masks Deeper Concerns

Prozone Realty Ltd. reported a consolidated net profit of ₹1.79 crores for Q3 FY26, marking a 123.75% year-on-year surge and a 17.76% sequential improvement from Q2 FY26. The micro-cap real estate developer, with a market capitalisation of ₹755.00 crores, witnessed its stock trade at ₹50.24 on February 6, 2026, down 29.82% from its 52-week high of ₹71.59. Despite the return to profitability after a loss-making FY25, the company faces significant valuation concerns and structural challenges that warrant cautious investor scrutiny.

Read full news articleAre Prozone Realty Ltd latest results good or bad?

Prozone Realty Ltd's latest financial results for Q2 FY26 reflect a company navigating significant operational volatility while demonstrating some positive trends in profitability. The net sales for the quarter amounted to ₹46.19 crores, marking a 20.79% sequential increase from the previous quarter, although this figure represents a 5.46% decline compared to the same period last year. This revenue fluctuation is indicative of the cyclical nature of the real estate sector, where project completions and customer handovers can lead to erratic sales patterns. The company reported a consolidated net profit of ₹1.52 crores, which signifies a recovery from a loss of ₹1.33 crores in the same quarter last year, showcasing a dramatic improvement in profitability. This recovery is further supported by a robust operating profit margin of 37.84%, despite a sequential contraction from the previous quarter's higher marg...

Read full news article

Prozone Realty Ltd is Rated Hold

Prozone Realty Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 14 August 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 06 February 2026, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Board Meeting Intimation for PRL_Prior Intimation Of Board Meeting.

30-Jan-2026 | Source : BSEProzone Realty Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 07/02/2026 inter alia to consider and approve Unaudited Financial Results for the quarter ended 31st December 2025.

Intimation Regarding Conversion Of Statutory Auditors Firm Into LLP

22-Jan-2026 | Source : BSEIntimation regarding conversion of Statutory Auditors Firm into LLP

Announcement under Regulation 30 (LODR)-Newspaper Publication

14-Jan-2026 | Source : BSECopies of Newspaper publications (Postal ballot notice sent to shareholders)-Regulation 47 of the SEBI (LODR) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 6 FIIs (3.26%)

Apax Trust (31.17%)

Saraswati Commercial (india) Ltd (4.64%)

24.54%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 26.07% vs 20.79% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 17.76% vs 108.22% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 4.16% vs -11.48% in Sep 2024

Growth in half year ended Sep 2025 is 138.07% vs -157.38% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 13.30% vs -5.30% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 179.06% vs -152.14% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -3.13% vs 6.55% in Mar 2024

YoY Growth in year ended Mar 2025 is -937.31% vs -82.10% in Mar 2024