Compare Pun. & Sind Bank with Similar Stocks

Dashboard

Despite the size of the company, domestic mutual funds hold only 1.75% of the company

- Domestic mutual funds have capability to do in-depth on-the-ground research on companies- their small stake may signify either they are not comfortable at the price or the business

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 0 per share ex-dividend date: Jul-29-2025

Risk Adjusted Returns v/s

Returns Beta

News

Punjab & Sind Bank is Rated Sell by MarketsMOJO

Punjab & Sind Bank is rated 'Sell' by MarketsMOJO, with this rating last updated on 11 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 06 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

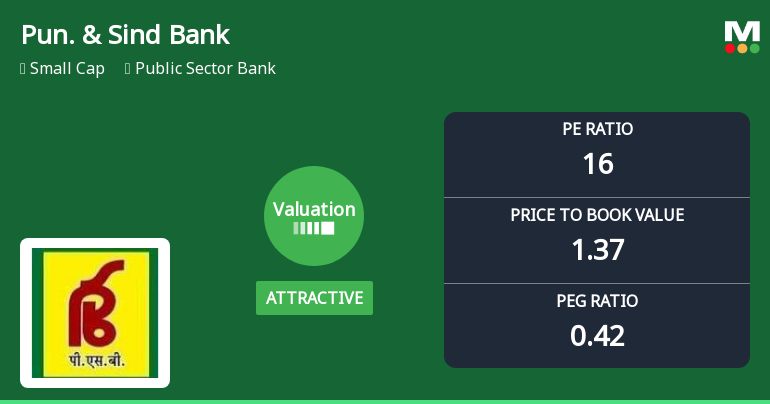

Punjab & Sind Bank Valuation Shifts to Attractive Amidst Mixed Market Returns

Punjab & Sind Bank’s valuation metrics have recently shifted from fair to attractive territory, reflecting a notable change in price attractiveness despite ongoing sector headwinds. With a price-to-earnings (P/E) ratio of 15.74 and a price-to-book value (P/BV) of 1.37, the public sector lender now presents a more compelling valuation compared to its historical averages and peer group, even as its overall market sentiment remains cautious.

Read full news article

Punjab & Sind Bank Technical Momentum Shifts Amid Bearish Signals

Punjab & Sind Bank has experienced a notable shift in its technical momentum, with key indicators signalling a transition from mildly bearish to a more pronounced bearish trend. This development comes amid a 2.58% decline in the stock price on 2 Feb 2026, reflecting growing investor caution in the public sector banking space.

Read full news article Announcements

Permission From Reserve Bank Of India To Setup IFSC Banking Unit (IBU) At Gift City Gujarat

28-Jan-2026 | Source : BSEPermission from Reserve Bank of India to setup IFSC Banking Unit (IBU) at Gift City Gujarat

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

28-Jan-2026 | Source : BSETranscript of the Earnings Call with Analysts/Investors on Reviewed Unaudited Financial Results for Quarter (Q3) / Nine Months ended December 31 2025

Announcement under Regulation 30 (LODR)-Strikes /Lockouts / Disturbances

26-Jan-2026 | Source : BSENotice of Strike

Corporate Actions

No Upcoming Board Meetings

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 7 Schemes (0.11%)

Held by 9 FIIs (0.16%)

President Of India (93.85%)

Life Insurance Corporation Of India (1.33%)

1.74%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 1.44% vs 3.03% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 14.23% vs 9.42% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 9.61% vs 14.18% in Sep 2024

Growth in half year ended Sep 2025 is 33.86% vs 23.21% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 7.56% vs 15.38% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 28.03% vs 54.15% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 18.44% vs 21.28% in Mar 2024

YoY Growth in year ended Mar 2025 is 70.61% vs -54.65% in Mar 2024