Dashboard

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.04 times

Healthy long term growth as Net Sales has grown by an annual rate of 17.69% and Operating profit at 17.98%

Flat results in Dec 25

With ROCE of 11.8, it has a Fair valuation with a 2 Enterprise value to Capital Employed

High Institutional Holdings at 39.08%

With its market cap of Rs 19,12,476 cr, it is the biggest company in the sector and constitutes 67.80% of the entire sector

Stock DNA

Oil

INR 1,907,943 Cr (Large Cap)

23.00

15

0.39%

0.17

9.47%

2.18

Total Returns (Price + Dividend)

Latest dividend: 5.5 per share ex-dividend date: Aug-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

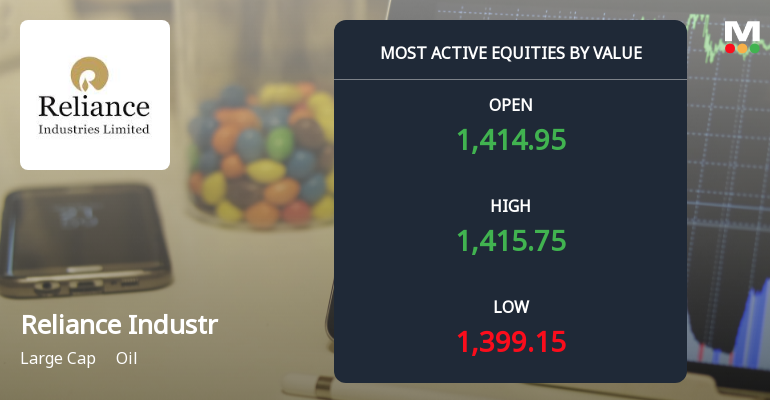

Reliance Industries Ltd Sees High-Value Trading Amidst Narrow Price Range and Institutional Interest

Reliance Industries Ltd (RELIANCE), a heavyweight in the Indian oil sector, witnessed significant trading activity on 20 Jan 2026, with a total traded value exceeding ₹415 crores. Despite a modest decline in price, the stock remains a focal point for institutional investors, reflecting a complex interplay of market sentiment and technical factors.

Read full news article

Reliance Industries Sees Heavy Put Option Activity Amid Bearish Sentiment

Reliance Industries Ltd, a heavyweight in the Indian oil sector, has witnessed significant put option trading ahead of the 27 January 2026 expiry, signalling increased bearish positioning and hedging activity among investors. The surge in put contracts at strike prices close to the current market level reflects growing caution amid a recent downtrend in the stock.

Read full news article

Reliance Industries Sees Robust Call Option Activity Ahead of January Expiry

Reliance Industries Ltd has witnessed significant call option trading activity ahead of the 27 January 2026 expiry, signalling a complex interplay between bullish positioning and recent price weakness. Despite a three-day losing streak and trading below key moving averages, the oil sector giant remains a focal point for options traders targeting strike prices near and above the current market level of ₹1,410.

Read full news article Announcements

Reliance Industries Limited - Press Release

05-Dec-2019 | Source : NSEReliance Industries Limited has informed the Exchange regarding a press release dated December 04, 2019, titled "JIO'S "NEW ALL-IN-ONE PLANS"

Reliance Industries Limited - Acquisition

28-Nov-2019 | Source : NSEReliance Industries Limited has informed the Exchange about Acquisition of shares of Jio Platforms Limited, a wholly-owned subsidiary.

Reliance Industries Limited - Analysts/Institutional Investor Meet/Con. Call Updates

26-Nov-2019 | Source : NSEReliance Industries Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Corporate Actions

No Upcoming Board Meetings

Reliance Industries Ltd has declared 55% dividend, ex-date: 14 Aug 25

No Splits history available

Reliance Industries Ltd has announced 1:1 bonus issue, ex-date: 28 Oct 24

Reliance Industries Ltd has announced 1:15 rights issue, ex-date: 13 May 20

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Promoters

None

Held by 74 Schemes (9.66%)

Held by 1703 FIIs (18.65%)

Srichakra Commercials Llp (11.13%)

Life Insurance Corporation Of India (6.94%)

8.5%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 4.04% vs 4.51% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 2.64% vs -32.71% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 7.54% vs 5.43% in Sep 2024

Growth in half year ended Sep 2025 is 42.45% vs -5.10% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 8.51% vs 5.83% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 27.00% vs -0.85% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.06% vs 2.65% in Mar 2024

YoY Growth in year ended Mar 2025 is 0.04% vs 4.38% in Mar 2024