Compare Richfield Fin with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 24 Cr (Micro Cap)

38.00

NA

0.00%

4.97

7.12%

2.68

Total Returns (Price + Dividend)

Latest dividend: 0.8000000000000002 per share ex-dividend date: Jun-07-2024

Risk Adjusted Returns v/s

Returns Beta

News

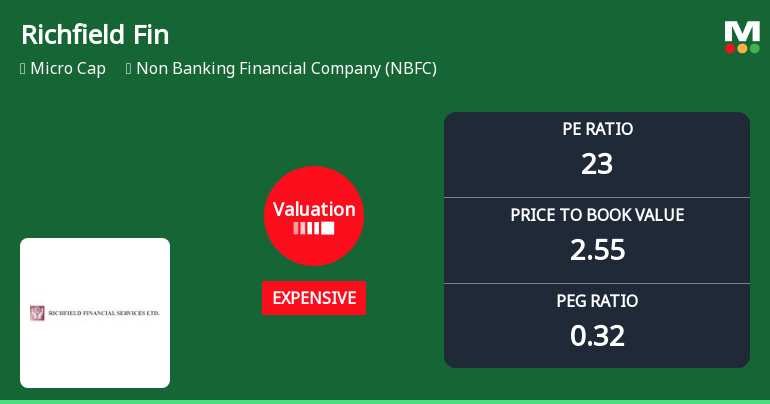

Richfield Financial Services Ltd Valuation Shifts Signal Price Attractiveness Concerns

Richfield Financial Services Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has seen a notable shift in its valuation parameters, moving from fair to expensive territory. This change, reflected in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios, raises questions about the stock’s price attractiveness relative to its historical averages and peer group benchmarks.

Read full news article

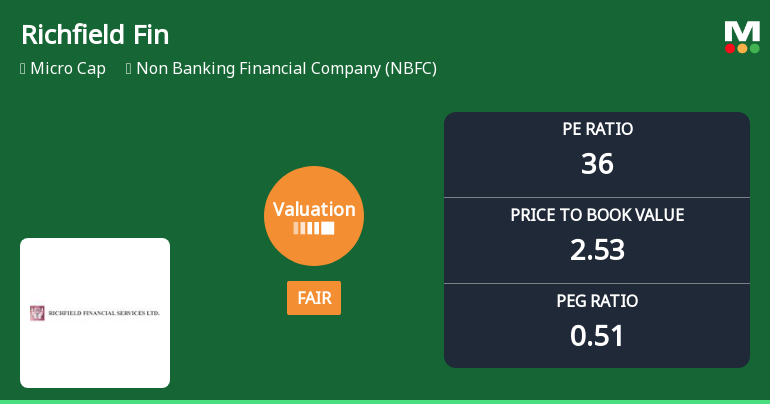

Richfield Financial Services Ltd Valuation Shifts to Fair Amidst Market Pressure

Richfield Financial Services Ltd, a key player in the Non Banking Financial Company (NBFC) sector, has witnessed a notable shift in its valuation parameters, moving from an expensive to a fair price territory. This transition, reflected in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios, offers investors a fresh perspective on the stock’s price attractiveness amid a challenging market backdrop.

Read full news articleAre Richfield Financial Services Ltd latest results good or bad?

Richfield Financial Services Ltd's latest financial results for Q3 FY26 present a complex picture characterized by significant revenue growth juxtaposed with a notable decline in profitability. The company reported net sales of ₹3.00 crores, reflecting a robust year-on-year growth of 167.86%, which indicates strong business expansion and operational traction. This marks the seventh consecutive quarter of sequential revenue growth, suggesting a positive trend in top-line performance. However, the profitability metrics reveal serious challenges. The net profit for the quarter was ₹0.09 crores, a substantial decline of 73.53% compared to the previous quarter, leading to a PAT margin of just 3.00%, down from 12.55%. This contraction in profitability is primarily attributed to a dramatic increase in interest expenses, which surged to ₹1.23 crores, consuming 41% of total revenue. This rise in interest costs has ...

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

27-Feb-2026 | Source : BSENewspaper Publication - Dispatch of Postal Ballot notice dated February 13 2026

Announcement Under Regulation 30 (LODR) - Intimation Of In-Principle Approval From BSE Limited

26-Feb-2026 | Source : BSEDear Sir/Madam We would like to inform that the BSE Limited have granted in-principle approval with regard to issue of 3442000 equity shares of Rs. 10 each at a price not less than Rs. 25 /- to promoter and non promoter category on preferential basis. The in-principle approval letter from BSE is enclosed herewith.

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

26-Feb-2026 | Source : BSENotice of Postal Ballot dated February 13 2026

Corporate Actions

No Upcoming Board Meetings

Richfield Financial Services Ltd has declared 8% dividend, ex-date: 07 Jun 24

No Splits history available

Richfield Financial Services Ltd has announced 1:1 bonus issue, ex-date: 14 Feb 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

V C Georgekutty (15.84%)

Anilkumar . (6.86%)

35.96%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 167.86% vs 100.00% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 800.00% vs -96.88% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 220.26% vs 150.82% in Sep 2024

Growth in half year ended Sep 2025 is 2,050.00% vs -89.47% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 198.11% vs 126.50% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 1,633.33% vs -94.12% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 138.80% vs 454.55% in Mar 2024

YoY Growth in year ended Mar 2025 is -80.00% vs 6,400.00% in Mar 2024