Stock DNA

Other Electrical Equipment

INR 1,202 Cr (Small Cap)

22.00

38

0.36%

0.80

9.72%

2.13

Total Returns (Price + Dividend)

Latest dividend: 2.5 per share ex-dividend date: Aug-29-2025

Risk Adjusted Returns v/s

Returns Beta

News

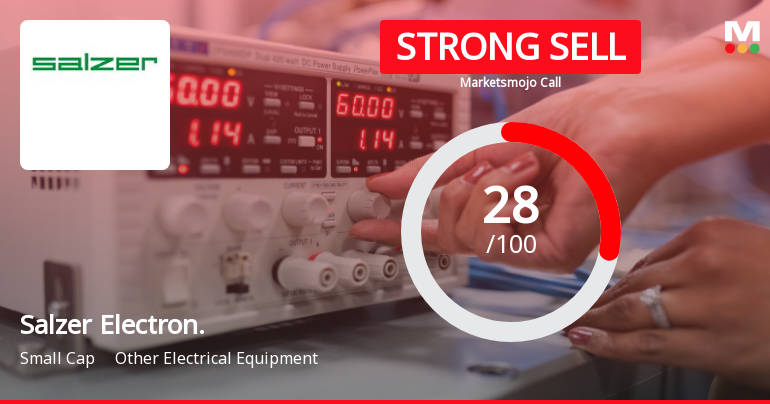

Salzer Electronics: Analytical Perspective Shifts Amidst Challenging Market and Financial Trends

Salzer Electronics has experienced a revision in its market assessment following a comprehensive review of its quality, valuation, financial trends, and technical indicators. This reassessment reflects the company's recent financial performance, market behaviour, and technical signals, providing investors with a nuanced understanding of its current standing within the Other Electrical Equipment sector.

Read More

Salzer Electronics Technical Momentum Shifts Amid Mixed Market Signals

Salzer Electronics, a key player in the Other Electrical Equipment sector, has experienced a nuanced shift in its technical momentum, reflecting a complex interplay of bearish and bullish indicators across multiple timeframes. Recent evaluation adjustments highlight a transition from a predominantly bearish stance to a more mildly bearish outlook, underscoring the evolving market dynamics for this stock.

Read More

Salzer Electronics Faces Bearish Momentum Amid Technical Indicator Shifts

Salzer Electronics, a key player in the Other Electrical Equipment sector, is currently exhibiting a shift in price momentum as reflected by recent technical indicator changes. The stock’s movement has transitioned towards a bearish trend, with several key metrics signalling caution for investors amid a broader market context.

Read More Announcements

Intimation Of Avendus Spark Annual Investor Conference

17-Nov-2025 | Source : BSEThis is to inform that the management of the company participated in Avendus Spark Annual Investor Conference at Grand Hyuatt Kalina Mumbai on 17.11.2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

11-Nov-2025 | Source : BSEThe management of the company participating in Avendus Spark Annual Investor Conference at Grand Hyatt Kalina Mumbai on 17.11.2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

03-Nov-2025 | Source : BSEFiling of paper clippings of publication of un-audited financial result for Q2FY26

Corporate Actions

No Upcoming Board Meetings

Salzer Electronics Ltd has declared 25% dividend, ex-date: 29 Aug 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Non Institution

17.1976

Held by 1 Schemes (0.02%)

Held by 5 FIIs (2.39%)

Quebec Information Services India Limited (6.26%)

Hmg Globetrotter (2.34%)

49.33%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 21.70% vs 22.62% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -51.53% vs 172.56% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 22.66% vs 23.14% in Sep 2024

Growth in half year ended Sep 2025 is -26.44% vs 108.19% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 24.16% vs 14.35% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 70.32% vs 13.26% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 21.61% vs 12.45% in Mar 2024

YoY Growth in year ended Mar 2025 is 10.81% vs 18.52% in Mar 2024