Compare Sh.Renuka Sugar with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 12.65% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

- The company has reported losses and also has negative networth. This is not a good sign for the investors. Either company will have to raise fresh capital or report profits to sustain going forward

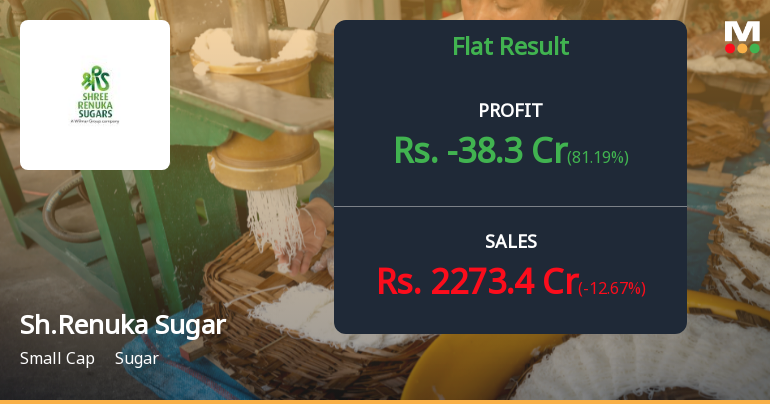

Flat results in Dec 25

Risky - Negative Operating Profits

Despite the size of the company, domestic mutual funds hold only 0.35% of the company

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Sugar

INR 5,219 Cr (Small Cap)

NA (Loss Making)

20

0.00%

-2.67

32.05%

-2.28

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Aug-19-2013

Risk Adjusted Returns v/s

Returns Beta

News

Are Shree Renuka Sugars Ltd latest results good or bad?

Shree Renuka Sugars Ltd continues to face significant operational challenges, as evidenced by its recent financial results. In the quarter ending December 2025, the company reported a net sales figure of ₹2,603.10 crores, reflecting a year-on-year decline of 12.67%. This contraction follows a previous trend of revenue difficulties, highlighting ongoing pricing pressures and demand challenges within the sugar sector. The company's consolidated net profit showed a notable change, with a reported loss of ₹38.30 crores, which represents an 81.19% improvement compared to the previous year's loss. This shift indicates some progress in managing losses, although the overall financial health remains concerning. The operating profit margin, excluding other income, was reported at 11.80%, down from 11.74% in the prior year, suggesting a slight deterioration in operational efficiency. Furthermore, the company’s inter...

Read full news article

Shree Renuka Sugars Q2 FY26: Losses Deepen as Sugar Sector Struggles Continue

Shree Renuka Sugars Ltd., one of India's largest integrated sugar manufacturers with the country's highest refining capacity of 4,000 tonnes per day, reported a consolidated net loss of ₹368.60 crores for Q2 FY26, marking a significant deterioration from the ₹22.30 crores loss in Q2 FY25. The stock has been under severe pressure, declining 32.28% over the past year and currently trading at ₹24.88, down 33.23% from its 52-week high of ₹37.26.

Read full news article

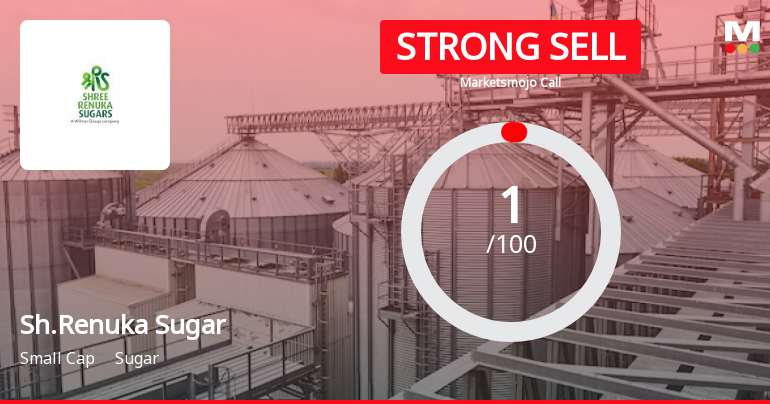

Shree Renuka Sugars Ltd is Rated Strong Sell

Shree Renuka Sugars Ltd is rated 'Strong Sell' by MarketsMOJO, with this rating last updated on 15 Oct 2024. However, the analysis and financial metrics discussed here reflect the company’s current position as of 01 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

07-Feb-2026 | Source : BSEThe Company hereby submits newspaper publication of the Unaudited Financial Results for the quarter and nine months ended 31st December 2025

Board Meeting Outcome for Board Meeting Outcome For Board Meeting Held On Thursday 5Th February 2026

05-Feb-2026 | Source : BSEThe Company hereby submits Outcome of Board Meeting held on Thursday 5th February 2026

Unaudited Financial Results (Standalone And Consolidated) For The Quarter And Nine Months Ended 31St December 2025

05-Feb-2026 | Source : BSEThe Company hereby submits Unaudited Financial Results (Standalone and Consolidated) for the quarter and nine months ended 31st December 2025

Corporate Actions

No Upcoming Board Meetings

Shree Renuka Sugars Ltd has declared 50% dividend, ex-date: 19 Aug 13

Shree Renuka Sugars Ltd has announced 1:10 stock split, ex-date: 10 Apr 08

Shree Renuka Sugars Ltd has announced 1:1 bonus issue, ex-date: 15 Mar 10

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 5 Schemes (0.13%)

Held by 62 FIIs (3.3%)

Wilmar Sugar And Energy Pte. Ltd (62.48%)

Icici Bank Ltd (8.07%)

21.58%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -12.67% vs -14.79% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 81.19% vs -18.17% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -21.12% vs 14.77% in Sep 2024

Growth in half year ended Sep 2025 is -236.32% vs 45.26% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -18.44% vs 3.41% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -71.15% vs 24.06% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -3.65% vs 25.57% in Mar 2024

YoY Growth in year ended Mar 2025 is 52.20% vs -218.38% in Mar 2024