Compare South Ind.Bank with Similar Stocks

Dashboard

Strong lending practices with low Gross NPA ratio of 2.67%

Strong Long Term Fundamental Strength with a 77.65% CAGR growth in Net Profits

Healthy long term growth as Net profit has grown by an annual rate of 77.65%

Positive results in Dec 25

With ROA of 1, it has a Attractive valuation with a 1 Price to Book Value

Total Returns (Price + Dividend)

Latest dividend: 0.4 per share ex-dividend date: Aug-13-2025

Risk Adjusted Returns v/s

Returns Beta

News

South Indian Bank Ltd Technical Momentum Shifts Signal Bullish Outlook

South Indian Bank Ltd has exhibited a notable shift in its technical momentum, moving from a mildly bullish stance to a more confident bullish trend. This transition is underpinned by a combination of key technical indicators, including MACD, RSI, moving averages, and Bollinger Bands, signalling renewed investor interest and potential upside in the private sector banking stock.

Read full news article

South Indian Bank Ltd Sees Exceptional Volume Surge Amid Positive Momentum

South Indian Bank Ltd (SOUTHBANK) has emerged as one of the most actively traded stocks on 1 Feb 2026, registering a remarkable surge in volume and positive price action. The private sector bank outperformed its sector and broader market peers, signalling renewed investor interest and potential accumulation after a brief period of decline.

Read full news article

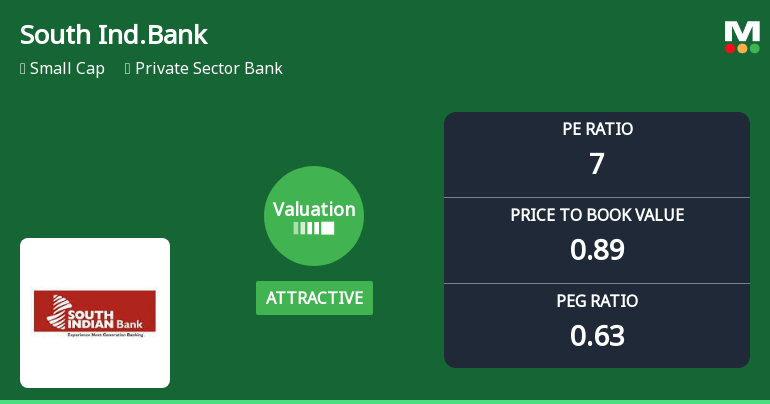

South Indian Bank Ltd Valuation Shifts to Attractive Amid Market Volatility

South Indian Bank Ltd has witnessed a significant shift in its valuation parameters, moving from an expensive to an attractive territory. This change, driven by a sharp correction in its share price and improved fundamental metrics, positions the private sector lender favourably against its peers and historical averages, offering investors a compelling entry point amid broader market fluctuations.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

05-Feb-2026 | Source : BSEIntimation of the Analyst / Investor Meeting held on February 05 2026

Intimation Under Regulation 30 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 -Appointment Of Sri. Jose Joseph Kattoor As The Non-Executive Part Time Chairman (Independent Director) Of The Bank

03-Feb-2026 | Source : BSEIntimation under Regulation 30 of the SEBI(LODR) Regulations 2015 - Appointment of Sri Jose Joseph Kattoor as the Non Executive Part Time Chairman (Independent Director) of the Bank

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

02-Feb-2026 | Source : BSEIntimation of Analyst/ Investor meeting held on February 02 2026

Corporate Actions

No Upcoming Board Meetings

South Indian Bank Ltd has declared 40% dividend, ex-date: 13 Aug 25

South Indian Bank Ltd has announced 1:10 stock split, ex-date: 23 Sep 10

South Indian Bank Ltd has announced 1:4 bonus issue, ex-date: 16 Oct 08

South Indian Bank Ltd has announced 1:4 rights issue, ex-date: 27 Feb 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 13 Schemes (11.9%)

Held by 208 FIIs (20.94%)

None

Bandhan Small Cap Fund (4.78%)

51.31%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 4.59% vs 1.89% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 6.53% vs 9.14% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 2.15% vs 12.4% in Sep 2024

Growth in half year ended Sep 2025 is 8.81% vs 29.69% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 3.51% vs 11.07% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 9.05% vs 22.77% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 9.29% vs 19.07% in Mar 2024

YoY Growth in year ended Mar 2025 is 21.76% vs 38.06% in Mar 2024