Compare Sri Adhik. Bros. with Similar Stocks

Dashboard

With HIgh Debt (Debt-Equity Ratio at 10.91 times)- the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -6.09

- The company has reported losses. Due to this company has reported negative ROE

Flat results in Sep 25

With ROCE of 3.4, it has a Very Expensive valuation with a 358.2 Enterprise value to Capital Employed

Falling Participation by Institutional Investors

Stock DNA

Media & Entertainment

INR 4,369 Cr (Small Cap)

8,917.00

18

0.00%

10.91

47.00%

4,191.12

Total Returns (Price + Dividend)

Latest dividend: 0.6 per share ex-dividend date: Sep-15-2017

Risk Adjusted Returns v/s

Returns Beta

News

Sri Adhikari Brothers Television Network Ltd Opens with Weak Gap Down Amid Market Concerns

Sri Adhikari Brothers Television Network Ltd witnessed a significant gap down at market open on 2 Feb 2026, reflecting ongoing market concerns and a continuation of recent downward momentum. The stock opened 5.0% lower, extending a losing streak that has seen it fall nearly 30% over the past seven trading sessions.

Read full news article

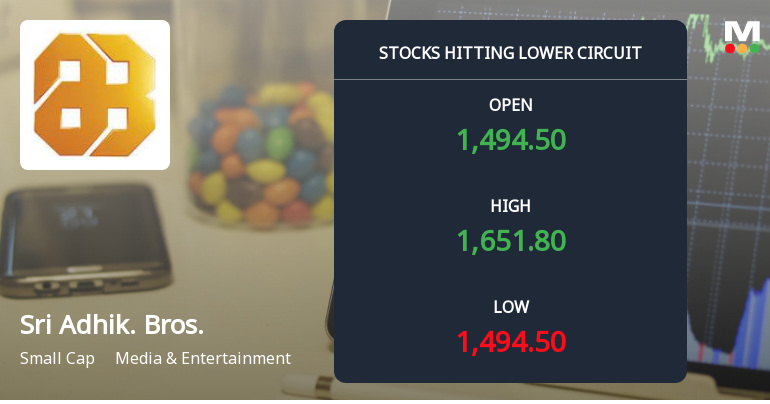

Sri Adhikari Brothers Television Network Ltd Hits Lower Circuit Amid Heavy Selling Pressure

Sri Adhikari Brothers Television Network Ltd (SABTN) witnessed intense selling pressure on 2 Feb 2026, hitting its lower circuit limit after a turbulent trading session marked by panic selling and unfilled supply. The stock’s sharp intraday decline and heightened volatility underscore growing investor concerns amid a challenging market environment for the media and entertainment sector.

Read full news article

Sri Adhikari Brothers Television Network Ltd: Technical Momentum Shifts Amid Mixed Signals

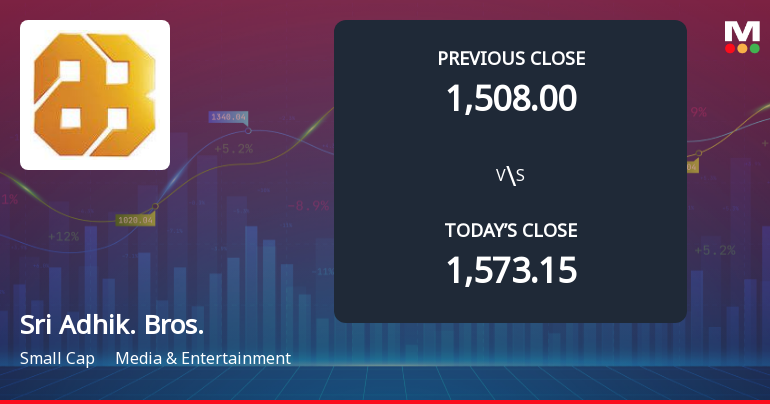

Sri Adhikari Brothers Television Network Ltd (SABTN) has experienced a notable shift in its technical momentum, moving from a bullish to a mildly bullish stance. Despite a recent 5.00% decline in its share price to ₹1,573.15, the stock’s technical indicators present a complex picture, with some signals suggesting potential for recovery while others indicate caution. This article analyses the latest technical parameters, price momentum, and relative performance against the Sensex to provide a comprehensive view for investors.

Read full news article Announcements

Sri Adhikari Brothers Television Network Limited - Outcome of Board Meeting

15-Nov-2019 | Source : NSESri Adhikari Brothers Television Network Limited has informed the Exchange regarding Board meeting held on November 14, 2019.

Sri Adhikari Brothers Television Network Limited - Updates

16-Oct-2019 | Source : NSESri Adhikari Brothers Television Network Limited has informed the Exchange regarding 'Pursuant to provisions of Regulation 7(3) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find enclosed the Compliance Certificate duly signed by the Compliance officer of the Company and Authorized Representative of the Registrar & Share Transfer Agent for the half year ended 30th September, 2019.

Sri Adhikari Brothers Television Network Limited - Disclosure under SEBI Takeover Regulations

09-Oct-2019 | Source : NSEDisclosure under SEBI Takeover Regulations SABTN : On behalf of Late Mr. Gautam Adhikari , Markand Adhikariáhas informed the Exchange regarding reason for encumbrance vide letter dated October 04, 2019 under SEBI ( SAST) Regulations, 2011.

Corporate Actions

No Upcoming Board Meetings

Sri Adhikari Brothers Television Network Ltd has declared 6% dividend, ex-date: 15 Sep 17

Sri Adhikari Brothers Television Network Ltd has announced 10:2 stock split, ex-date: 25 Oct 07

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

16.6664

Held by 2 Schemes (0.0%)

Held by 4 FIIs (0.71%)

Kurjibhai Premjibhai Rupareliya (59.12%)

Sera Investments & Finance India Ltd. (18.9%)

4.74%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 14,366.67% vs -97.84% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 866.85% vs -1,633.33% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 92.95% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is 5,012.50% vs 102.25% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1,375.00% vs 0.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -43.49% vs -0.44% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 121.38% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -5.22% vs 0.00% in Mar 2024