Compare T N Newsprint with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.91 times

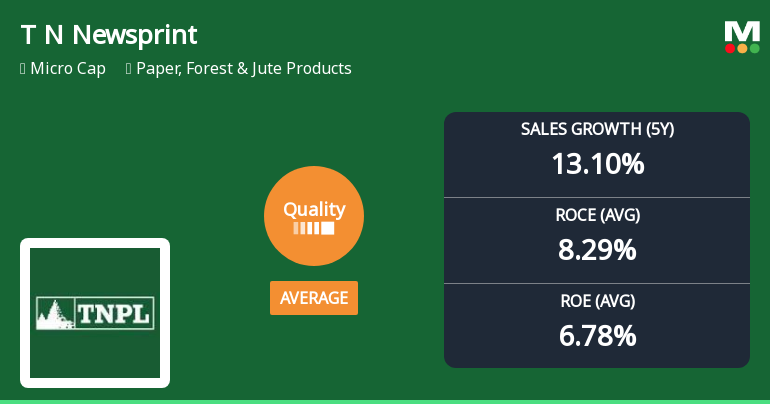

- Poor long term growth as Net Sales has grown by an annual rate of 13.10% and Operating profit at 19.91% over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.91 times

- The company has been able to generate a Return on Equity (avg) of 6.78% signifying low profitability per unit of shareholders funds

Poor long term growth as Net Sales has grown by an annual rate of 13.10% and Operating profit at 19.91% over the last 5 years

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Paper, Forest & Jute Products

INR 917 Cr (Micro Cap)

31.00

17

2.30%

0.90

1.43%

0.44

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Sep-11-2025

Risk Adjusted Returns v/s

Returns Beta

News

Tamil Nadu Newsprint & Papers Ltd: Quality Parameters Improve Amidst Mixed Financial Performance

Tamil Nadu Newsprint & Papers Ltd (TNNPL) has witnessed a notable upgrade in its quality grading from below average to average, reflecting improvements in key business fundamentals such as return on equity (ROE), return on capital employed (ROCE), and operational consistency. However, the company continues to face headwinds from elevated debt levels and subdued market performance, underscoring a mixed outlook for investors navigating the Paper, Forest & Jute Products sector.

Read full news articleAre Tamil Nadu Newsprint & Papers Ltd latest results good or bad?

The latest financial results for Tamil Nadu Newsprint & Papers Ltd (TNPL) reflect a complex operational landscape. In Q2 FY26, the company reported a net profit of ₹8.10 crore, marking a significant turnaround from a loss of ₹7.41 crore in the previous quarter, and demonstrating a year-on-year growth of 212.74%. This improvement in profitability provides a positive signal, although the profit margin remains thin at 0.74%. Revenue for the quarter stood at ₹1,090.73 crore, which represents a sequential decline of 3.42% from ₹1,129.40 crore in Q1 FY26, yet shows a robust year-on-year increase of 20.86% compared to ₹902.49 crore in Q2 FY24. The decline in revenue on a quarter-over-quarter basis may be attributed to typical seasonality patterns within the paper industry, while the year-on-year growth indicates a stronger operational performance over a longer timeframe. Operating margins, excluding other income...

Read full news article

TNPL Q2 FY26: Margin Recovery Amidst Persistent Profitability Challenges

Tamil Nadu Newsprint & Papers Ltd. (TNPL) posted a net profit of ₹8.10 crores in Q2 FY26, marking a significant turnaround from the ₹7.41 crore loss in the preceding quarter, though profitability remains under pressure with a meagre 0.74% profit margin. The micro-cap paper manufacturer, with a market capitalisation of ₹955 crores, demonstrated resilience in revenue generation with sales reaching ₹1,090.73 crores, up 20.86% year-on-year, even as the stock tumbled 4.73% to ₹134 following the results announcement.

Read full news article Announcements

Tamil Nadu Newsprint & Papers Limited - Analysts/Institutional Investor Meet/Con. Call Updates

27-Nov-2019 | Source : NSETamil Nadu Newsprint & Papers Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Tamil Nadu Newsprint & Papers Limited - Updates

08-Nov-2019 | Source : NSETamil Nadu Newsprint & Papers Limited has informed the Exchange regarding 'Unaudited Financial Results '.

Tamil Nadu Newsprint & Papers Limited - Updates

18-Oct-2019 | Source : NSETamil Nadu Newsprint & Papers Limited has informed the Exchange regarding 'We are pleased to enclose herewith copy of the Minutes of the 39th Annual General Meeting of the members of Tamilnadu Newsprint and Papers Limited held on Thursday, 19th September, 2019.

Corporate Actions

No Upcoming Board Meetings

Tamil Nadu Newsprint & Papers Ltd has declared 30% dividend, ex-date: 11 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 2 Schemes (9.56%)

Held by 42 FIIs (5.08%)

Governor Of Tamilnadu . (35.32%)

Lok Prakashan Ltd (8.36%)

26.55%

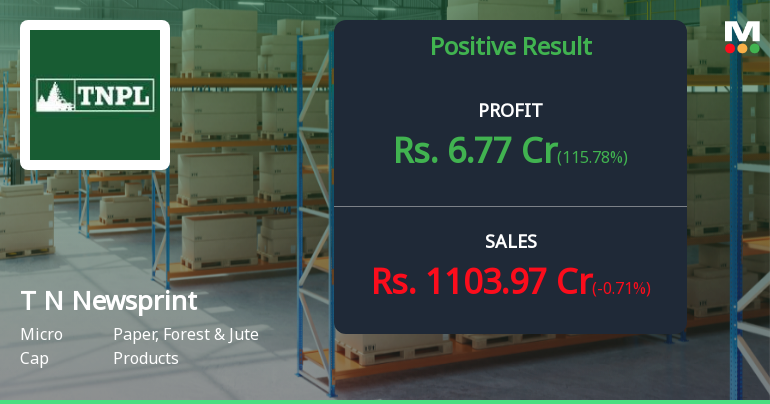

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -0.71% vs -9.52% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 115.78% vs -364.75% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 10.58% vs -8.55% in Sep 2024

Growth in half year ended Sep 2025 is -97.18% vs -84.59% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 6.55% vs -8.90% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 140.54% vs -110.50% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -4.32% vs -9.26% in Mar 2024

YoY Growth in year ended Mar 2025 is -98.21% vs -46.33% in Mar 2024