Compare Tata Comm with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 18.37%

High Debt Company with a Debt to Equity ratio (avg) at 12.62 times

Poor long term growth as Operating profit has grown by an annual rate 2.06% of over the last 5 years

Flat results in Dec 25

With ROCE of 12.5, it has a Attractive valuation with a 3.6 Enterprise value to Capital Employed

High Institutional Holdings at 32.95%

Stock DNA

Telecom - Services

INR 43,843 Cr (Mid Cap)

37.00

37

1.61%

4.52

36.64%

15.51

Total Returns (Price + Dividend)

Latest dividend: 25 per share ex-dividend date: Jun-19-2025

Risk Adjusted Returns v/s

Returns Beta

News

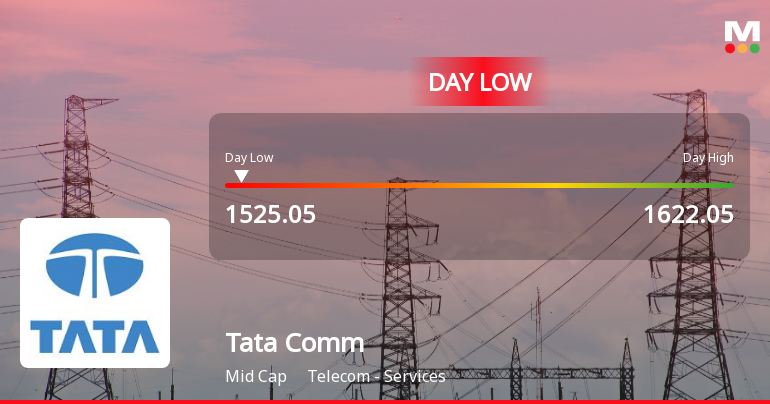

Tata Communications Ltd Hits Intraday Low Amid Price Pressure on 2 Feb 2026

Tata Communications Ltd experienced a notable intraday decline on 2 Feb 2026, touching a low of Rs 1,528.75, down 5.43% from previous levels. The stock underperformed its sector and broader market indices, reflecting immediate selling pressure and subdued market sentiment within the telecom services space.

Read full news article

Tata Communications Ltd Technical Momentum Shifts Amid Mixed Market Signals

Tata Communications Ltd has experienced a notable shift in its technical momentum, moving from a mildly bearish stance to a sideways trend, reflecting a complex interplay of bullish and bearish signals across key indicators. Despite a recent 2.93% rise in the stock price to ₹1,571, the company’s technical outlook remains nuanced, with mixed signals from MACD, RSI, moving averages, and other momentum indicators.

Read full news article

Tata Communications Ltd is Rated Hold

Tata Communications Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 04 August 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 31 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Change in Management

03-Feb-2026 | Source : BSEIntimation under Regulation 30 of SEBI Listing Regulations - Change in Key Managerial Personnel - Resignation of Chief Financial Officer

Announcement under Regulation 30 (LODR)-Press Release / Media Release

30-Jan-2026 | Source : BSETata Communications launches AI-ready suite to empower enterprises

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

28-Jan-2026 | Source : BSEIntimation of Schedule of Analyst / Institutional Investor Meetings

Corporate Actions

No Upcoming Board Meetings

Tata Communications Ltd has declared 250% dividend, ex-date: 19 Jun 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 25 Schemes (16.06%)

Held by 516 FIIs (14.46%)

Panatone Finvest Limited (44.8%)

Hdfc Mutual Fund - Hdfc Mid-cap Fund (4.66%)

6.69%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 1.46% vs 2.35% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 99.54% vs -3.64% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.53% vs 17.38% in Sep 2024

Growth in half year ended Sep 2025 is -33.39% vs -7.02% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 6.60% vs 12.39% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -7.25% vs 23.00% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.18% vs 16.52% in Mar 2024

YoY Growth in year ended Mar 2025 is 89.64% vs -46.08% in Mar 2024