Compare Transchem with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Operating profit has grown by an annual rate 3.88% of over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -1.92

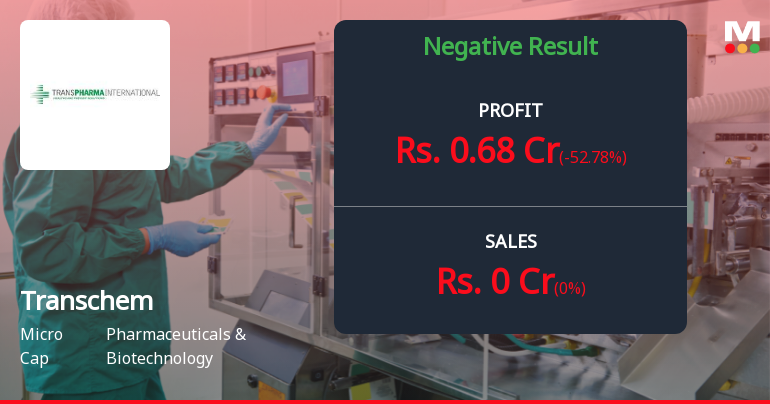

Negative results in Dec 25

Risky - Negative EBITDA

Stock DNA

Pharmaceuticals & Biotechnology

INR 192 Cr (Micro Cap)

54.00

32

0.00%

-0.01

4.68%

2.52

Total Returns (Price + Dividend)

Transchem for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Transchem Ltd Investment Rating Upgraded to Sell on Technical Improvements

Transchem Ltd, a player in the Pharmaceuticals & Biotechnology sector, has seen its investment rating upgraded from Strong Sell to Sell as of 6 February 2026. This change reflects a nuanced shift in the company’s technical outlook despite ongoing financial challenges, with the MarketsMOJO Mojo Score adjusting to 31.0. Investors are advised to consider the detailed analysis across quality, valuation, financial trends, and technical indicators before making decisions.

Read full news articleAre Transchem Ltd latest results good or bad?

Transchem Ltd's latest financial results for Q2 FY26 reveal significant operational challenges, primarily characterized by a complete absence of net sales, which remained at ₹0.00 crore for two consecutive quarters. This stark situation contrasts sharply with the previous year, where minimal trading activity was recorded. The company reported a net profit of ₹0.68 crore, reflecting a decline of 31.31% quarter-on-quarter, driven largely by its reliance on other income, which accounted for ₹1.68 crore in the latest quarter. This other income represents a substantial 239.36% of profit before tax, underscoring the company's dependence on non-operating sources for its financial performance. The operational metrics indicate that Transchem has not generated any meaningful sales since Q1 FY26, and its core business continues to incur losses, with an operating profit before depreciation, interest, and tax (excludin...

Read full news article

Transchem Ltd Q2 FY26: Operations Stalled, Other Income Props Up Profits

Transchem Limited, a micro-cap pharmaceutical company with a market capitalisation of ₹204.00 crores, reported net profit of ₹0.68 crores for Q2 FY26, down 31.31% quarter-on-quarter from ₹0.99 crores in Q1 FY26. The company continues to face operational challenges, with zero sales recorded for the second consecutive quarter whilst remaining almost entirely dependent on other income to sustain profitability.

Read full news article Announcements

Board Meeting Outcome for The Meeting Held On February 07 2026 Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015.

07-Feb-2026 | Source : BSEPlease refer the attached intimation.

Un-Audited Financial Results Of The Company For The Quarter And Nine Months Ended December 31 2025 Along With Limited Review Report.

07-Feb-2026 | Source : BSEPlease refer the attached intimation.

Board Meeting Intimation for For Approval Of Un-Audited Financial Results Of The Company For The Quarter And Nine Months Ended December 31 2025.

02-Feb-2026 | Source : BSETranschem Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 07/02/2026 inter alia to consider and approve Un-Audited Financial Results of the Company for the Quarter and Nine Months ended December 31 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs (0.03%)

Priyanka Finance Private Limited (40.11%)

Smit Capital Services Private Limited (11.02%)

21.78%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -100.00% vs 0.00% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -61.87% vs 21.93% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 0.00% vs 0.00% in Sep 2024

Growth in half year ended Sep 2025 is -46.30% vs 71.82% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -100.00% vs 0.00% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -51.11% vs 52.54% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 541.46% vs 0.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 24.52% vs 238.71% in Mar 2024