Compare Trident Lifeline with Similar Stocks

Dashboard

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.77 times

Healthy long term growth as Net Sales has grown by an annual rate of 58.70% and Operating profit at 55.07%

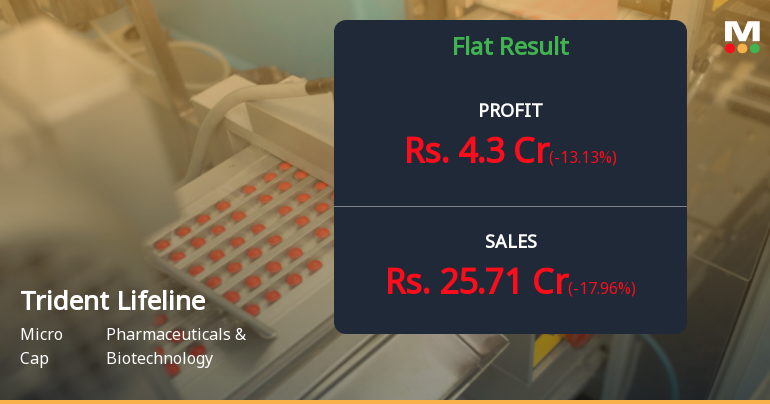

Flat results in Dec 25

With ROCE of 13.7, it has a Expensive valuation with a 2.9 Enterprise value to Capital Employed

Rising Promoter Confidence

Consistent Returns over the last 3 years

Stock DNA

Pharmaceuticals & Biotechnology

INR 362 Cr (Micro Cap)

18.00

32

0.00%

0.70

22.08%

4.47

Total Returns (Price + Dividend)

Trident Lifeline for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Trident Lifeline Ltd is Rated Hold by MarketsMOJO

Trident Lifeline Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 18 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 January 2026, providing investors with the most up-to-date view of the company’s performance and outlook.

Read full news article

Trident Lifeline Q3 FY26: Strong Revenue Growth Masks Margin Pressure and Profit Decline

Trident Lifeline Ltd., a micro-cap pharmaceutical company specialising in marketing ethical pharmaceutical products domestically and internationally, reported mixed results for Q3 FY26, with consolidated net profit declining 13.13% quarter-on-quarter to ₹4.30 crores despite robust revenue growth. The company, with a market capitalisation of ₹363.96 crores, saw its stock trading at ₹305.00 on January 19, 2026, down 0.57% from the previous close, reflecting investor concerns over deteriorating profitability metrics and rising operational costs.

Read full news article

Trident Lifeline Ltd is Rated Buy

Trident Lifeline Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 29 December 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 14 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Investor Presentation

20-Jan-2026 | Source : BSEPursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find enclosed herewith Earnings Presentation for the quarter ended 31st December 2025 (Q3FY26).

Announcement under Regulation 30 (LODR)-Newspaper Publication

19-Jan-2026 | Source : BSEIn accordance with Regulation 47 and other applicable provisions of SEBI (Listing Obligations and Disclosure Requirements) Regulations we hereby enclose copies of newspaper advertisement published on January 19 2026 regarding extract of the Un-Audited Standalone and Consolidated Financial Statements for the quarter ended 31st December 2025.

Statement Of Deviation Or Variation Of Funds Under Regulation 32 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 For The Quarter Ended 31.12.2025

17-Jan-2026 | Source : BSEplease find enclosed herewith the Statement of Deviation or Variation along with Certificate issued by Statutory Auditor

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

6.7692

Held by 0 Schemes

Held by 4 FIIs (7.37%)

Hardik Jigishkumar Desai (22.64%)

Nav Capital Vcc - Nav Capital Emerging Star Fund (5.43%)

16.91%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -17.96% vs 32.74% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -13.13% vs 61.76% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 7.54% vs 69.64% in Mar 2025

Growth in half year ended Sep 2025 is 10.33% vs 34.69% in Mar 2025

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 92.48% vs -7.25% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 50.49% vs 10.39% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 94.85% vs 40.83% in Mar 2024

YoY Growth in year ended Mar 2025 is 85.33% vs 5.49% in Mar 2024