Compare Union Bank (I) with Similar Stocks

Dashboard

Strong Provisioning Practices with a Provision Coverage Ratio of 76.68%

Strong Long Term Fundamental Strength with a 63.27% CAGR growth in Net Profits

Healthy long term growth as Net profit has grown by an annual rate of 63.27%

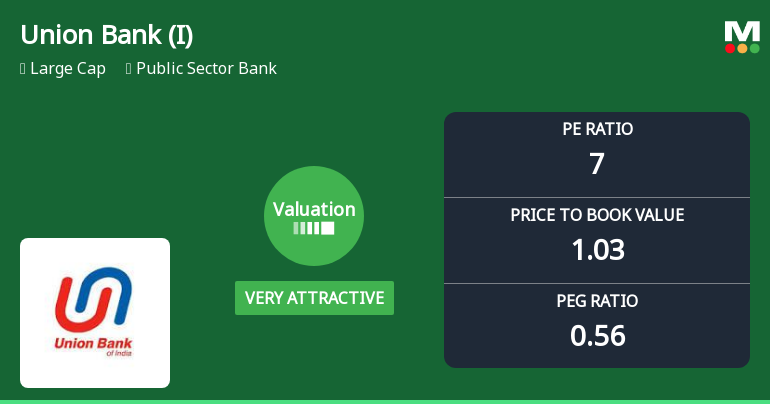

With ROA of 1.2, it has a Very Attractive valuation with a 1.1 Price to Book Value

Total Returns (Price + Dividend)

Latest dividend: 4.7 per share ex-dividend date: Jul-25-2025

Risk Adjusted Returns v/s

Returns Beta

News

Union Bank of India Upgraded to Strong Buy on Robust Valuation and Financials

Union Bank of India has seen its investment rating upgraded from Buy to Strong Buy, driven primarily by a significant improvement in valuation metrics alongside robust financial trends and solid quality indicators. The bank’s enhanced score reflects a comprehensive reassessment of its fundamentals, technical outlook, and market positioning as of 2 February 2026.

Read full news article

Union Bank of India’s Valuation Shifts to ‘Very Attractive’ Amid Strong Market Performance

Union Bank of India has witnessed a significant improvement in its valuation parameters, moving from an attractive to a very attractive rating, supported by robust financial metrics and a strong market performance that outpaces key benchmarks such as the Sensex.

Read full news article

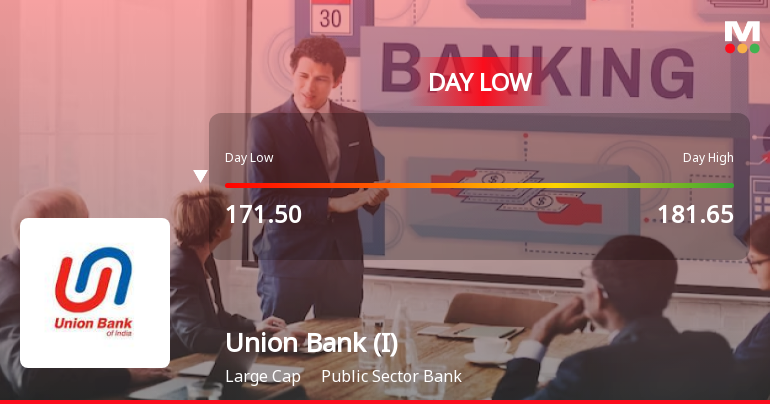

Union Bank of India Hits Intraday Low Amid Price Pressure on 1 Feb 2026

Union Bank of India experienced a notable intraday decline on 1 Feb 2026, touching a low of ₹173.35, reflecting a 4.04% drop from previous levels as the stock faced significant price pressure amid broader market weakness.

Read full news article Announcements

Change In Senior Management Of The Bank.

01-Feb-2026 | Source : BSEIn terms of Regulation 30 and 51 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we wish to inform that Shri Bhaskara Rao Kare Chief General Manager of the Bank has superannuated from the services of the Bank on January 31st 2026. Further to this we wish to inform that Shri Sarvesh Ranjan General Manager of the Bank will be elevated to the post of Chief General Manager of the Bank w.e.f. February 01st 2026.

Certificate For Timely Payment Of Principal And Annual Interest On Bonds

29-Jan-2026 | Source : BSECertificate for Timely payment of Principal and Annual Interest on Bonds

Appointment of Company Secretary and Compliance Officer

28-Jan-2026 | Source : BSEChange in Company Secretary and Compliance Officer of the Bank

Corporate Actions

No Upcoming Board Meetings

Union Bank of India has declared 47% dividend, ex-date: 25 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 35 Schemes (3.82%)

Held by 640 FIIs (8.14%)

President Of India (74.76%)

Lici Ulip-growth Fund (5.76%)

4.73%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 0.97% vs -4.05% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 18.07% vs 3.25% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 1.64% vs 10.42% in Sep 2024

Growth in half year ended Sep 2025 is -0.40% vs 24.46% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.97% vs 8.43% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 2.92% vs 25.77% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 6.14% vs 23.57% in Mar 2024

YoY Growth in year ended Mar 2025 is 31.79% vs 61.84% in Mar 2024