Compare Ventive Hospital with Similar Stocks

Dashboard

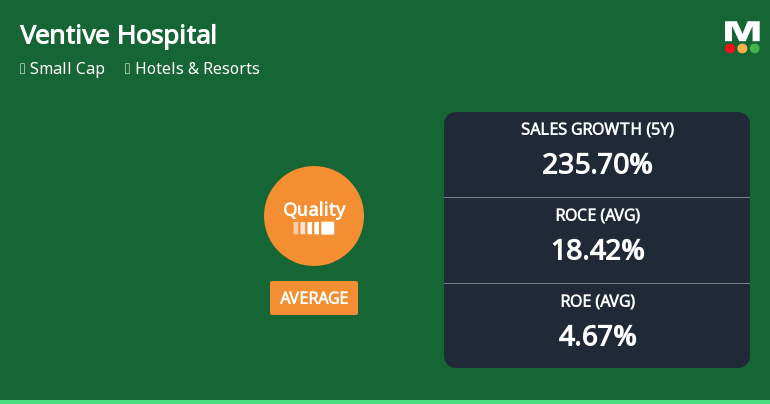

Poor Management Efficiency with a low ROCE of 8.98%

- The company has been able to generate a Return on Capital Employed (avg) of 8.98% signifying low profitability per unit of total capital (equity and debt)

Healthy long term growth as Net Sales has grown by an annual rate of 235.70% and Operating profit at 114.11%

With a growth in Net Profit of 118.7%, the company declared Very Positive results in Dec 25

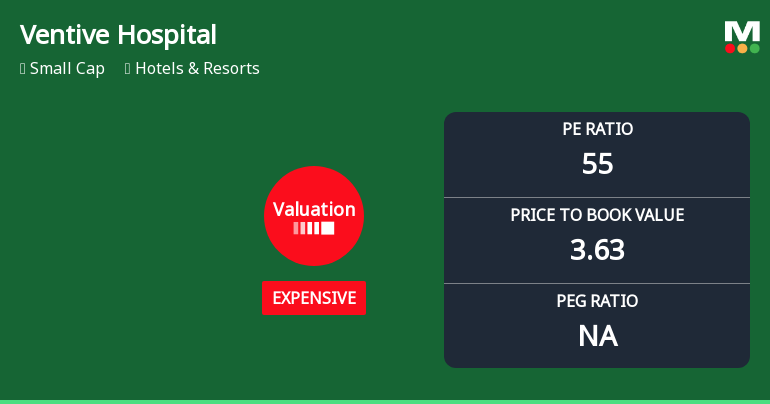

With ROCE of 9, it has a Expensive valuation with a 2.9 Enterprise value to Capital Employed

Majority shareholders : Promoters

Stock DNA

Hotels & Resorts

INR 18,049 Cr (Small Cap)

56.00

NA

0.00%

0.43

4.67%

3.66

Total Returns (Price + Dividend)

Ventive Hospital for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Ventive Hospitality Ltd Downgraded to Hold Amid Valuation and Quality Concerns

Ventive Hospitality Ltd has seen its investment rating downgraded from Buy to Hold as of 3 February 2026, reflecting a nuanced reassessment across key parameters including quality, valuation, financial trends, and technicals. Despite robust sales and profit growth, concerns over valuation and management efficiency have tempered enthusiasm, prompting a more cautious stance from analysts.

Read full news article

Ventive Hospitality Ltd Valuation Shifts Amid Market Volatility

Ventive Hospitality Ltd has recently undergone a notable shift in its valuation parameters, moving from a 'very expensive' to an 'expensive' rating. This change reflects evolving market perceptions amid fluctuating price-to-earnings (P/E) and price-to-book value (P/BV) ratios, prompting investors to reassess the stock’s price attractiveness within the Hotels & Resorts sector.

Read full news article

Ventive Hospitality Ltd Quality Grade Downgrade: A Detailed Analysis of Business Fundamentals

Ventive Hospitality Ltd has recently experienced a downgrade in its quality grade from 'Good' to 'Average', reflecting shifts in its core business fundamentals. This article delves into the key financial metrics and operational parameters that have influenced this change, analysing the company’s return ratios, debt levels, and growth consistency in the context of the Hotels & Resorts sector.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

04-Feb-2026 | Source : BSENewspaper Publications of the Extract of Unaudited Financial Results for the Quarter and Nine months ended 31st December 2025.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

03-Feb-2026 | Source : BSEDisclosure under Regulation 30 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 (SEBI Listing Regulations) - Audio recording of the Conference Call dated 3rd February 2026.

Announcement Under Regulation 30 - ESG Rating

03-Feb-2026 | Source : BSEDisclosure under Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 - ESG Ratings

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

4.698

Held by 18 Schemes (5.18%)

Held by 20 FIIs (1.55%)

Premsagar Infra Realty Private Limited (37.28%)

Quant Mutual Fund-quant Elss Tax Saver Fund (4.97%)

2.73%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 40.09% vs -3.57% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 121.82% vs 95.21% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 16.07% vs 31.62% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 108.40% vs 33.65% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 17.47% vs 10.95% in Mar 2024

YoY Growth in year ended Mar 2025 is -19.61% vs 26.70% in Mar 2024