Compare Viyash Scientifi with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -3.55% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 8.15 times

- The company has been able to generate a Return on Equity (avg) of 3.90% signifying low profitability per unit of shareholders funds

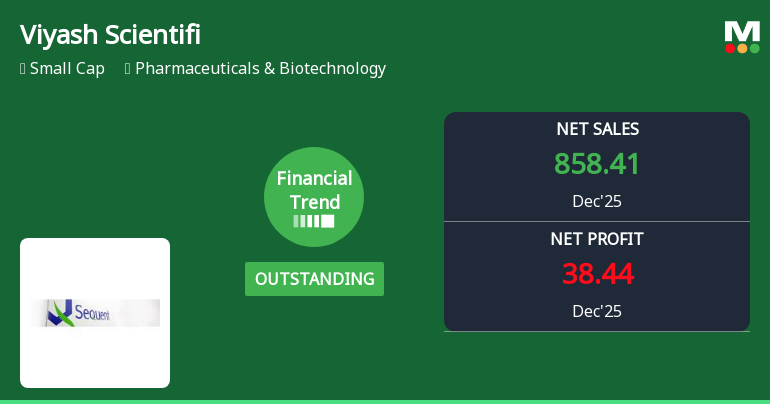

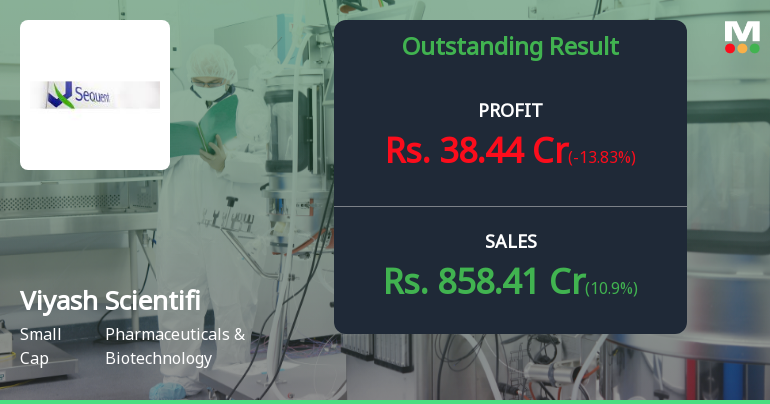

With a growth in Operating Profit of 78.2%, the company declared Outstanding results in Dec 25

With ROCE of 18.1, it has a Expensive valuation with a 7.5 Enterprise value to Capital Employed

Rising Promoter Confidence

Stock DNA

Pharmaceuticals & Biotechnology

INR 8,798 Cr (Small Cap)

60.00

32

0.00%

0.52

5.48%

11.27

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Sep-08-2021

Risk Adjusted Returns v/s

Returns Beta

News

Are Viyash Scientific Ltd latest results good or bad?

Viyash Scientific Ltd's latest financial results for Q3 FY26 present a complex picture of operational performance and profitability challenges. The company reported a record revenue of ₹858.41 crores, reflecting a year-on-year growth of 10.90% and a slight sequential increase of 0.95%. This achievement highlights Viyash Scientific's ability to capture market share within the animal health pharmaceutical sector, despite a moderation in growth compared to previous quarters. However, the net profit for the same period was ₹38.44 crores, which represents a significant decline of 29.99% quarter-on-quarter and a 13.83% decrease year-on-year. This decline raises concerns regarding the sustainability of earnings, particularly as the profit margins have compressed. The PAT margin fell to 5.65%, down from 8.57% in the previous quarter, primarily due to increased tax expenses and higher depreciation charges. On the ...

Read full news article

Viyash Scientific Ltd Reports Outstanding Quarterly Performance Amid Sector Challenges

Viyash Scientific Ltd has delivered an outstanding financial performance in the December 2025 quarter, marking a significant improvement in key metrics such as revenue growth, profitability, and operational efficiency. This robust quarter contrasts with the company’s previous trend and positions it favourably within the Pharmaceuticals & Biotechnology sector, despite a recent dip in share price and broader market volatility.

Read full news article

Viyash Scientific Q3 FY26: Strong Revenue Growth Masks Profit Volatility and Valuation Concerns

Viyash Scientific Ltd. (formerly Sequent Scientific Ltd.), a leading integrated pharmaceutical company operating in animal health APIs and formulations, reported its Q3 FY26 results with consolidated net profit declining 29.99% quarter-on-quarter to ₹38.44 crores, despite revenue reaching an all-time high of ₹858.41 crores. The stock, trading at ₹200.85 with a market capitalisation of ₹9,121 crores, has declined 3.92% following the results announcement, reflecting investor concerns over profit volatility and stretched valuations at 206x P/E ratio.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Investor Presentation

06-Feb-2026 | Source : BSEInvestor Presentation Q3 FY26

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

06-Feb-2026 | Source : BSEAudio Recording of Earnings call pertaining to the Unaudited Financial Results (Consolidated and Standalone) for the quarter and nine months December 31 2025

Announcement under Regulation 30 (LODR)-Change in Management

05-Feb-2026 | Source : BSEChange in Management

Corporate Actions

No Upcoming Board Meetings

Viyash Scientific Ltd has declared 25% dividend, ex-date: 08 Sep 21

Viyash Scientific Ltd has announced 2:10 stock split, ex-date: 25 Feb 16

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 7 Schemes (5.85%)

Held by 39 FIIs (3.16%)

Ca Hull Investments (31.22%)

Quant Mutual Fund - Quant Small Cap Fund (5.5%)

19.24%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 10.90% vs 135.01% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -13.83% vs 439.42% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 14.04% vs 11.73% in Sep 2024

Growth in half year ended Sep 2025 is 218.53% vs 121.10% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 12.46% vs 51.99% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 25.61% vs 253.69% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 119.52% vs -3.60% in Mar 2024

YoY Growth in year ended Mar 2025 is 164.72% vs 70.39% in Mar 2024