Compare Zaggle Prepaid with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0 times

Healthy long term growth as Net Sales has grown by an annual rate of 53.96% and Operating profit at 72.02%

With a growth in Net Sales of 30.2%, the company declared Very Positive results in Sep 25

With ROE of 8.5, it has a Fair valuation with a 2.9 Price to Book Value

Falling Participation by Institutional Investors

Stock DNA

Computers - Software & Consulting

INR 3,775 Cr (Small Cap)

34.00

27

0.00%

-0.43

8.54%

2.89

Total Returns (Price + Dividend)

Zaggle Prepaid for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Zaggle Prepaid Ocean Services Ltd is Rated Hold by MarketsMOJO

Zaggle Prepaid Ocean Services Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 24 Nov 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 29 January 2026, providing investors with the latest insights into the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

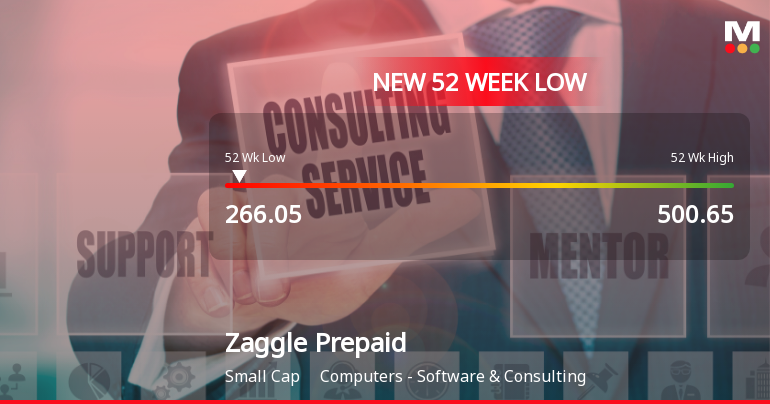

Zaggle Prepaid Ocean Services Ltd Falls to 52-Week Low of Rs.266.05

Zaggle Prepaid Ocean Services Ltd touched a fresh 52-week low of Rs.266.05 today, marking a significant decline amid broader market pressures and company-specific factors. The stock has now fallen for two consecutive sessions, cumulatively losing 4.79% over this period, underperforming its sector and reflecting ongoing challenges in maintaining upward momentum.

Read full news article

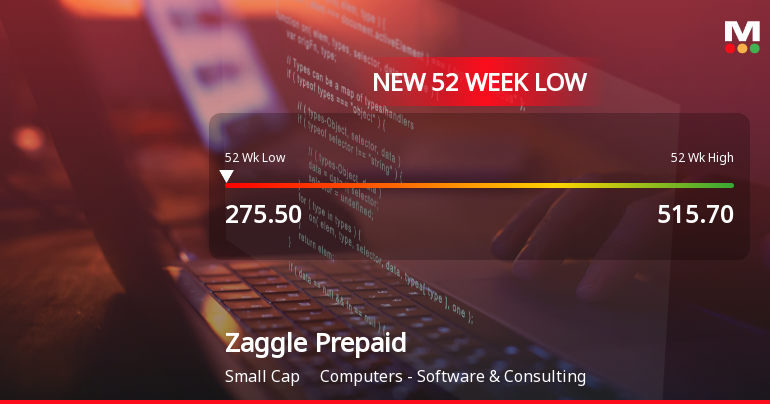

Zaggle Prepaid Ocean Services Ltd Falls to 52-Week Low of Rs.275.5

Zaggle Prepaid Ocean Services Ltd’s stock declined sharply to a new 52-week low of Rs.275.5 on 23 Jan 2026, marking a significant drop amid broader market fluctuations and sector underperformance. The stock’s fall reflects a continuation of its subdued trend over the past year, contrasting with the relatively stable Sensex performance.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

0.3611

Held by 8 Schemes (3.7%)

Held by 57 FIIs (7.61%)

Raj P Narayanam (34.33%)

Zuzu Software Services Llp (3.9%)

31.4%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 30.20% vs -19.45% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 34.01% vs -16.15% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 37.75% vs 83.26% in Sep 2024

Growth in half year ended Sep 2025 is 65.00% vs 284.13% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is 77.45% vs 36.99% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 123.33% vs 62.06% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 68.10% vs 40.14% in Mar 2024

YoY Growth in year ended Mar 2025 is 99.73% vs 92.23% in Mar 2024