Compare KIOCL with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 0.70

- The company has been able to generate a Return on Equity (avg) of 4.28% signifying low profitability per unit of shareholders funds

Risky - Negative EBITDA

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Ferrous Metals

INR 21,603 Cr (Small Cap)

NA (Loss Making)

10

0.00%

-0.32

-8.42%

12.73

Total Returns (Price + Dividend)

Latest dividend: 0.7 per share ex-dividend date: Sep-08-2022

Risk Adjusted Returns v/s

Returns Beta

News

KIOCL Ltd is Rated Sell by MarketsMOJO

KIOCL Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 22 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 27 January 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

KIOCL Ltd is Rated Sell by MarketsMOJO

KIOCL Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 22 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 January 2026, providing investors with the most recent and relevant data to assess the company’s prospects.

Read full news article

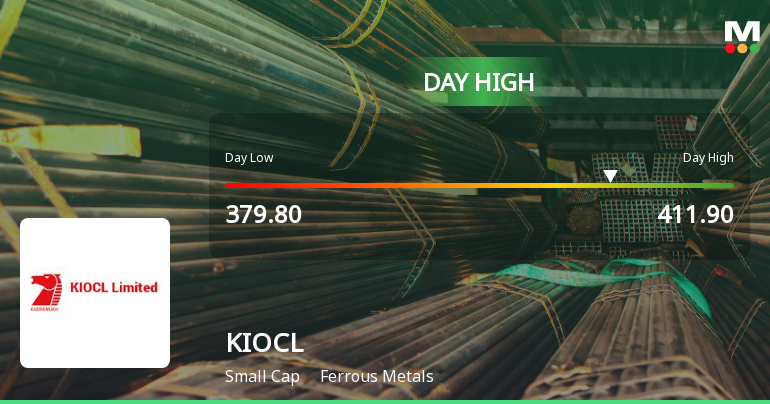

KIOCL Ltd Hits Intraday High with 7.01% Surge on 30 Dec 2025

KIOCL Ltd demonstrated robust intraday performance on 30 Dec 2025, surging to an intraday high of Rs 411.9, marking an 8.59% increase from its previous close. The stock outperformed its sector and the broader market, reflecting significant trading momentum within the ferrous metals industry.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

16-Jan-2026 | Source : BSEPlease Find Enclosed herewith certificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for qtr ended December 31 2025.

Closure of Trading Window

29-Dec-2025 | Source : BSEIn pursuance to the provisions of SEBI (PIT) Regulations 2015 and amendments thereto and the Code of Practices procedures for fair disclosure of UPSI and Conduct of Regulating Monitoring and Reporting of trading by insiders of KIOCL Limited the trading window for the Insiders is required to be closed from the end of the Quarter till the declaration of financial results for the relevant quarter. Accordingly the trading window for dealing in Equity Shares of the Company shall remain closed for the designated persons of the company from December 31st 2025 till 48 hours from the date of Board Meeting in which the un-audited financial results for the quarter and nine moths ended December 31 2025 are approved.

Rumour verification - Regulation 30(11)

29-Dec-2025 | Source : BSEClarification on Volume Movement Letter

Corporate Actions

No Upcoming Board Meetings

KIOCL Ltd has declared 7% dividend, ex-date: 08 Sep 22

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.0%)

Held by 5 FIIs (0.01%)

President Of India (99.03%)

None

0.8%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 798.74% vs -96.32% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 75.21% vs -223.56% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 43.04% vs -82.50% in Sep 2024

Growth in half year ended Sep 2025 is 54.18% vs -50.99% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -76.80% vs 83.29% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -315.15% vs 77.54% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -68.15% vs 20.14% in Mar 2024

YoY Growth in year ended Mar 2025 is -145.56% vs 14.70% in Mar 2024