Compare G R Infraproject with Similar Stocks

Stock DNA

Construction

INR 8,943 Cr (Small Cap)

9.00

35

1.35%

0.54

12.14%

1.00

Total Returns (Price + Dividend)

Latest dividend: 12.5 per share ex-dividend date: Mar-13-2025

Risk Adjusted Returns v/s

Returns Beta

News

G R Infraprojects Ltd is Rated Sell

G R Infraprojects Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 Oct 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

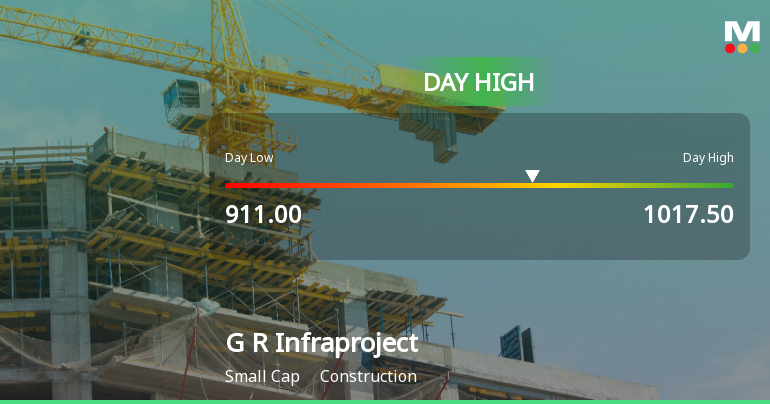

G R Infraprojects Ltd Hits Intraday High with 9.11% Surge on 30 Jan 2026

G R Infraprojects Ltd recorded a robust intraday performance on 30 Jan 2026, surging to a day’s high of Rs 982, marking a 9.11% increase. This strong upward movement outpaced the broader construction sector and the Sensex, reflecting notable trading momentum in the stock.

Read full news article

G R Infraprojects Ltd Falls to 52-Week Low Amidst Continued Downtrend

Shares of G R Infraprojects Ltd touched a fresh 52-week low of Rs.883.35 on 27 Jan 2026, marking a significant decline amid a broader market downturn and company-specific performance pressures. The stock underperformed its sector and key indices, reflecting ongoing challenges in maintaining upward momentum.

Read full news article Announcements

G R Infraprojects Limited Has Been Emerged As L-1 Bidder For The Project EPC Package For BESS Implementation At NTPC Thermal Power Stations (Lot-1); Mouda Super Thermal Power Station (Mouda).

16-Jan-2026 | Source : BSEG R Infraprojects Limited has been emerged as L-1 bidder for a project.

Announcement under Regulation 30 (LODR)-Change in Management

09-Jan-2026 | Source : BSEIntimation of Additional details required for corporate announcement filed under Regulation 30 of SEBI (LODR) Regulation 2015.

Issue Of Provisional Completion Certificate.

08-Jan-2026 | Source : BSEIssue of Provisional Completion Certificate.

Corporate Actions

No Upcoming Board Meetings

G R Infraprojects Ltd has declared 250% dividend, ex-date: 13 Mar 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 14 Schemes (19.45%)

Held by 89 FIIs (2.67%)

Lokesh Builders Private Limited (31.8%)

Sbi Mutual Fund (8.69%)

1.66%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -19.40% vs -12.65% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -21.08% vs -39.57% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 4.83% vs -21.47% in Sep 2024

Growth in half year ended Sep 2025 is 25.22% vs -33.83% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -21.18% vs -7.48% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -20.69% vs -27.71% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -17.66% vs -5.29% in Mar 2024

YoY Growth in year ended Mar 2025 is -23.37% vs -8.99% in Mar 2024