Compare Hero MotoCorp with Similar Stocks

Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 20.04%

- Healthy long term growth as Net Sales has grown by an annual rate of 10.29% and Operating profit at 17.46%

- Company has a low Debt to Equity ratio (avg) at 0 times

With ROE of 25.2, it has a Attractive valuation with a 5.5 Price to Book Value

High Institutional Holdings at 55.8%

Company is among the highest 1% of companies rated by MarketsMojo across all 4,000 stocks

Market Beating performance in long term as well as near term

Stock DNA

Automobiles

INR 115,165 Cr (Mid Cap)

22.00

34

2.86%

-0.48

25.15%

5.50

Total Returns (Price + Dividend)

Latest dividend: 65 per share ex-dividend date: Jul-24-2025

Risk Adjusted Returns v/s

Returns Beta

News

Hero MotoCorp Sees Surge in Call Option Activity Ahead of February Expiry

Hero MotoCorp Ltd. has emerged as the most active stock in call options trading this week, signalling heightened bullish sentiment among investors. With a significant volume of contracts traded at the 5,800 strike price expiring on 24 February 2026, market participants appear confident in the stock’s near-term upside potential despite mixed technical signals and a slight dip in investor participation.

Read full news article

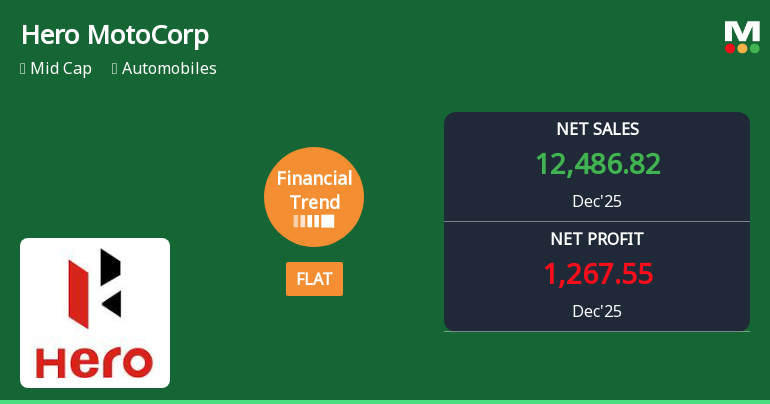

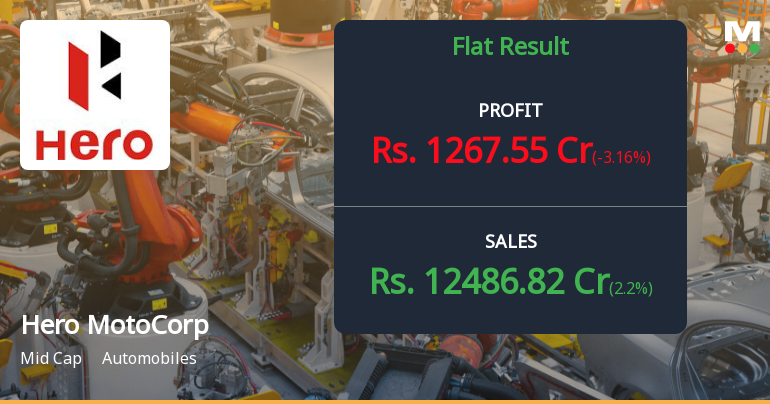

Hero MotoCorp Ltd. Reports Flat Quarterly Financial Trend Amid Strong Historical Growth

Hero MotoCorp Ltd., India’s leading two-wheeler manufacturer, has reported a flat financial performance for the quarter ended December 2025, marking a notable shift from its previously positive growth trajectory. Despite this recent plateau, the company continues to demonstrate robust historical growth and operational efficiency, maintaining a strong position within the automobile sector.

Read full news article

Hero MotoCorp Q3 FY26: Strong Revenue Growth Masks Profit Moderation Amid Margin Pressures

Hero MotoCorp Ltd., the world's largest two-wheeler manufacturer, delivered a mixed performance in Q3 FY26, posting consolidated net profit of ₹1,267.55 crores—down 3.16% quarter-on-quarter but up 14.45% year-on-year. The company's revenue surged 21.71% YoY to ₹12,486.82 crores, marking its highest-ever quarterly sales, but profitability came under pressure as margins contracted sequentially. Despite the near-term headwinds, the stock has gained 36.16% over the past year, significantly outperforming the Sensex's 6.38% return and trading at ₹5,763.10 with a market capitalisation of ₹115,423 crores.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

04-Feb-2026 | Source : BSEThe Nomination and Remuneration Committee of the Company at its meeting held today i.e. February 4 2026 has allotted 8165 equity shares of face value of Rs. 2/- each to the eligible employees of the Company who have exercised their stock options/ units under Employee Incentive Scheme 2014.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Feb-2026 | Source : BSEPursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 please find attached herewith the schedule of investor conference(s).

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Feb-2026 | Source : BSEPlease find enclosed herewith a copy of the Press Release being issued by the Company.

Corporate Actions

No Upcoming Board Meetings

Hero MotoCorp Ltd. has declared 3250% dividend, ex-date: 24 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 41 Schemes (14.41%)

Held by 1012 FIIs (29.44%)

Bahadur Chand Investments Pvt Ltd (20.01%)

Life Insurance Corporation Of India (5.73%)

7.49%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 2.20% vs 25.60% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -3.16% vs -23.25% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.05% vs 12.56% in Sep 2024

Growth in half year ended Sep 2025 is 42.88% vs 22.91% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 11.24% vs 9.87% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 33.09% vs 14.50% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 8.30% vs 10.63% in Mar 2024

YoY Growth in year ended Mar 2025 is 16.92% vs 33.27% in Mar 2024