Compare Aegis Logistics with Similar Stocks

Dashboard

With ROE of 12.1, it has a Expensive valuation with a 4.1 Price to Book Value

- The stock is trading at a discount compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of -14.88%, its profits have risen by 33.1% ; the PEG ratio of the company is 1

Underperformed the market in the last 1 year

Total Returns (Price + Dividend)

Latest dividend: 6 per share ex-dividend date: Jul-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

Aegis Logistics Ltd is Rated Sell

Aegis Logistics Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 24 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 07 February 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news articleAre Aegis Logistics Ltd latest results good or bad?

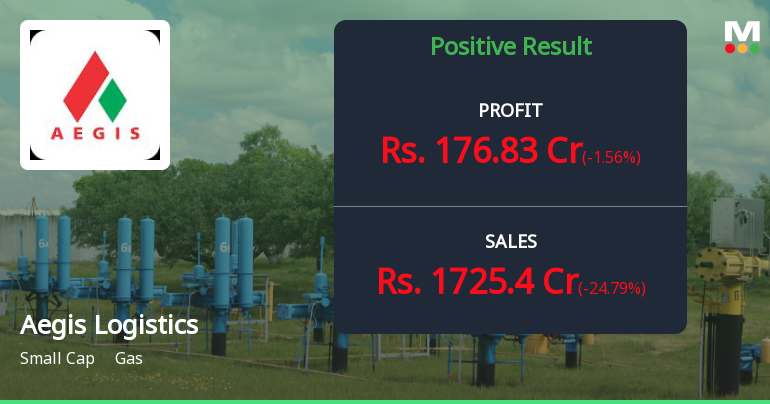

Aegis Logistics Ltd's latest financial results for Q3 FY26 present a mixed operational picture. The company reported a consolidated net profit of ₹176.83 crores, reflecting a year-on-year increase of 42.32%, which indicates strong profitability growth despite a sequential decline of 1.56% from the previous quarter. This suggests that while the company has managed to enhance its profitability metrics, there are challenges in maintaining consistent revenue growth. Net sales for the quarter amounted to ₹1,725.40 crores, which represents a slight year-on-year increase of 1.08%. However, this figure reflects a significant sequential decline of 24.79% from the elevated sales of ₹2,294.01 crores in Q2 FY26. This sharp drop raises concerns regarding the sustainability of demand in Aegis's logistics and gas terminal businesses, especially following a strong performance in the prior quarter. On the operational fron...

Read full news article

Aegis Logistics Q3 FY26: Profit Surge Masks Revenue Concerns

Aegis Logistics Ltd., a key player in India's integrated logistics and gas distribution sector, reported a consolidated net profit of ₹176.83 crores for Q3 FY26 (October-December 2025), representing a marginal sequential decline of 1.56% from ₹179.63 crores in Q2 FY26, but a robust year-on-year growth of 42.32% from ₹124.25 crores in Q3 FY25. The company's stock surged 4.67% to ₹730.45 following the results announcement, as investors focused on the strong profitability growth despite a 24.79% sequential revenue contraction.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

05-Feb-2026 | Source : BSEEarnings Call Transcript Intimation is attached.

Announcement under Regulation 30 (LODR)-Newspaper Publication

04-Feb-2026 | Source : BSECopy of newspaper publication with regard to Special Window for Transfer and Dematerialisation of Physical Securities is attached.

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

31-Jan-2026 | Source : BSEIntimation is attached.

Corporate Actions

No Upcoming Board Meetings

Aegis Logistics Ltd has declared 600% dividend, ex-date: 18 Jul 25

Aegis Logistics Ltd has announced 1:10 stock split, ex-date: 16 Sep 15

Aegis Logistics Ltd has announced 2:3 bonus issue, ex-date: 18 Aug 10

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 21 Schemes (5.08%)

Held by 178 FIIs (17.87%)

Huron Holdings Limited (31.67%)

Sudhir Omprakash Malhotra (4.46%)

9.68%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -24.79% vs 33.42% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -1.56% vs 36.79% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 19.74% vs 0.49% in Sep 2024

Growth in half year ended Sep 2025 is 20.78% vs 6.04% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 13.44% vs -2.88% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 27.79% vs 2.35% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -4.00% vs -18.33% in Mar 2024

YoY Growth in year ended Mar 2025 is 16.54% vs 22.95% in Mar 2024