Compare Antony Waste han with Similar Stocks

Stock DNA

Other Utilities

INR 1,609 Cr (Small Cap)

24.00

34

0.00%

0.54

9.34%

2.24

Total Returns (Price + Dividend)

Antony Waste han for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Antony Waste Handling Cell Ltd is Rated Sell

Antony Waste Handling Cell Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 16 January 2026. However, the analysis and financial metrics discussed below reflect the stock's current position as of 30 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

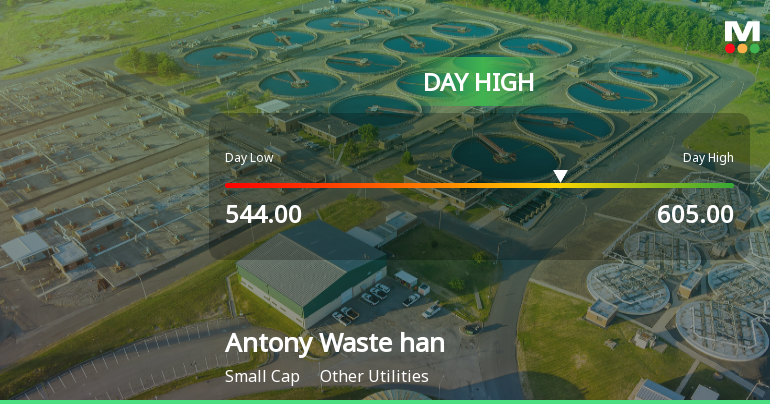

Antony Waste Handling Cell Ltd Hits Intraday High with 8.72% Surge

Antony Waste Handling Cell Ltd recorded a robust intraday performance on 30 Jan 2026, surging to an intraday high of Rs 602.65, marking a significant 8.72% gain. This strong upward movement comes after two consecutive days of decline, signalling a notable reversal in the stock’s short-term trend.

Read full news article

Antony Waste Handling Cell Ltd Sees Technical Momentum Shift Amid Mixed Signals

Antony Waste Handling Cell Ltd has experienced a notable shift in its technical momentum, moving from a mildly bearish stance to a sideways trend. Despite a strong day change of 13.95%, the stock’s technical indicators present a complex picture, with mixed signals from MACD, RSI, Bollinger Bands, and moving averages. This article analyses these developments in detail, placing them in the context of the company’s recent price action and broader market performance.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

27-Jan-2026 | Source : BSEPlease find intimation w.r.t Earnings Call scheduled on Monday February 02 2026

Board Meeting Intimation for Board Meeting Scheduled On Friday January 30 2026

19-Jan-2026 | Source : BSEAntony Waste Handling Cell Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 30/01/2026 inter alia to consider and approve Unaudited financial results (standalone and consolidated) for the quarter and nine months ended December 31 2025

Business Update For Quarter And Nine-Month Period Ended December 31 2025

08-Jan-2026 | Source : BSEPlease find attached intimation w.r.t Business Update for quarter and nine- month period ended December 31 2025

Corporate Actions

(30 Jan 2026)

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

0.2294

Held by 1 Schemes (2.25%)

Held by 36 FIIs (11.78%)

Jose Jacob Kallarakal (18.4%)

Massachusetts Institute Of Technology (6.93%)

30.21%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 4.17% vs 1.93% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -23.23% vs -55.55% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 12.67% vs 0.59% in Sep 2024

Growth in half year ended Sep 2025 is 6.22% vs -35.53% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 4.26% vs 1.57% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -22.74% vs 0.31% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.14% vs 2.01% in Mar 2024

YoY Growth in year ended Mar 2025 is -0.99% vs 26.63% in Mar 2024