Compare Bajaj Consumer with Similar Stocks

Dashboard

High Management Efficiency with a high ROE of 20.87%

Company has a low Debt to Equity ratio (avg) at 0 times

With a growth in Net Profit of 83.21%, the company declared Very Positive results in Dec 25

With ROE of 21.2, it has a Fair valuation with a 7.2 Price to Book Value

High Institutional Holdings at 25.45%

Market Beating performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Feb-16-2024

Risk Adjusted Returns v/s

Returns Beta

News

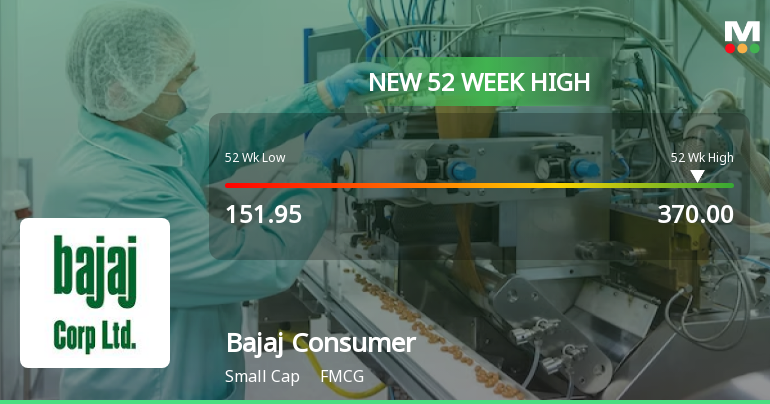

Bajaj Consumer Care Ltd Hits New 52-Week High of Rs 370

Bajaj Consumer Care Ltd has reached a significant milestone by hitting a new 52-week high of Rs.370, marking a notable surge in its stock price amid a strong performance in the FMCG sector. This achievement underscores the company’s robust momentum and sustained growth over the past year.

Read full news article

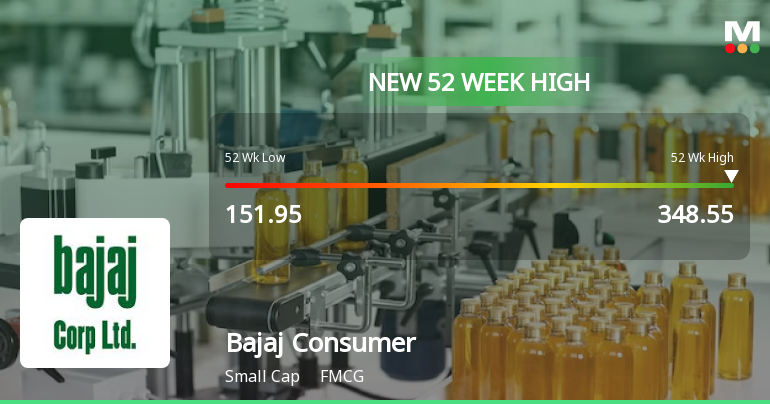

Bajaj Consumer Care Ltd Hits New 52-Week High at Rs 348.55

Bajaj Consumer Care Ltd has surged to a fresh 52-week high of Rs.348.55, reflecting robust momentum in the FMCG sector and underscoring the company’s impressive performance over the past year. This milestone highlights the stock’s significant outperformance relative to its peers and the broader market.

Read full news article

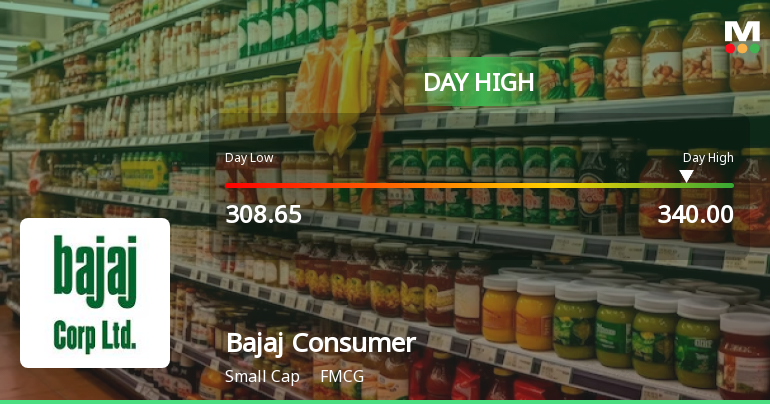

Bajaj Consumer Care Ltd Hits Intraday High with 8.13% Surge on 2 Feb 2026

Bajaj Consumer Care Ltd demonstrated robust intraday strength on 2 Feb 2026, surging 8.13% to touch a high of ₹338, just 1.32% shy of its 52-week peak of ₹342.45. The stock outperformed its FMCG sector peers and the broader market, reflecting strong trading momentum and positive market sentiment.

Read full news article Announcements

Bajaj Consumer Care Limited - Analysts/Institutional Investor Meet/Con. Call Updates

15-Nov-2019 | Source : NSEBajaj Consumer Care Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Bajaj Consumer Care Limited - Analysts/Institutional Investor Meet/Con. Call Updates

05-Nov-2019 | Source : NSEBajaj Consumer Care Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Bajaj Consumer Care Limited - Analysts/Institutional Investor Meet/Con. Call Updates

23-Oct-2019 | Source : NSEBajaj Consumer Care Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates_Transcripts of Conference Call dated 18th October 2019

Corporate Actions

No Upcoming Board Meetings

Bajaj Consumer Care Ltd has declared 300% dividend, ex-date: 16 Feb 24

Bajaj Consumer Care Ltd has announced 1:5 stock split, ex-date: 05 May 11

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 4 Schemes (15.02%)

Held by 93 FIIs (9.7%)

Bajaj Resources Private Limited (42.96%)

Hdfc Small Cap Fund (7.16%)

22.26%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 30.58% vs -1.98% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 83.21% vs -30.37% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 10.85% vs -4.97% in Sep 2024

Growth in half year ended Sep 2025 is 16.30% vs -17.40% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 17.32% vs -4.01% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 34.26% vs -21.34% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -1.96% vs 2.42% in Mar 2024

YoY Growth in year ended Mar 2025 is -19.41% vs 11.64% in Mar 2024