Compare Bharti Airtel with Similar Stocks

Dashboard

High Debt Company with a Debt to Equity ratio (avg) at 2.42 times

- High Debt Company with a Debt to Equity ratio (avg) at 2.42 times

Healthy long term growth as Net Sales has grown by an annual rate of 15.68% and Operating profit at 37.60%

The company has declared Positive results for the last 8 consecutive quarters

With ROCE of 19.6, it has a Fair valuation with a 4.5 Enterprise value to Capital Employed

Reducing Promoter Confidence

Consistent Returns over the last 3 years

Stock DNA

Telecom - Services

INR 1,144,441 Cr (Large Cap)

38.00

37

0.80%

1.56

26.72%

9.64

Total Returns (Price + Dividend)

Latest dividend: 16 per share ex-dividend date: Jul-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Bharti Airtel Ltd latest results good or bad?

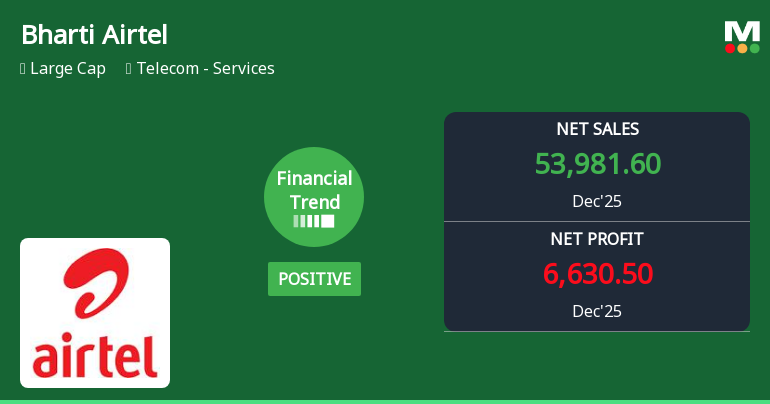

Bharti Airtel Ltd's latest financial results for the quarter ending December 2025 reflect a complex operational landscape. The company reported net sales of ₹53,981.60 crores, marking a year-on-year growth of 19.62%, which is the highest quarterly revenue in its history. This growth was driven by effective tariff optimization in mobile services and strong performance in enterprise and digital services segments. Additionally, the operating margin expanded to 57.02%, indicating enhanced pricing power and operational efficiency. However, the consolidated net profit for the quarter was ₹6,630.50 crores, which represents a significant year-on-year decline of 55.14%. This drop is attributed to the absence of exceptional gains that were recognized in the previous year. On a sequential basis, the net profit decreased by 2.37% from the previous quarter, reflecting a more nuanced picture of profitability amidst stro...

Read full news article

Bharti Airtel Ltd Reports Mixed Quarterly Results Amid Flattening Financial Trend

Bharti Airtel Ltd, a leading player in the Indian telecom services sector, has reported its December 2025 quarter results that reveal a notable shift in its financial trend from positive to flat. While the company continues to demonstrate strong revenue and operating profit metrics, certain key profitability indicators have softened, prompting a reassessment of its growth trajectory and investment appeal.

Read full news article

Bharti Airtel Sees Heavy Put Option Activity Ahead of February Expiry

Bharti Airtel Ltd has emerged as the most active stock in put options trading, signalling a notable shift in market sentiment. With significant volumes concentrated at the ₹2,000 strike price for the 24 February 2026 expiry, investors appear to be positioning for downside risk or hedging existing exposures in the telecom sector.

Read full news article Announcements

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

04-Feb-2026 | Source : BSEDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

02-Feb-2026 | Source : BSEDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

02-Feb-2026 | Source : BSEDisclosure under Regulation 44 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Bharti Airtel Ltd has declared 320% dividend, ex-date: 18 Jul 25

Bharti Airtel Ltd has announced 5:10 stock split, ex-date: 24 Jul 09

No Bonus history available

Bharti Airtel Ltd has announced 1:14 rights issue, ex-date: 27 Sep 21

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 48 Schemes (11.36%)

Held by 2028 FIIs (28.76%)

Bharti Telecom Limited (40.47%)

Lici Market Plus 1 Balanced Fund (3.81%)

1.78%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 3.52% vs 5.42% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -2.37% vs 14.19% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 27.04% vs 7.38% in Sep 2024

Growth in half year ended Sep 2025 is 64.32% vs 162.53% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 24.36% vs 11.32% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -14.04% vs 317.66% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 15.34% vs 7.79% in Mar 2024

YoY Growth in year ended Mar 2025 is 349.39% vs -10.53% in Mar 2024