Compare Bosch Home Comfo with Similar Stocks

Dashboard

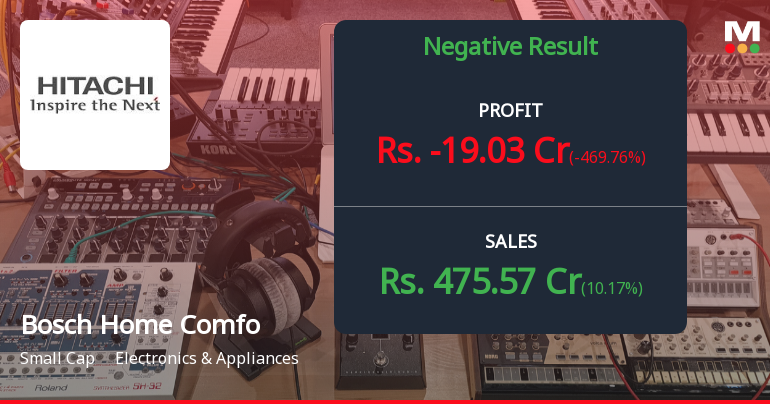

Negative results in Dec 25

- PBT LESS OI(Q) At Rs -19.30 cr has Fallen at -139.16%

- PAT(Q) At Rs -11.14 cr has Fallen at -233.5%

- CASH AND CASH EQUIVALENTS(HY) Lowest at Rs 19.67 cr

With ROCE of 5.8, it has a Expensive valuation with a 6.1 Enterprise value to Capital Employed

29.19% of Promoter Shares are Pledged

Below par performance in long term as well as near term

Stock DNA

Electronics & Appliances

INR 3,704 Cr (Small Cap)

115.00

74

2.71%

0.34

6.82%

7.57

Total Returns (Price + Dividend)

Latest dividend: 36 per share ex-dividend date: Jul-09-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Bosch Home Comfort India Ltd latest results good or bad?

Bosch Home Comfort India Ltd's latest financial results for the quarter ended December 2025 reveal a complex operational landscape. The company reported a net loss of ₹19.03 crores, which marks a significant decline compared to the same quarter last year, reflecting a year-on-year change of -469.76%. This indicates a substantial deterioration in profitability despite a revenue growth of 10.17%, which amounted to ₹475.57 crores. The operating margin turned negative at -0.20%, a stark contrast to the 2.32% margin reported in the previous year, highlighting ongoing challenges in cost management and pricing power. The profit before tax also worsened, standing at ₹-24.84 crores, compared to a loss of ₹-3.68 crores in the same quarter last year. Sequentially, the company saw a reduction in losses from ₹39.96 crores in the previous quarter, suggesting some recovery; however, this was primarily driven by a 17.3...

Read full news article

Bosch Home Comfort Q3 FY26: Losses Deepen as Operational Challenges Mount

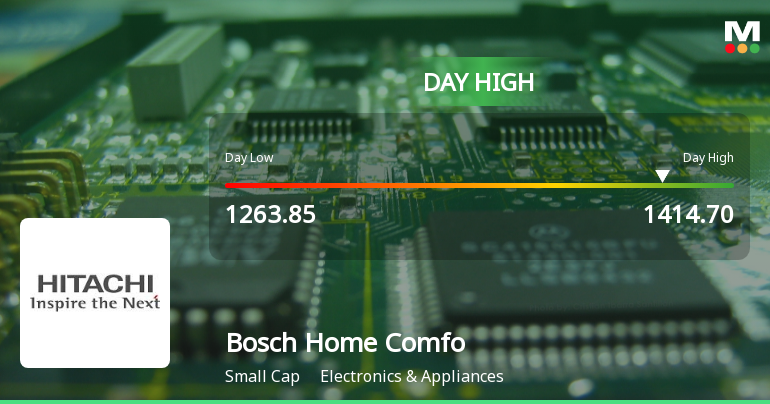

Bosch Home Comfort India Ltd. (formerly Johnson Controls-Hitachi Air Conditioning India Company) reported a challenging third quarter for FY2026, posting a net loss of ₹19.03 crores compared to a loss of ₹3.34 crores in Q3 FY25, marking a steep deterioration of 469.76% year-on-year. The small-cap electronics and appliances manufacturer, with a market capitalisation of ₹3,518 crores, saw its stock surge 6.91% to ₹1,375 on January 28, 2026, though this appears to be a technical rebound from its 52-week low of ₹1,263.85 rather than a fundamental vote of confidence.

Read full news article

Bosch Home Comfort India Ltd Hits Intraday High with 10% Surge on 28 Jan 2026

Bosch Home Comfort India Ltd demonstrated a robust intraday performance on 28 Jan 2026, surging 10.0% to touch an intraday high of Rs 1393.05, marking a significant rebound after two consecutive days of decline.

Read full news article Announcements

Johnson Controls - Hitachi Air Conditioning India Limited - Other General Purpose

13-Nov-2019 | Source : NSEJohnson Controls - Hitachi Air Conditioning India Limited has informed the Exchange that Related party transactions for the Half year ended 30th September, 2019 are attached.

Shareholders meeting

14-Aug-2019 | Source : NSE

| Johnson Controls - Hitachi Air Conditioning India Limited has informed the Exchange regarding Proceedings of Annual General Meeting held on August 14, 2019 |

Financial Result Updates

14-Aug-2019 | Source : NSE

| Johnson Controls - Hitachi Air Conditioning India Limited has submitted to the Exchange, the financial results for the period ended June 30, 2019. |

Corporate Actions

No Upcoming Board Meetings

Bosch Home Comfort India Ltd has declared 360% dividend, ex-date: 09 Jul 25

No Splits history available

No Bonus history available

Bosch Home Comfort India Ltd has announced 1:5 rights issue, ex-date: 05 Mar 13

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

29.1889

Held by 7 Schemes (1.06%)

Held by 24 FIIs (0.74%)

Jchac India Holdco Limited (74.25%)

None

12.41%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 10.17% vs 44.09% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -469.76% vs 87.68% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -9.66% vs 64.31% in Sep 2024

Growth in half year ended Sep 2025 is -505.08% vs 106.26% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -4.96% vs 59.03% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -1,684.78% vs 102.22% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 43.66% vs -19.53% in Mar 2024

YoY Growth in year ended Mar 2025 is 177.70% vs 7.83% in Mar 2024