Compare Finkurve Fin. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 8.24%

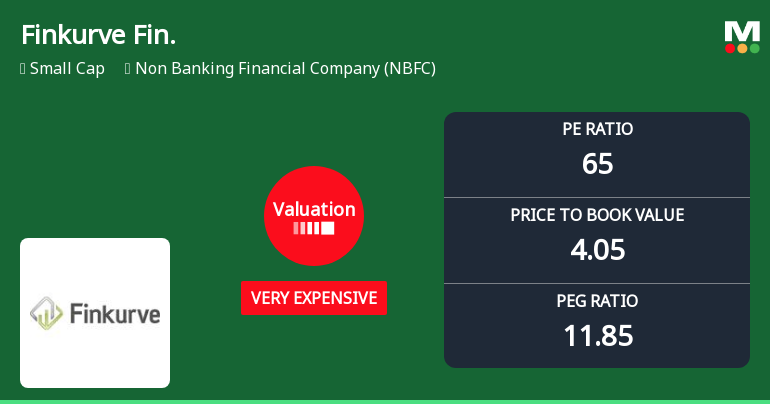

With ROE of 6.3, it has a Very Expensive valuation with a 4 Price to Book Value

Despite the size of the company, domestic mutual funds hold only 0% of the company

Below par performance in long term as well as near term

Stock DNA

Non Banking Financial Company (NBFC)

INR 1,378 Cr (Small Cap)

63.00

22

0.00%

1.16

6.26%

4.05

Total Returns (Price + Dividend)

Finkurve Fin. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Finkurve Financial Services Q3 FY26: Growth Momentum Stalls as Profitability Plunges 71%

Finkurve Financial Services Ltd., a Mumbai-based non-banking financial company (NBFC), reported a concerning quarter-on-quarter decline in profitability for Q3 FY26, with consolidated net profit plummeting 71.15% to ₹4.91 crores from ₹17.02 crores in Q2 FY26. Despite this sequential setback, the company maintained year-on-year momentum, with net profit surging 165.41% compared to a loss of ₹0.67 crores in Q3 FY25. The stock, currently trading at ₹93.20 with a market capitalisation of ₹1,378 crores, has underperformed significantly, declining 11.45% over the past year whilst the broader market gained 7.07%.

Read full news articleAre Finkurve Financial Services Ltd latest results good or bad?

Finkurve Financial Services Ltd has reported its latest financial results for the quarter ended September 2025, showcasing a notable growth trajectory in net sales, which reached ₹48.05 crores, reflecting a quarter-on-quarter increase of 20.49%. This growth is significant compared to the previous quarter, where net sales showed a marginal decline. The company's operating profit margin for this period was recorded at 34.15%, indicating a consistent performance in maintaining operational efficiency, although it represents a slight decrease from the previous quarter's margin. In terms of profitability, the standalone net profit for the quarter was ₹5.92 crores, marking a growth of 16.31% compared to the prior quarter. However, this growth rate is lower than the 30.18% growth observed in the previous quarter, suggesting some volatility in profit generation. Despite the positive sales and profit growth, Finkur...

Read full news article

Finkurve Financial Services Ltd Valuation Shifts Signal Heightened Price Risk

Finkurve Financial Services Ltd, a notable player in the Non Banking Financial Company (NBFC) sector, has seen its valuation parameters shift markedly, with its price-to-earnings (P/E) and price-to-book value (P/BV) ratios moving into the 'very expensive' territory. Despite this, the stock’s recent returns have been mixed when compared to the broader Sensex, prompting a reassessment of its investment appeal.

Read full news article Announcements

Compliances-Reg. 57 (1) - Certificate of interest payment/Principal in case of NCD

04-Feb-2026 | Source : BSEPursuant to Regulation 57 of SEBI (LODR) Regulations 2015 and SEBI Master Circular dated May 22 2024 interest payment has been made to concerned NCD holders. Details of the same are enclosed herewith.

Board Meeting Intimation for Such Meeting To Be Held On Monday February 09 2026.

04-Feb-2026 | Source : BSEFinkurve Financial Services Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/02/2026 inter alia to consider and approve the raising of funds by issuance of Non-Convertible Debentures having face value of Rs. 10000 (Indian Rupees Ten Thousand only) each and issue price of Rs. 10000 (Indian Rupees Ten Thousand only) through private placement via Electronic Bidding Platform (EBP).

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

03-Feb-2026 | Source : BSEPursuant to Regulation 30 read with the applicable provisions of Schedule III of the Securities Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015 we would like to inform you that the Company will be hosting an Investors /Analysts call on the financial results of the Company for the Quarter and Nine months ended December 31 2025 on Monday February 09 2026 from 12:00 Noon - 01:00 P.M. (IST). Details of registration link and dial in numbers pertaining to the aforesaid call are enclosed herewith.

Corporate Actions

09 Feb 2026

No Dividend history available

Finkurve Financial Services Ltd has announced 1:10 stock split, ex-date: 26 Feb 14

Finkurve Financial Services Ltd has announced 6:1 bonus issue, ex-date: 22 Aug 13

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

19.0427

Held by 0 Schemes

Held by 5 FIIs (6.7%)

Mohinidevi Bhanwarlal Kothari (28.92%)

Thomas John Muthoot (13.15%)

30.41%

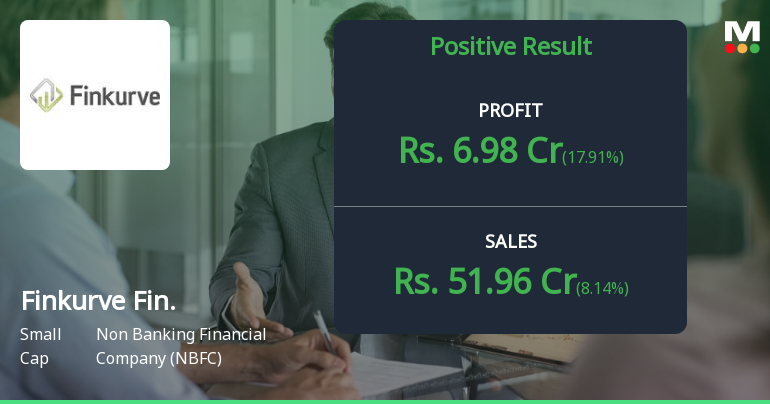

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 8.14% vs 20.49% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 17.91% vs 16.31% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 45.75% vs 40.14% in Sep 2024

Growth in half year ended Sep 2025 is 40.08% vs 25.56% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 39.61% vs 50.25% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 33.26% vs 20.86% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 56.02% vs 78.54% in Mar 2024

YoY Growth in year ended Mar 2025 is 8.34% vs 12.22% in Mar 2024