Compare Fusion Finance with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with an average Return on Equity (ROE) of 0%

- Poor long term growth as Operating profit has grown by an annual rate of -31.08%

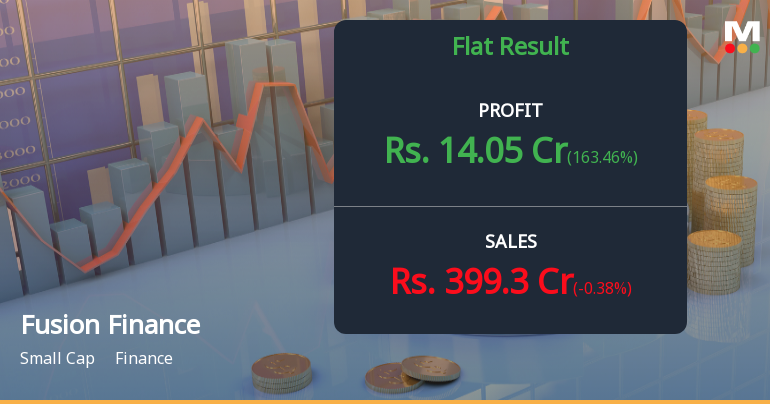

Flat results in Dec 25

With ROE of -13.8, it has a Very Expensive valuation with a 1.5 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Finance

INR 2,984 Cr (Small Cap)

NA (Loss Making)

22

0.00%

2.57

-52.04%

1.60

Total Returns (Price + Dividend)

Fusion Finance for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Fusion Finance Ltd latest results good or bad?

Fusion Finance Ltd's latest financial results for Q3 FY26 indicate a significant operational turnaround, highlighted by a net profit of ₹14.05 crores, a stark contrast to the substantial loss of ₹719.32 crores in the same quarter last year. This marks the company's first profitable quarter after a series of losses, reflecting a notable improvement in operational efficiency and interest cost management. The operating margin surged to 33.14%, a remarkable recovery from a negative margin of 63.18% year-on-year. However, the company faced challenges with revenue, which declined by 15.73% year-on-year to ₹399.30 crores, and also saw a slight sequential decrease of 0.38% from the previous quarter. This revenue contraction raises concerns about the sustainability of the recent profitability, especially as the nine-month revenue total shows a significant decline of 31.48% compared to the same period last year. In...

Read full news article

Fusion Finance Q3 FY26: Return to Profitability After Six Loss-Making Quarters

Fusion Finance Limited has posted a net profit of ₹14.05 crores in Q3 FY26, marking a dramatic turnaround from six consecutive quarters of losses that culminated in a staggering ₹719.32-crore loss in December 2024. The small-cap NBFC, with a market capitalisation of ₹3,098 crores, delivered this quarter's profit on revenue of ₹399.30 crores, though topline declined 15.73% year-on-year and remained essentially flat on a sequential basis.

Read full news articleAre Fusion Finance Ltd latest results good or bad?

Fusion Finance Ltd's latest financial results reveal a complex picture of the company's operational performance and ongoing challenges. The company reported a net loss of ₹22.14 crores for Q2 FY26, which, while a significant reduction from the previous quarter's loss of ₹92.25 crores, still indicates persistent operational difficulties. Over the past four quarters, Fusion Finance has accumulated losses exceeding ₹1,300 crores, raising concerns about its long-term viability. In terms of revenue, the company generated ₹400.82 crores in Q2 FY26, marking a sequential decline of 7.74% from the previous quarter and a substantial year-on-year decrease of 42.04% from ₹691.55 crores in Q2 FY25. This decline reflects a troubling trend, as it represents the seventh consecutive quarter of revenue contraction, highlighting ongoing issues with revenue generation and asset quality. On a more positive note, the operating...

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

07-Feb-2026 | Source : BSEPublication of financial results in newspaper as per detailed disclosure enclosed

Announcement under Regulation 30 (LODR)-Monitoring Agency Report

07-Feb-2026 | Source : BSEAs per detailed disclosure enclosed

December 31 2025

06-Feb-2026 | Source : BSEOutcome of Board Meeting

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Fusion Finance Ltd has announced 55:91 rights issue, ex-date: 04 Apr 25

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

4.4936

Held by 7 Schemes (7.15%)

Held by 39 FIIs (4.89%)

Honey Rose Investment Ltd (35.2%)

Hdfc Mutual Fund - Hdfc Banking And Financial Services Fund (2.98%)

18.93%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -0.38% vs -7.74% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 163.46% vs 76.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -39.47% vs 28.04% in Sep 2024

Growth in half year ended Sep 2025 is 66.42% vs -238.40% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -33.40% vs 10.95% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 90.53% vs -384.48% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 0.13% vs 33.00% in Mar 2024

YoY Growth in year ended Mar 2025 is -342.34% vs 30.52% in Mar 2024