Compare Khadim India with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -4.87% CAGR growth in Net Sales over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.37 times

- The company has been able to generate a Return on Equity (avg) of 6.90% signifying low profitability per unit of shareholders funds

Negative results in Sep 25

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Jul-31-2019

Risk Adjusted Returns v/s

Returns Beta

News

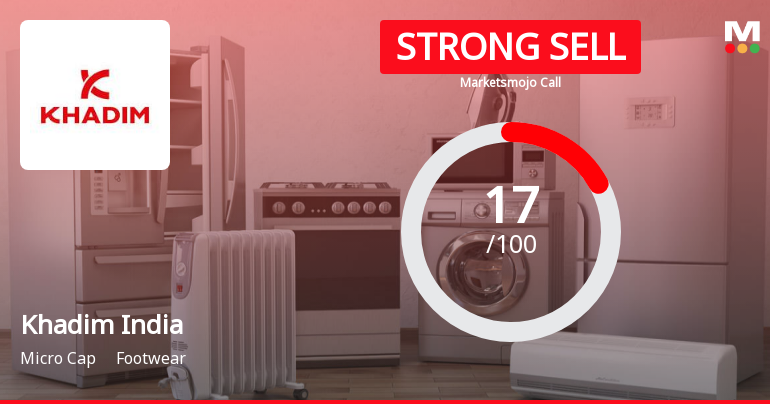

Khadim India Ltd is Rated Strong Sell

Khadim India Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 12 August 2025. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 05 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

Khadim India Ltd is Rated Strong Sell

Khadim India Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 12 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

Khadim India Ltd is Rated Strong Sell

Khadim India Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 12 August 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 14 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Board Meeting Intimation for Board Meeting Intimation For Unaudited Standalone And Consolidated Financial Results Of The Company For The Quarter And Nine Months Ended Dec 31 2025

30-Jan-2026 | Source : BSEKhadim India Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve Board Meeting Intimation for unaudited standalone and consolidated financial results of the Company for the quarter and nine months ended Dec 31 2025

Announcement under Regulation 30 (LODR)-Credit Rating

12-Jan-2026 | Source : BSECredit Rating

Closure of Trading Window

31-Dec-2025 | Source : BSEClosure of Trading Window for the quarter ending 31st December 2025

Corporate Actions

10 Feb 2026

Khadim India Ltd has declared 10% dividend, ex-date: 31 Jul 19

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 2 FIIs (0.31%)

Khadim Development Company Private Limited (50.46%)

Bharadhwajan Jaganathan Velamur (4.49%)

30.36%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -36.73% vs 2.22% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -28.33% vs 30.17% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -37.26% vs -0.19% in Sep 2024

Growth in half year ended Sep 2025 is -15.44% vs -13.12% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -9.88% vs -5.95% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -21.14% vs -60.20% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 9.96% vs -35.44% in Mar 2024

YoY Growth in year ended Mar 2025 is -19.43% vs -64.07% in Mar 2024