Compare Modern Shares with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 8.06% and Operating profit at 8.88%

Flat results in Dec 25

With ROE of 1.6, it has a Expensive valuation with a 0.6 Price to Book Value

Underperformed the market in the last 1 year

Stock DNA

Non Banking Financial Company (NBFC)

INR 8 Cr (Micro Cap)

36.00

21

0.00%

0.00

1.61%

0.59

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Jul-24-2018

Risk Adjusted Returns v/s

Returns Beta

News

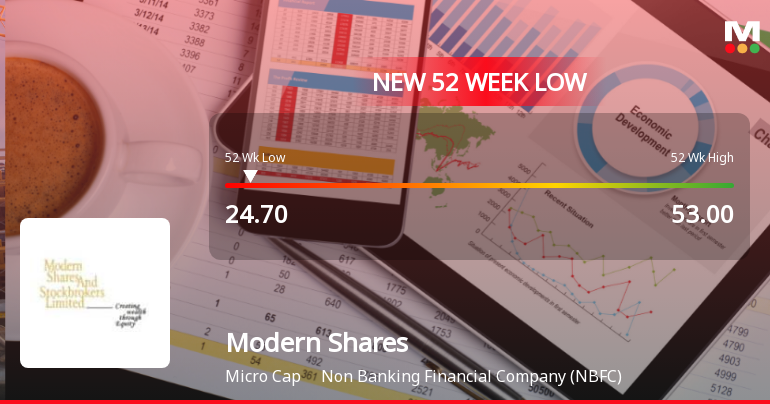

Modern Shares & Stockbrokers Ltd Falls to 52-Week Low Amidst Continued Downtrend

Modern Shares & Stockbrokers Ltd, a Non Banking Financial Company (NBFC), touched a fresh 52-week low of Rs.24.7 today, marking a significant decline amid a challenging market environment and subdued financial performance over the past year.

Read full news article

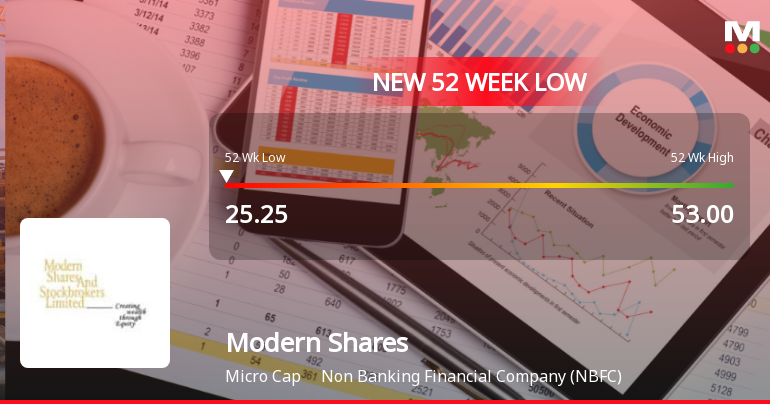

Modern Shares & Stockbrokers Ltd Falls to 52-Week Low Amidst Continued Downtrend

Modern Shares & Stockbrokers Ltd has touched a fresh 52-week low of Rs.25.5 today, marking a significant decline in its share price amid a prolonged period of underperformance relative to its sector and broader market indices.

Read full news article

Modern Shares & Stockbrokers Ltd Falls to 52-Week Low Amidst Continued Downtrend

Modern Shares & Stockbrokers Ltd has declined to a fresh 52-week low of Rs.26.05, marking a significant downturn amid a series of consecutive losses. The stock’s recent performance highlights ongoing pressures within the Non Banking Financial Company (NBFC) sector, with the share price falling sharply over the past week and underperforming its sector peers.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

02-Feb-2026 | Source : BSEPursuant of Regulation 47 of SEBI (LODR) Regulations 2015 please find attached the Newspaper Extracts of the Unaudited Financial Results as on December 31 2025 in Free Press Journal and Navshakti Times. The results were published on February 1 2026

Unaudited Financial Results For The Quarter Ended December 31 2025

30-Jan-2026 | Source : BSEPlease find attached the unaudited results for the quarter ended December 31 2025 Limited review report and the result unaudited results published in newspaper.

Board Meeting Intimation for The Estimated (Provisional) Un-Audited Results For The 3Rd Quarter Ended December 31 2025

12-Jan-2026 | Source : BSEModern Shares & Stockbrokers Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 30/01/2026 inter alia to consider and approve the estimated (provisional) un-audited results for the 3rd Quarter ended December 31 2025. The notice has been issued pursuant to Regulation 29(1) (a) & 29(2) of the Listing Regulations. Please note that as informed in our letter dated January 2 2026 the Trading Window has been closed from Friday January 2 2026 and the said window shall open 48 hours after the outcome of the aforesaid meeting is made public.

Corporate Actions

No Upcoming Board Meetings

Modern Shares & Stockbrokers Ltd has declared 5% dividend, ex-date: 24 Jul 18

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Bhagwanti Exports Private Limited (36.68%)

Kamal Ramesh Dhanwani (3.41%)

14.36%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -8.79% vs 7.06% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -400.00% vs -111.11% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 1.00% vs 25.62% in Sep 2024

Growth in half year ended Sep 2025 is 10.71% vs 33.33% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -2.05% vs 19.18% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -3.70% vs -10.00% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 9.44% vs 14.14% in Mar 2024

YoY Growth in year ended Mar 2025 is -45.00% vs 166.67% in Mar 2024