Compare Muller & Phipps with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 9.11% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

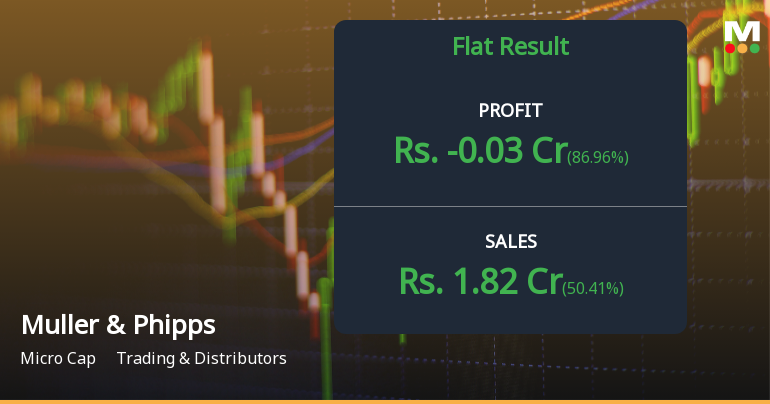

Flat results in Dec 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Trading & Distributors

INR 15 Cr (Micro Cap)

NA (Loss Making)

22

0.00%

-0.51

-5.59%

-10.14

Total Returns (Price + Dividend)

Muller & Phipps for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are Muller & Phipps (India) Ltd latest results good or bad?

Muller & Phipps (India) Ltd's latest financial results indicate a challenging operational landscape. In Q2 FY26, the company reported net sales of ₹1.82 crores, reflecting a significant quarter-on-quarter growth of 97.83% and a year-on-year increase of 50.41%. However, this topline growth did not translate into profitability, as the company recorded a net loss of ₹0.03 crores, marking a substantial decline compared to the previous quarter's profit. The operating margin, excluding other income, was reported at -4.11%, which, while an improvement from the previous quarter's -38.03%, remains deeply negative. The PAT margin also fell to -1.74%, a stark contrast to the previous quarter's exceptional 75.71%. This indicates persistent operational challenges and an inability to achieve profitability from core trading activities. The balance sheet reveals significant structural weaknesses, with shareholder funds a...

Read full news article

Muller & Phipps Q2 FY26: Losses Deepen as Operational Challenges Mount

Muller & Phipps (India) Ltd., the century-old trading and distribution company, reported a net loss of ₹0.03 crores for Q2 FY26, marking a dramatic reversal from the ₹0.70 crores profit posted in Q1 FY26. The loss represents a sequential decline of 104.29% and an 86.96% deterioration on a year-on-year basis, underscoring persistent operational challenges at the ₹14.34 crore market capitalisation firm.

Read full news article

Muller & Phipps (India) Ltd Stock Hits 52-Week Low at Rs.202

Muller & Phipps (India) Ltd, a player in the Trading & Distributors sector, touched a new 52-week low of Rs.202 today, marking a significant decline in its share price amid broader market fluctuations and company-specific factors.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

13-Feb-2026 | Source : BSENewspaper publication for unaudited Financial results for the quarter and nine months ended 31-12-2025

Board Meeting Outcome for Quarterly Results For Quarter And Nine Months Ended 31-12-2025

11-Feb-2026 | Source : BSEPursuant to Regulation 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulation 2015 we would like to inform you that the Board of Directors of the Company at its meeting held today has interalia: 1. Approved the Unaudited Financial Results for the quarter and nine months ended 31-12-2025 along with the Independent Auditors Review Report which were duly recommended by the Audit Committee and approved by Board of Directors of the company The meeting of the Board of Directors commenced at 4.30 p.m. and concluded at 6.40 p.m.

Unaudited Quarter Results For The Quarter And Nine Month Ended 31-12-2025

11-Feb-2026 | Source : BSEResults for the quarter and nine month ended 31-12-2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Development Holding Asia Limited (51.63%)

Swar Investments And Trading Co. Private Limited (9.02%)

24.66%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is -7.95% vs 98.68% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -225.00% vs -140.00% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 1.48% vs 4.65% in Sep 2024

Growth in half year ended Sep 2025 is 494.12% vs -136.17% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -1.90% vs 26.05% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 196.55% vs -169.05% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 43.00% vs 5.88% in Mar 2024

YoY Growth in year ended Mar 2025 is -204.11% vs 247.62% in Mar 2024