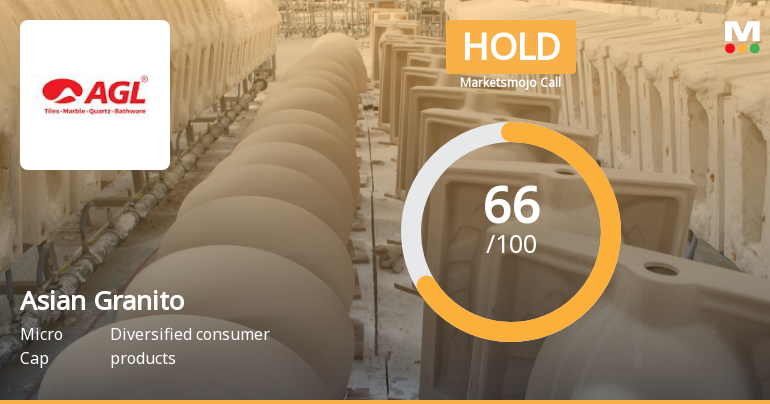

Asian Granito India Ltd is Rated Hold

2026-02-02 10:10:04Asian Granito India Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 16 Oct 2025. While this rating change occurred several months ago, the analysis and financial metrics presented here reflect the company’s current position as of 02 February 2026, providing investors with an up-to-date view of the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Asian Granito India Ltd Technical Momentum Shifts Amid Mixed Market Signals

2026-02-02 08:03:25Asian Granito India Ltd has experienced a nuanced shift in its technical momentum, transitioning from a bullish to a mildly bullish trend as of early February 2026. Despite a recent decline in price, key technical indicators present a mixed picture, reflecting both cautious optimism and underlying challenges within the diversified consumer products sector.

Read full news article

Asian Granito India Ltd is Rated Hold

2026-01-22 10:10:04Asian Granito India Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 16 Oct 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 22 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article

Asian Granito India Ltd is Rated Hold by MarketsMOJO

2026-01-11 10:10:03Asian Granito India Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 16 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 11 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Asian Granito India Ltd is Rated Hold by MarketsMOJO

2025-12-31 10:10:03Asian Granito India Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 16 Oct 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 31 December 2025, providing investors with an up-to-date perspective on its fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Asian Granito India Hits New 52-Week High at Rs.76.93

2025-12-24 14:20:29Asian Granito India has reached a significant milestone by touching a new 52-week high of Rs.76.93, reflecting notable momentum in the stock’s performance within the diversified consumer products sector.

Read full news article

Asian Granito India Hits New 52-Week High of Rs.75.2, Marking Strong Market Momentum

2025-12-22 09:48:49Asian Granito India has reached a significant milestone by touching a new 52-week high of Rs.75.2, reflecting sustained momentum in the stock over recent sessions. This achievement underscores the stock’s robust performance within the diversified consumer products sector amid a broadly positive market environment.

Read full news article

Asian Granito’s Evaluation Revised Amid Mixed Financial Signals and Market Momentum

2025-12-20 10:10:04Asian Granito has experienced a revision in its evaluation metrics, reflecting a nuanced shift in its financial and market profile. This change comes amid a backdrop of strong recent quarterly results, attractive valuation levels, and a bullish technical outlook, despite ongoing challenges in long-term profitability and fundamental strength.

Read full news article

Asian Granito India Shows Shift in Price Momentum Amid Mixed Technical Signals

2025-12-18 08:08:05Asian Granito India has exhibited a notable shift in its price momentum, reflecting a transition in technical indicators that suggest evolving market sentiment. The stock’s recent trading activity and technical parameters reveal a complex picture, with bullish signals emerging alongside some neutral and bearish elements, underscoring the importance of a nuanced analysis for investors in the diversified consumer products sector.

Read full news articleAnnouncement under Regulation 30 (LODR)-Monitoring Agency Report

30-Jan-2026 | Source : BSEPlease find intimation with respect to Monitoring Agency Report.

Statement Of Deviation

30-Jan-2026 | Source : BSEPlease find intimation with respect to Statement of Deviation.

Announcement under Regulation 30 (LODR)-Resignation of Chief Financial Officer (CFO)

28-Jan-2026 | Source : BSEPlease find intimation with respect to Resignation of Chief Financial Officer (CFO).

Corporate Actions

04 Feb 2026

Asian Granito India Ltd has declared 7% dividend, ex-date: 09 Jun 22

No Splits history available

No Bonus history available

Asian Granito India Ltd has announced 37:30 rights issue, ex-date: 11 Apr 22