Cosmo Ferrites Ltd is Rated Strong Sell

2026-02-08 10:10:29Cosmo Ferrites Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 29 August 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 08 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news articleWhen is the next results date for Cosmo Ferrites Ltd?

2026-02-06 23:17:10The next results date for Cosmo Ferrites Ltd is scheduled for 10 February 2026....

Read full news article

Cosmo Ferrites Ltd is Rated Strong Sell

2026-01-28 10:10:35Cosmo Ferrites Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 29 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 28 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Cosmo Ferrites Ltd Falls to 52-Week Low of Rs.123 Amidst Prolonged Downtrend

2026-01-12 11:38:49Cosmo Ferrites Ltd’s stock price declined to a fresh 52-week low of Rs.123 today, marking a significant milestone in its ongoing downward trajectory. The stock has now recorded a consecutive five-day fall, accumulating a loss of 17.84% over this period, reflecting persistent pressures within the Industrial Manufacturing sector.

Read full news article

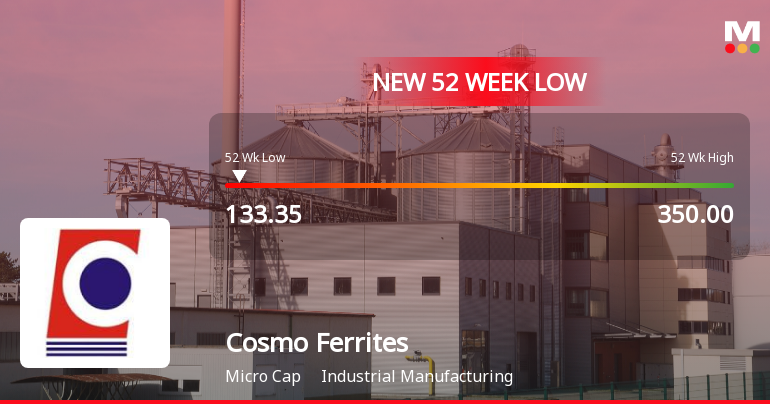

Cosmo Ferrites Ltd Stock Hits 52-Week Low Amid Continued Downtrend

2026-01-09 10:21:49Cosmo Ferrites Ltd, a key player in the industrial manufacturing sector, touched a fresh 52-week low of Rs.133.35 today, marking a significant decline amid a sustained downward trajectory over recent sessions. The stock has now recorded a cumulative loss of 15.6% over the past four trading days, reflecting ongoing pressures on its market valuation.

Read full news article

Cosmo Ferrites Ltd is Rated Strong Sell

2026-01-05 10:13:31Cosmo Ferrites Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 29 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Cosmo Ferrites Ltd is Rated Strong Sell

2025-12-25 12:58:03Cosmo Ferrites Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 29 August 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 25 December 2025, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

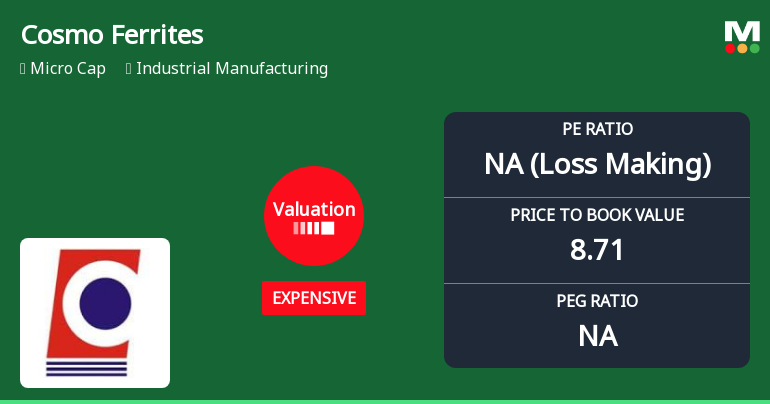

Cosmo Ferrites Valuation Shifts Highlight Price Attractiveness Changes Amid Market Challenges

2025-12-15 08:00:26Cosmo Ferrites, a key player in the industrial manufacturing sector, has experienced notable shifts in its valuation parameters, reflecting a changed market assessment of its price attractiveness. Recent data reveals adjustments in key financial metrics such as the price-to-earnings (P/E) ratio and price-to-book value (P/BV), positioning the stock differently compared to its historical averages and peer group benchmarks.

Read full news article

Cosmo Ferrites Sees Revision in Market Evaluation Amidst Challenging Fundamentals

2025-12-04 11:08:33Cosmo Ferrites, a microcap player in the industrial manufacturing sector, has experienced a revision in its market evaluation reflecting ongoing challenges in its financial and technical outlook. The stock’s recent assessment highlights subdued operational momentum and persistent headwinds impacting investor sentiment.

Read full news articleBoard Meeting Intimation for Approval Of Un-Audited Financial Results Of The Company For The Quarter Ended As On December 31 2025.

05-Feb-2026 | Source : BSECosmo Ferrites Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve Approval of Un-Audited Financial Results of the Company for the Quarter ended as on December 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulations 2018 for the Quarter ended December 31 2025.

Closure of Trading Window

30-Dec-2025 | Source : BSEIntimation of Closure of Trading Window for the Quarter Ended December 31 2025.

Corporate Actions

(10 Feb 2026)

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available