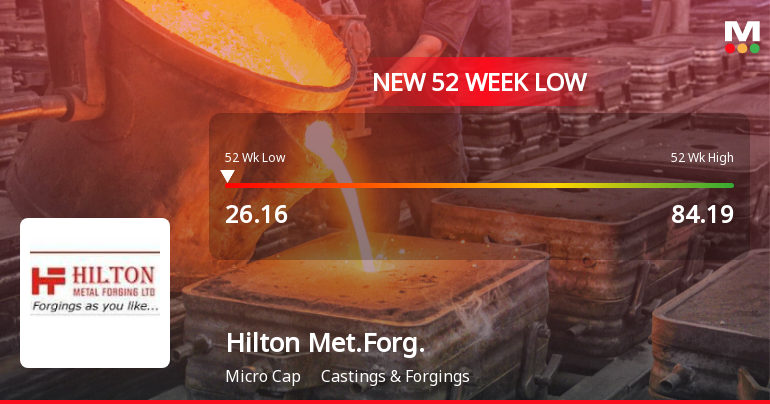

Hilton Metal Forging Ltd Falls to 52-Week Low of Rs.26.16

2026-02-02 11:21:41Hilton Metal Forging Ltd has reached a new 52-week low of Rs.26.16 today, marking a significant decline amid a sustained downward trend. The stock has underperformed its sector and broader market indices, reflecting ongoing pressures on its valuation and performance metrics.

Read full news article

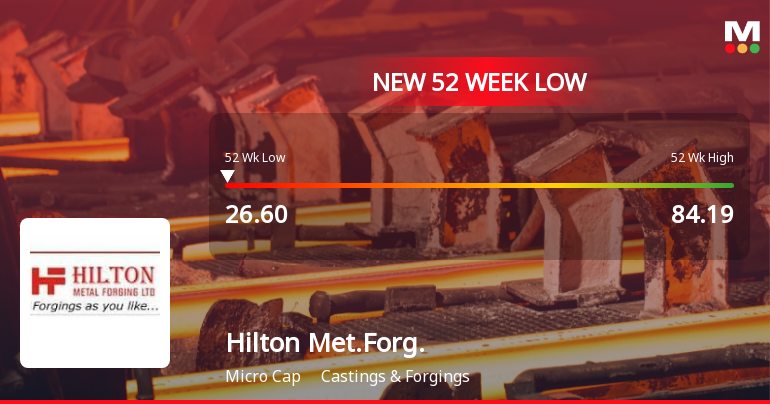

Hilton Metal Forging Ltd Falls to 52-Week Low Amid Continued Downtrend

2026-02-01 15:42:51Hilton Metal Forging Ltd’s stock declined to a fresh 52-week low of Rs.26.6 today, marking a significant drop amid broader market weakness and sectoral underperformance. The stock’s recent trajectory reflects a continuation of downward momentum, with notable underperformance relative to its peers and benchmark indices.

Read full news article

Hilton Metal Forging Ltd is Rated Sell

2026-01-29 10:10:29Hilton Metal Forging Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 15 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

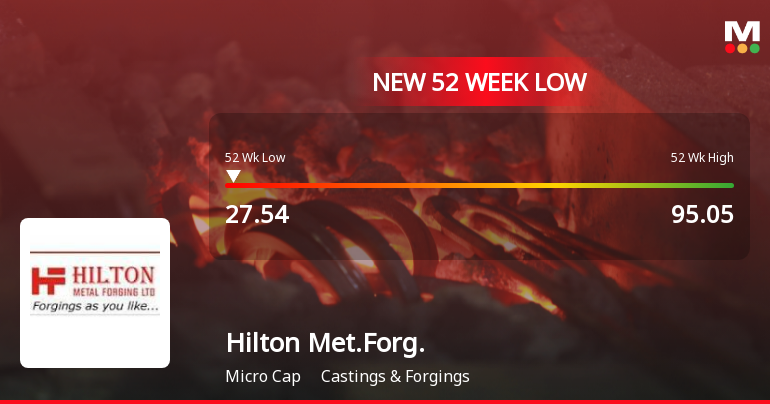

Hilton Metal Forging Ltd Falls to 52-Week Low of Rs.27.54

2026-01-28 09:50:20Hilton Metal Forging Ltd, a player in the Castings & Forgings sector, touched a new 52-week low of Rs.27.54 today, marking a significant decline in its stock price amid broader market movements and company-specific factors.

Read full news article

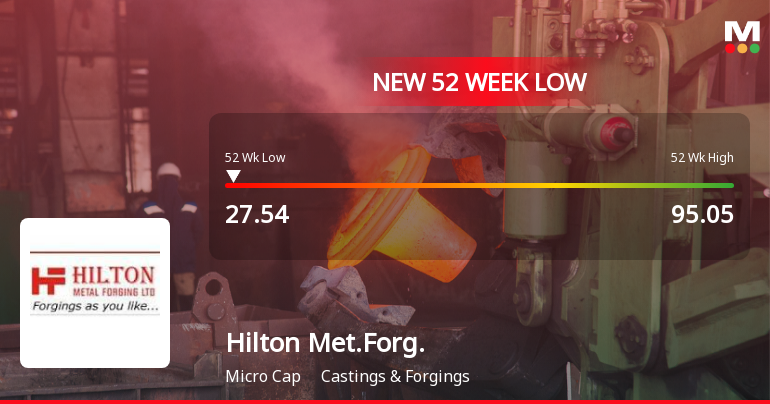

Hilton Metal Forging Ltd Falls to 52-Week Low of Rs.27.54 Amidst Continued Underperformance

2026-01-28 09:50:16Hilton Metal Forging Ltd’s stock touched a fresh 52-week low of Rs.27.54 today, marking a significant milestone in its ongoing decline. Despite a slight rebound after four consecutive days of losses, the share price remains substantially below key moving averages, reflecting persistent pressures on the company’s market valuation.

Read full news article

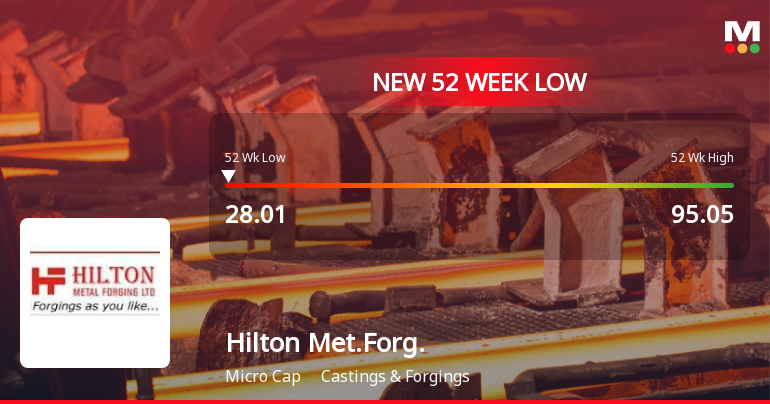

Hilton Metal Forging Ltd Falls to 52-Week Low of Rs.28.12 Amid Continued Downtrend

2026-01-19 09:57:14Hilton Metal Forging Ltd touched a fresh 52-week low of Rs.28.12 today, marking a significant decline in its share price amid sustained downward momentum. The stock has underperformed both its sector and broader market indices, reflecting ongoing concerns about its financial metrics and valuation.

Read full news article

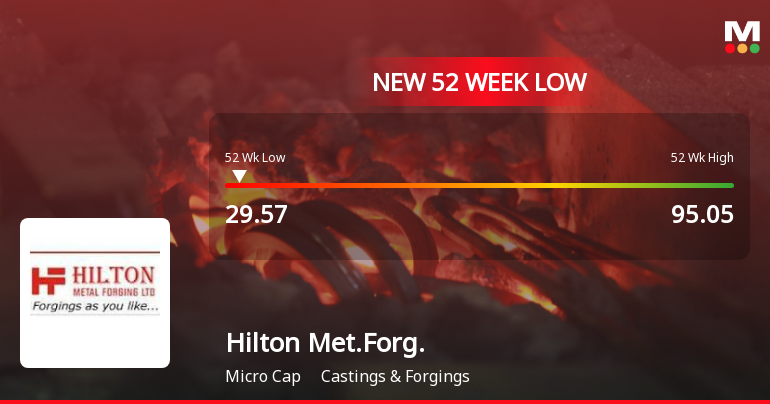

Hilton Metal Forging Ltd Falls to 52-Week Low of Rs.29.57

2026-01-12 12:24:51Hilton Metal Forging Ltd’s stock declined to a fresh 52-week low of Rs.29.57 on 12 Jan 2026, marking a significant milestone in its ongoing downward trajectory. The stock has experienced a sustained fall over the past three days, shedding 9.29% in returns during this period, reflecting persistent pressures within the Castings & Forgings sector.

Read full news article

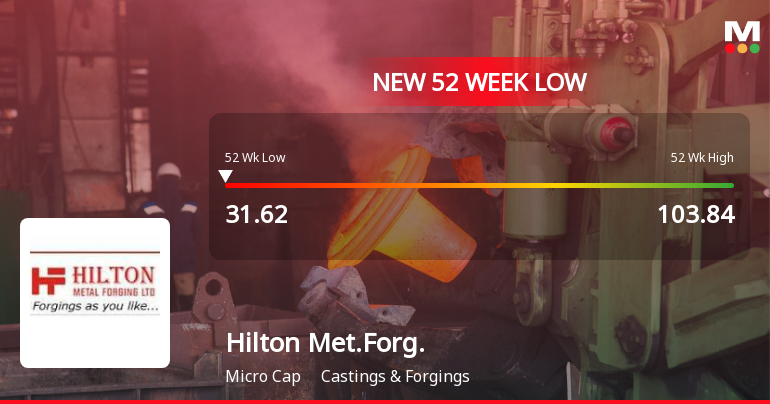

Hilton Metal Forging Ltd Falls to 52-Week Low Amidst Continued Downtrend

2026-01-09 12:42:24Hilton Metal Forging Ltd has reached a new 52-week low of Rs.31.62 today, marking a significant decline in its stock price amid ongoing market pressures and company-specific factors. The stock has underperformed its sector and broader market indices, reflecting persistent challenges in its financial and valuation metrics.

Read full news article

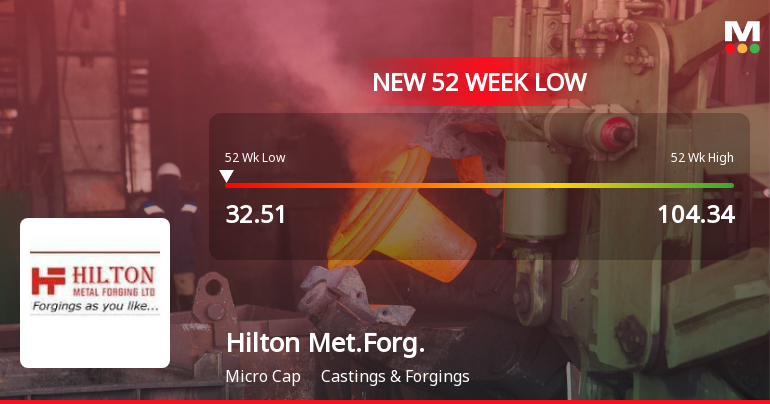

Hilton Metal Forging Ltd Stock Hits 52-Week Low Amidst Continued Downtrend

2026-01-08 14:23:07Hilton Metal Forging Ltd’s stock declined sharply today, hitting a fresh 52-week low of Rs.32.51, marking a significant milestone in its ongoing downward trajectory. The stock underperformed its sector by 2.33% and closed the day down 3.82%, reflecting persistent pressures on the company’s market valuation.

Read full news articleHilton Metal Forging Limited - Reply to Clarification Sought

22-Nov-2019 | Source : NSEHilton Metal Forging Limitedg Limited with respect to announcement dated 11-Nov-2019, regarding Board meeting held on November 11, 2019. On basis of above the Company was required to clarify following: 1. Confirmation from Independent Director that there are no material reasons other than that provided 2. Detailed Reasons for Resignation. The response of the Company is attached.

Hilton Metal Forging Limited - Clarification

18-Nov-2019 | Source : NSEHilton Metal Forging Limited with respect to announcement dated 11-Nov-2019, regarding Board meeting held on November 11, 2019. On basis of above the Company is required to clarify following: 1. Confirmation from Independent Director that there are no material reasons other than that provided 2. Detailed Reasons for Resignation. The response of the Company is awaited.

Hilton Metal Forging Limited - Updates

13-Nov-2019 | Source : NSEHilton Metal Forging Limited has informed the Exchange regarding 'Newspaper Publication of Unaudited Financial Results for September quarter'.

Corporate Actions

(04 Feb 2026)

Hilton Metal Forging Ltd has declared 2% dividend, ex-date: 21 Sep 15

No Splits history available

No Bonus history available

Hilton Metal Forging Ltd has announced 14:29 rights issue, ex-date: 26 Dec 25