Key Events This Week

Jan 19: Stock opens strong at Rs.651.70 (+2.83%) despite Sensex decline

Jan 20-21: Consecutive declines with Rs.629.35 and Rs.622.70 closes

Jan 22: Intraday low hit at Rs.566.65 amid 10% price drop and open interest surge

Jan 23: Strong quarterly results announced; stock closes at Rs.521.00 (-3.66%)

Has IIFL Finance Ltd declared dividend?

2026-01-23 23:30:48IIFL Finance Ltd has declared a dividend. Dividend Details: - Percentage announced: 200% - Amount per share: 4 - Ex-date: Jan-25-2024 Dividend Yield: 0% Total Returns by Period: In the last 3 months, the price return was 6.0%, the dividend return was 0.79%, resulting in a total return of 6.79%. Over the past 6 months, the price return was -2.37%, the dividend return was 0.81%, leading to a total return of -1.56%. In the last year, the price return was 34.85%, the dividend return was 1.14%, culminating in a total return of 35.99%. For the 2-year period, the price return was -13.95%, the dividend return was 0.69%, resulting in a total return of -13.26%. In the 3-year span, the price return was 12.63%, the dividend return was 1.69%, leading to a total return of 14.32%. Over the last 4 years, the price return was 74.74%, the dividend return was 3.92%, culminating in a total return of 78.66%. Finally, i...

Read full news articleAre IIFL Finance Ltd latest results good or bad?

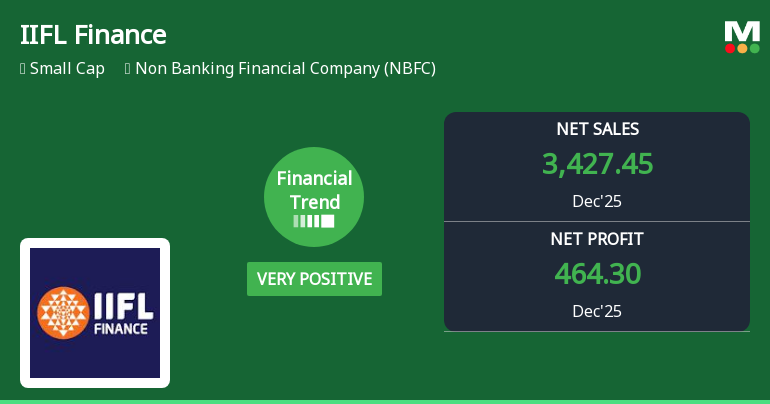

2026-01-23 19:15:22IIFL Finance Ltd's latest financial results for the quarter ending December 2025 reflect a significant recovery from the previous year's challenges. The company reported a consolidated net profit of ₹464.30 crores, marking a remarkable year-on-year growth of 1,040.79%, compared to a meager profit in the same quarter last year. This recovery is primarily attributed to strong interest income growth, which reached ₹3,427.45 crores, representing a 40.32% increase year-on-year. The operating margin, excluding other income, stood at 62.65%, showcasing a substantial improvement from the previous year, driven by operational efficiencies and controlled credit costs. The quarter-on-quarter performance also indicates positive momentum, with net profit advancing 23.38% from the prior quarter, supported by margin expansion and a disciplined approach to interest expenses. Despite these operational successes, the marke...

Read full news article

IIFL Finance Sees Surge in Put Option Activity Amid Mixed Technical Signals

2026-01-23 10:00:14IIFL Finance Ltd has emerged as the most active stock in put option trading this week, signalling heightened bearish sentiment and strategic hedging among investors. With a significant volume of put contracts traded at the ₹500 strike price expiring on 27 Jan 2026, market participants appear to be positioning cautiously despite the stock’s recent outperformance.

Read full news article

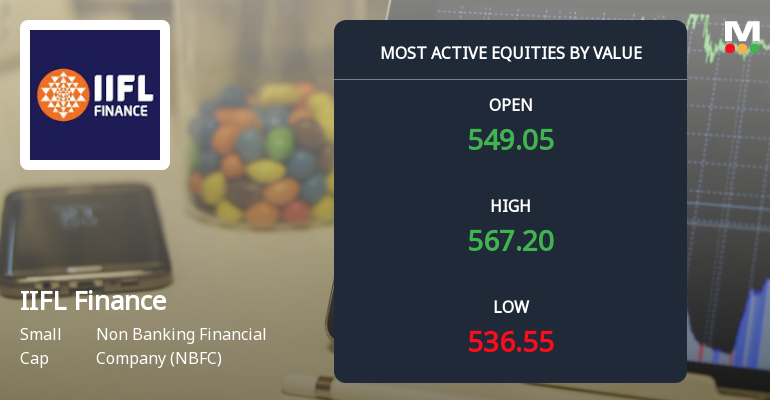

IIFL Finance Ltd Sees Robust Trading Activity Amid Institutional Interest

2026-01-23 10:00:14IIFL Finance Ltd, a prominent player in the Non Banking Financial Company (NBFC) sector, witnessed significant trading activity on 23 January 2026, emerging as one of the highest value turnover stocks on the day. The stock outperformed its sector peers and demonstrated strong institutional participation, signalling renewed investor confidence and a potential trend reversal after a brief period of decline.

Read full news article

IIFL Finance Ltd Technical Momentum Shifts Amid Market Volatility

2026-01-23 08:01:14IIFL Finance Ltd, a prominent player in the Non Banking Financial Company (NBFC) sector, has experienced a notable shift in its technical momentum as of January 2026. Despite a sharp one-day decline of 13.15% to close at ₹540.80, the stock’s broader technical indicators reveal a nuanced picture of evolving market sentiment and price dynamics.

Read full news article

IIFL Finance Ltd Reports Strongest Quarterly Performance Amid Market Volatility

2026-01-23 08:00:12IIFL Finance Ltd has delivered its most robust quarterly results to date for the December 2025 quarter, marking a significant turnaround in its financial trend from flat to very positive. The company’s revenue, profitability, and earnings per share have all surged to record highs, reflecting strong operational execution despite a challenging macroeconomic environment.

Read full news article