Recent Price Movement and Market Behaviour

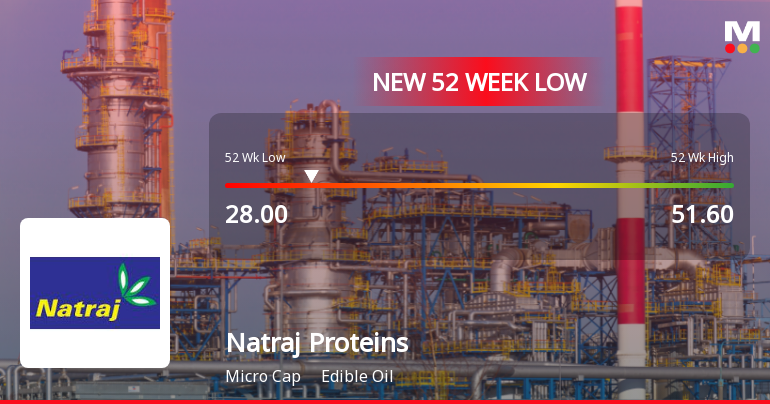

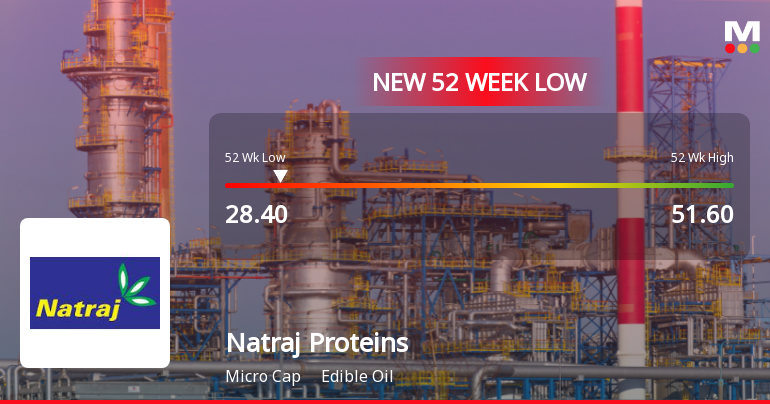

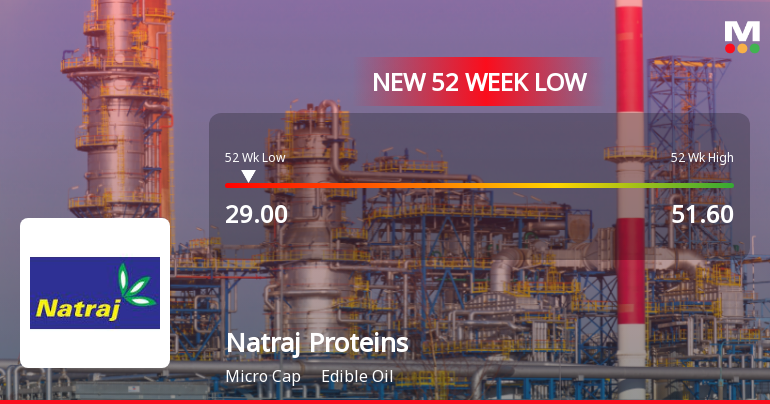

On 02-Mar, the stock opened with a gap down of 2.13%, signalling immediate bearish sentiment among investors. Throughout the trading session, the share price exhibited high volatility, with an intraday range of ₹3.6 and a low of ₹28.6, marking a 13.07% decline from previous levels. The weighted average price indicated that a larger volume of shares traded closer to the day’s low, underscoring selling pressure. This price action was accompanied by a notable drop in investor participation, with delivery volumes on 27 Feb falling by 65.59% compared to the five-day average, suggesting waning confidence among shareholders.

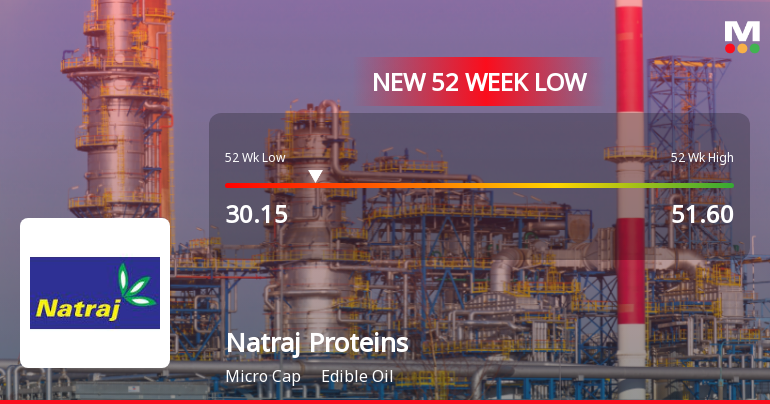

Furthermore, the stock has been on a downward trajectory for two consecutive days, losing 9.3% over this perio...

Read full news article