Key Events This Week

Jan 27: Q3 FY26 results reveal stellar profit surge

Jan 28: Company reports outstanding quarterly performance amid mixed market returns

Jan 30: Stock closes week at Rs.2,010.70, down 4.21% on the day

Mar 05

BSE+NSE Vol: 99

NBI Industrial Finance Company Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 27 January 2026. However, all fundamentals, returns, and financial metrics discussed here reflect the stock's current position as of 26 February 2026, providing investors with the most up-to-date analysis.

Read full news article

NBI Industrial Finance Company Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 27 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 15 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

NBI Industrial Finance Company Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 27 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 04 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Jan 27: Q3 FY26 results reveal stellar profit surge

Jan 28: Company reports outstanding quarterly performance amid mixed market returns

Jan 30: Stock closes week at Rs.2,010.70, down 4.21% on the day

Recent Price Performance and Market Comparison

Over the past week, NBI Industrial Finance’s stock has declined by 6.48%, significantly underperforming the Sensex, which gained 1.09% during the same period. The downward trend extends over longer horizons as well, with the stock falling 9.26% in the last month and 9.87% year-to-date, compared to the Sensex’s respective declines of 2.38% and 3.10%. Over the past year, the stock has generated a negative return of 11.33%, while the Sensex has appreciated by 8.91%. Even over three and five years, the stock’s cumulative returns of 28.07% and 21.71% lag behind the Sensex’s 43.47% and 85.71%, respectively. This persistent underperformance highlights investor caution and a lack of confidence relative to broader market indices.

<...

Read full news article

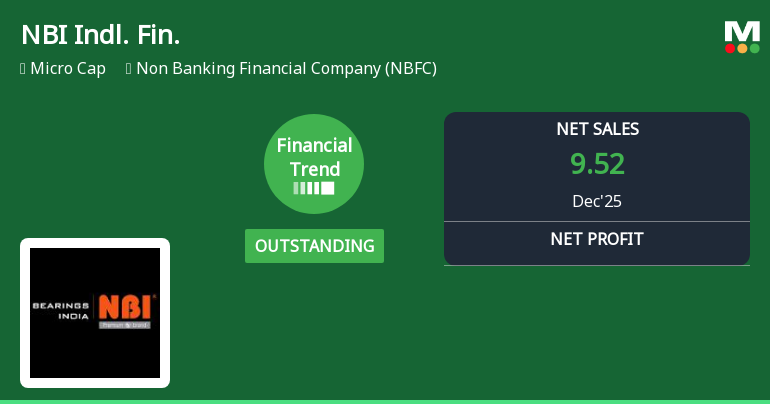

NBI Industrial Finance Company Ltd has delivered an outstanding quarterly performance for the period ended December 2025, marking a significant turnaround in its financial trend. The company reported record-high net sales, profitability, and earnings per share, signalling robust operational momentum despite a challenging broader market environment.

Read full news articleNBI Industrial Finance Company Ltd's latest financial results for Q3 FY26 reflect a significant surge in both net sales and net profit compared to the previous year. The company reported net sales of ₹9.52 crores, which represents a substantial year-on-year growth of 1,435.48%, up from ₹0.62 crores in Q3 FY25. Similarly, net profit reached ₹6.49 crores, marking an extraordinary year-on-year increase of 1,808.82% from ₹0.34 crores in the same quarter last year. The operating profit margin, excluding other income, was reported at 91.60%, indicating a strong capacity to generate profit from its core operations, although this is a slight compression from the previous quarter's margin. The company maintained minimal operating expenses, with employee costs remaining low at ₹0.60 crores for the quarter. Despite these impressive headline figures, the underlying operational quality raises concerns. The average re...

Read full news article

NBI Industrial Finance Company Ltd., a Kolkata-based non-banking financial company, reported a remarkable turnaround in its Q3 FY26 results, with net profit surging to ₹6.49 crores—a staggering 1808.82% year-on-year increase from ₹0.34 crores in Q3 FY25. However, the micro-cap NBFC's stock continued its bearish trajectory, trading at ₹2,139.00 with a market capitalisation of ₹622.00 crores, reflecting investor scepticism about the sustainability of this dramatic improvement.

Read full news article

NBI Industrial Finance Company Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 24 Nov 2025, reflecting a reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed here are current as of 24 January 2026, providing investors with the latest perspective on the company’s position.

Read full news article

| N. B. I. Industrial Finance Company Limited has submitted to the Exchange, the financial results for the period ended June 30, 2019. |

| N. B. I. Industrial Finance Company Limited has informed the Exchange that NSE mail ref : NSE/LIST/FR/89160IND ?? AS have become applicable to the Company w.e.f. 1st quarter of FY 2019-20. The Company has notified NSE that quarterly results for quarter ended 30th June 2019 would be submitted by 14th September i.e. within one month of the due date in accordance with SEBI Circular No. CIR/CFD/FAC/62/2016 dated July 05, 2016 after approval of our Board. NSE has been notified of deferment of submission of the results vide Notice dated 13.08.2019 filed in NEAPS App. No. 2019/Aug/4404/4562Thanks,Team NBI |

| N. B. I. Industrial Finance Company Limited has informed the Exchange regarding the Trading Window closure pursuant to SEBI (Prohibition of Insider Trading) Regulations, 2015 |

No Upcoming Board Meetings

NBI Industrial Finance Company Ltd has declared 10% dividend, ex-date: 14 Aug 25

NBI Industrial Finance Company Ltd has announced 5:10 stock split, ex-date: 07 Dec 17

No Bonus history available

No Rights history available