Persistent Downtrend and Market Underperformance

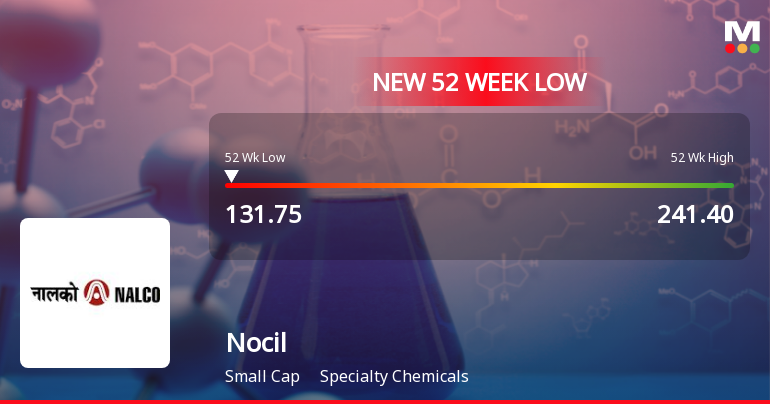

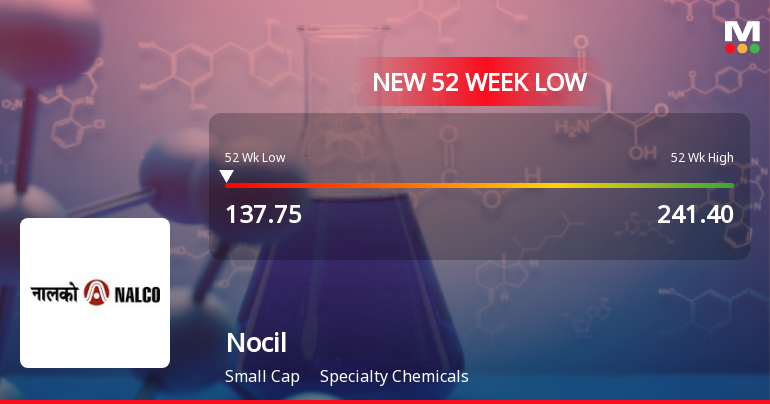

The stock has been on a consistent slide, losing value for six consecutive trading sessions and falling by 9.46% during this period. It also hit a fresh 52-week low of ₹134.35 on the day, underscoring the bearish sentiment among investors. When compared to the broader market, Nocil’s performance has been markedly weak. Over the past week, the stock declined by 5.53%, while the Sensex remained virtually flat with a marginal 0.01% change. This underperformance extends over longer horizons as well, with the stock falling 13.16% in the last month against the Sensex’s 1.31% decline, and a year-to-date drop of 12.31% compared to the benchmark’s 1.94% fall.

More strikingly, over the last year, Nocil’s shares have plummeted by 4...

Read full news article