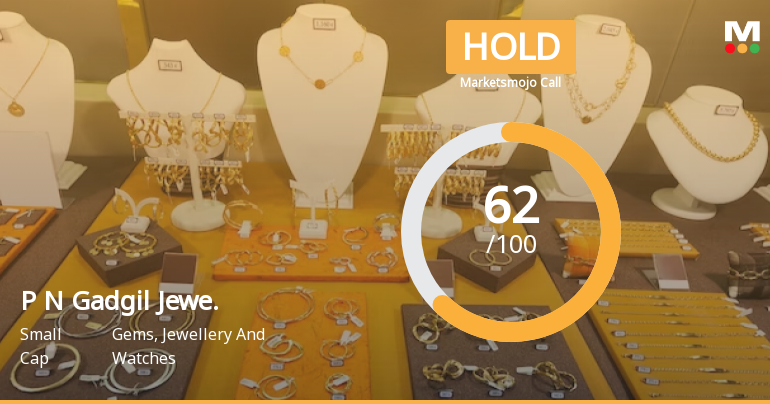

Recent Price Performance and Market Comparison

The stock has underperformed significantly against the broader market benchmark, the Sensex, over multiple time frames. Over the past week, P N Gadgil Jewellers Ltd’s shares have declined by 8.2%, compared to a relatively modest 1.86% fall in the Sensex. Similarly, the one-month and year-to-date returns for the stock stand at -3.37% and -3.28% respectively, both lagging behind the Sensex’s corresponding declines of -2.21% and -2.16%. Over the last year, while the Sensex has delivered a robust 9.0% gain, the company’s stock has fallen by 2.87%, highlighting a divergence from broader market gains.

Technical Indicators and Trading Activity

Technical analysis reveals that the stock is trading below all ...

Read full news article