Key Events This Week

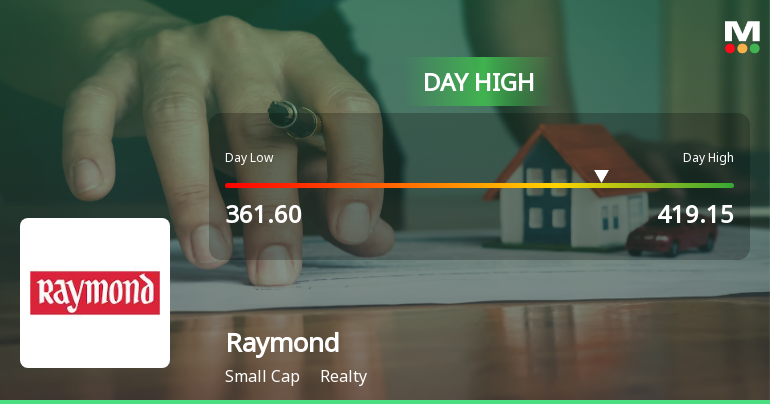

27 Jan: Stock hits 52-week low of Rs.361.6 and intraday high of Rs.419.15

27 Jan: Reports flat quarterly performance with margin gains but rising interest expenses

29 Jan: Stock declines 3.51% amid broader market gains

30 Jan: Week closes at Rs.379.75, up 2.75% for the week

Raymond Ltd is Rated Sell

2026-02-01 10:10:56Raymond Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 October 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news articleAre Raymond Ltd latest results good or bad?

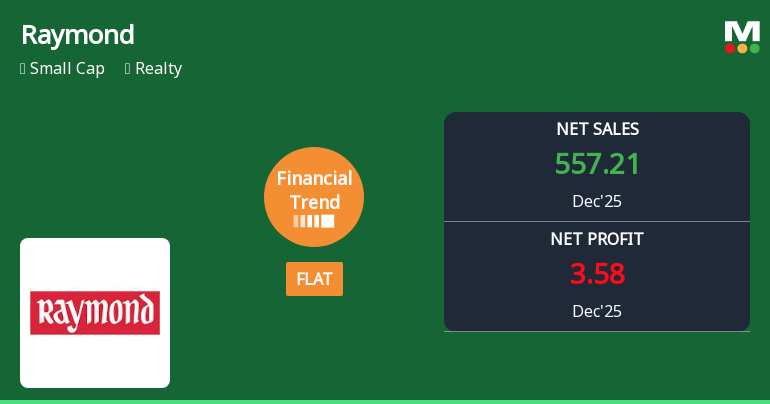

2026-01-27 19:12:37Raymond Ltd's latest financial results for Q3 FY26 present a complex picture of operational resilience juxtaposed with significant challenges in profitability. The company reported consolidated net sales of ₹557.21 crores, reflecting a year-on-year growth of 19.54%, marking the fourth consecutive quarter of double-digit revenue growth. This indicates a strong underlying demand in its textile and realty segments. Furthermore, operating margins, excluding other income, reached 10.76%, the highest in recent quarters, showcasing improved operational efficiency and cost management. However, the consolidated net profit was reported at just ₹3.58 crores, down 95.04% year-on-year, highlighting severe constraints on profitability, primarily due to exceptional items and tax adjustments. This stark contrast between the standalone profit of ₹7.23 crores and the consolidated figure raises concerns about the sustainabil...

Read full news article

Raymond Ltd Reports Flat Quarterly Performance Amid Margin Gains and Rising Interest Costs

2026-01-27 16:00:05Raymond Ltd's latest quarterly results for December 2025 reveal a stabilisation in financial performance after a period of decline, with flat revenue growth and notable margin expansion. However, rising interest expenses and subdued earnings per share continue to weigh on investor sentiment, prompting a downgrade in the company’s mojo grade to Sell.

Read full news article

Raymond Ltd Q3 FY26: Operational Gains Overshadowed by Exceptional Items and Structural Challenges

2026-01-27 14:34:55Raymond Ltd., the integrated textile and realty conglomerate with a market capitalisation of ₹2,582.40 crores, reported a consolidated net profit of ₹3.58 crores for Q3 FY26 ended December 2025, marking a dramatic 95.04% year-on-year decline from ₹72.13 crores in the corresponding quarter last year. The quarter-on-quarter performance was equally concerning, with consolidated net profit plunging 68.54% from ₹11.38 crores in Q2 FY26. The stock closed at ₹387.90 on January 27, 2026, up 4.95% on the day but down 50.40% from its 52-week high of ₹782.00, reflecting investor concerns about the company's deteriorating profitability despite operational improvements.

Read full news article

Raymond Ltd Hits Intraday High with Strong 8.78% Surge on 27 Jan 2026

2026-01-27 12:22:40Raymond Ltd demonstrated a robust intraday performance on 27 Jan 2026, surging to an intraday high of Rs 419.15, marking a 13.41% increase from its previous close. The stock outperformed its Realty sector peers and the broader market indices, reflecting heightened volatility and active trading throughout the session.

Read full news article

Raymond Ltd Stock Falls to 52-Week Low of Rs.361.6 Amidst Continued Underperformance

2026-01-27 10:04:56Raymond Ltd, a key player in the Realty sector, witnessed its stock price decline to a fresh 52-week low of Rs.361.6 today, marking a significant milestone in its ongoing downward trajectory. This new low reflects persistent pressures on the company’s market valuation amid subdued financial performance and sectoral headwinds.

Read full news article

Raymond Ltd Stock Hits 52-Week Low at Rs.376.9 Amidst Continued Downtrend

2026-01-23 09:44:21Raymond Ltd’s shares touched a fresh 52-week low of Rs.376.9 today, marking a significant decline amid ongoing pressures in the realty sector. The stock has underperformed its sector and benchmark indices, reflecting persistent headwinds and subdued financial performance over recent quarters.

Read full news article