Key Events This Week

2 Feb: Technical momentum shift to mildly bearish; stock closes at Rs.533.55 (-1.93%)

3 Feb: Hits upper circuit amid strong buying pressure; closes at Rs.560.00 (+4.96%)

4 Feb: Shift to mildly bullish technical momentum; closes at Rs.585.65 (+4.58%)

5 Feb: Profit-taking and concerns over promoter pledging; closes at Rs.575.60 (-1.72%)

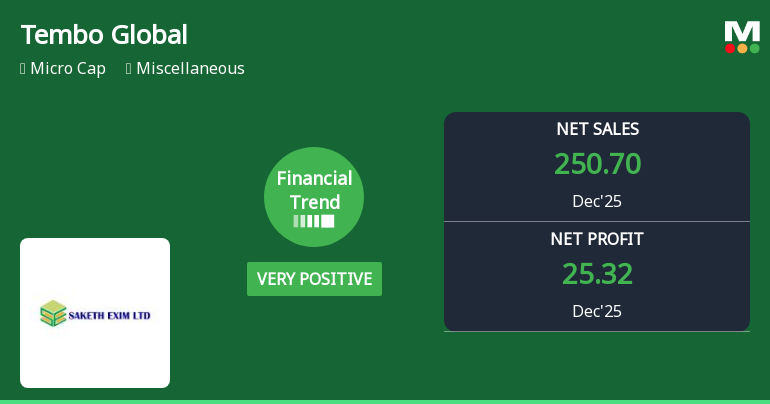

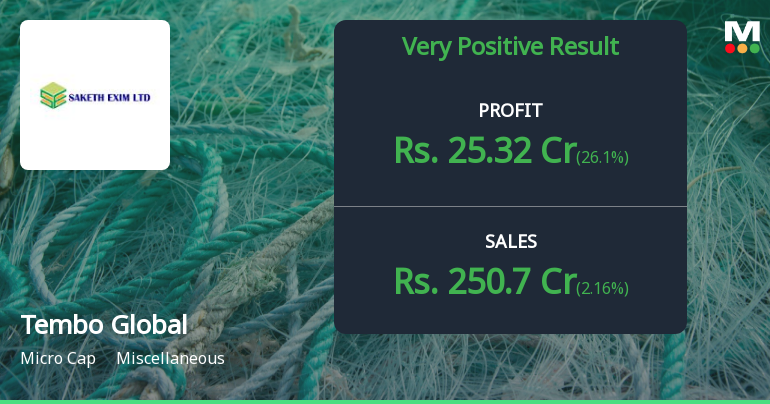

6 Feb: Reports strong quarterly growth; closes at Rs.572.30 (-0.57%)