Strong Price Momentum Amidst Market Volatility

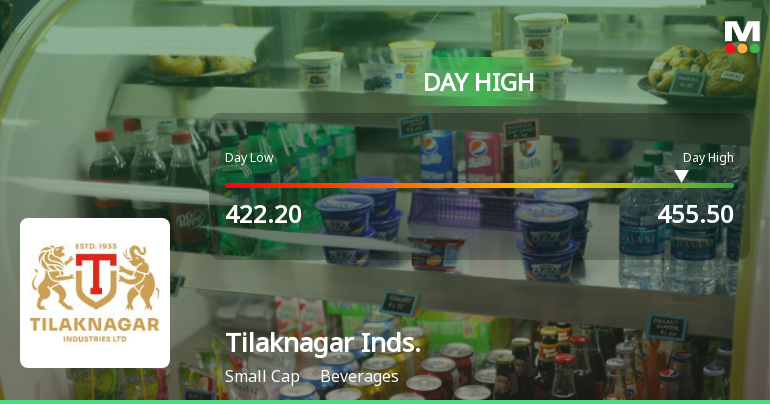

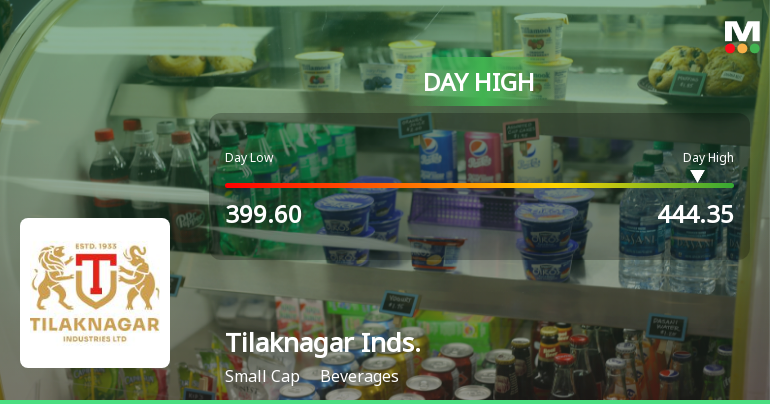

Tilaknagar Industries Ltd outperformed its sector and benchmark indices on 28-Jan, registering an intraday high of ₹444.35, a 10.53% increase from previous levels. The stock has been on an upward trajectory for two consecutive days, delivering an 11.91% return over this short span. This performance starkly contrasts with the broader market, where the Sensex recorded a modest 0.53% gain over the past week and a 3.37% decline year-to-date. Despite a one-month dip of 6.84%, the stock’s resilience is evident in its longer-term returns, having generated a remarkable 21.10% gain over the last year and an extraordinary 298.17% over three years, far outpacing the Sensex’s respective 8.49% and 38.79% returns.

Investor Parti...

Read full news article