Key Events This Week

2 Feb: Stock opens week at Rs.456.50 with 5.59% gain

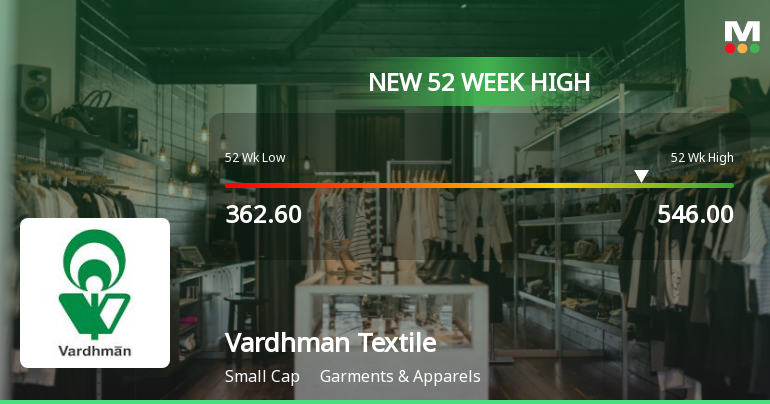

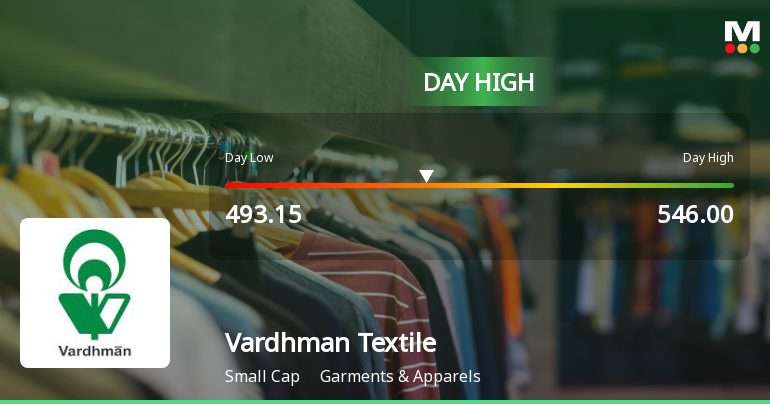

3 Feb: New 52-week high at Rs.546, strong gap up and intraday surge

4 Feb: Mojo Grade upgraded from Sell to Hold amid technical improvements

5 Feb: Minor price correction with low volume

6 Feb: Week closes at Rs.480.15, maintaining outperformance