Compare Reliance Communi with Similar Stocks

Dashboard

With a Negative Book Value, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of -17.98% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

Negative results in Sep 25

Risky - Negative EBITDA

Below par performance in long term as well as near term

Stock DNA

Telecom - Services

INR 293 Cr (Micro Cap)

NA (Loss Making)

38

0.00%

-0.48

0.22%

0.00

Total Returns (Price + Dividend)

Latest dividend: 0.25 per share ex-dividend date: Aug-14-2013

Risk Adjusted Returns v/s

Returns Beta

News

Reliance Communications Ltd is Rated Strong Sell

Reliance Communications Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 13 January 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 05 February 2026, providing investors with an up-to-date view of its fundamentals, valuation, financial trends, and technical outlook.

Read full news article

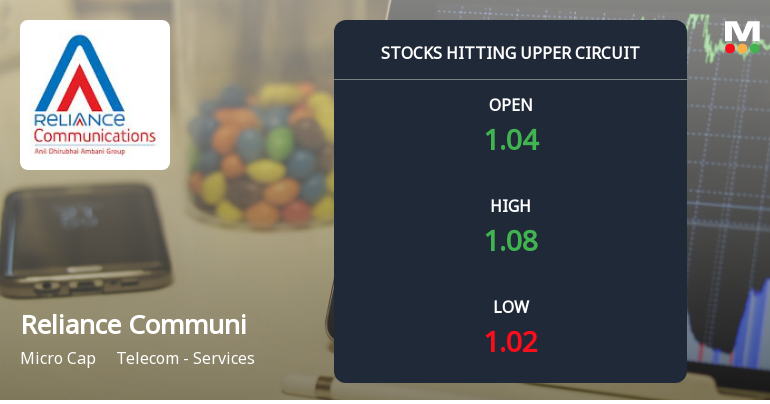

Reliance Communications Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Reliance Communications Ltd (RCom) surged to hit its upper circuit limit on 4 February 2026, propelled by robust buying interest and a maximum daily gain of 2.91%. The telecom services micro-cap stock demonstrated a notable rebound after two consecutive days of decline, outperforming its sector and broader market indices amid heightened investor enthusiasm.

Read full news article

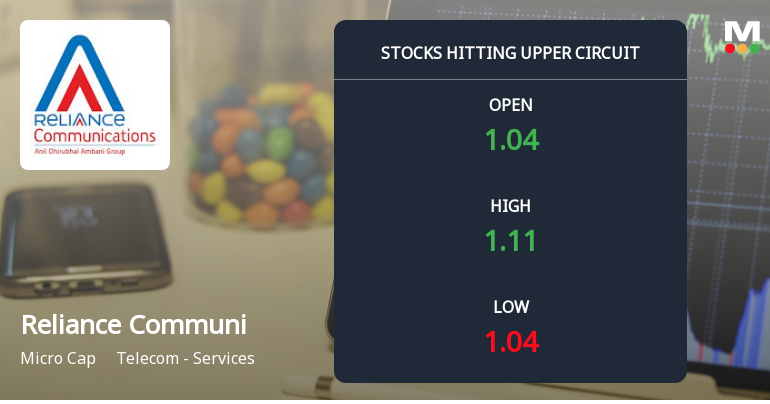

Reliance Communications Ltd Surges to Upper Circuit Amid Strong Buying Pressure

Reliance Communications Ltd (RCom) witnessed a robust rally on 1 Feb 2026, hitting its upper circuit limit of 5% and closing at ₹1.11, marking a significant 4.72% gain on the day. This surge was driven by intense buying pressure amid a backdrop of falling investor participation and a micro-cap valuation of ₹306.97 crore, signalling renewed interest despite lingering concerns in the telecom services sector.

Read full news article Announcements

Board Meeting Intimation for Unaudited Financial Results For The Quarter Ended December 31 2025

06-Feb-2026 | Source : BSEReliance Communications Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 13/02/2026 inter alia to consider and approve Unaudited financial results for the quarter ended December 31 2025

Corporate Insolvency Resolution Process (CIRP)-Intimation of meeting of Committee of Creditors

27-Jan-2026 | Source : BSENotice of Re-schedule of Committee of Creditors (CoC) meeting from Friday December 19 2025 to Thursday January 29 2026

Quarterly Disclosures By Listed Entities Of Defaults On Payment Of Interest/ Repayment Of Principal Amount On Loans From Banks / Financial Institutions And Unlisted Debt Securities

07-Jan-2026 | Source : BSEQuarterly Disclosures by listed entities of defaults on payment of interest/ repayment of principal amount on loans from banks / financial institutions and unlisted debt securities

Corporate Actions

13 Feb 2026

Reliance Communications Ltd has declared 5% dividend, ex-date: 14 Aug 13

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 27 Schemes (0.01%)

Held by 71 FIIs (0.07%)

Rwtipl Industries Private Limited (0.31%)

Life Insurance Corporation Of India (4.13%)

85.85%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 4.82% vs -4.60% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -5.51% vs -2.32% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -8.11% vs -6.09% in Sep 2024

Growth in half year ended Sep 2025 is -16.78% vs -48.96% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -6.53% vs -20.92% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -35.40% vs 59.70% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -6.53% vs -20.04% in Mar 2024

YoY Growth in year ended Mar 2025 is -30.19% vs 50.26% in Mar 2024