Compare Sejal Glass with Similar Stocks

Dashboard

High Debt company with Weak Long Term Fundamental Strength

- High Debt Company with a Debt to Equity ratio (avg) at 4.52 times

- The company has been able to generate a Return on Capital Employed (avg) of 5.85% signifying low profitability per unit of total capital (equity and debt)

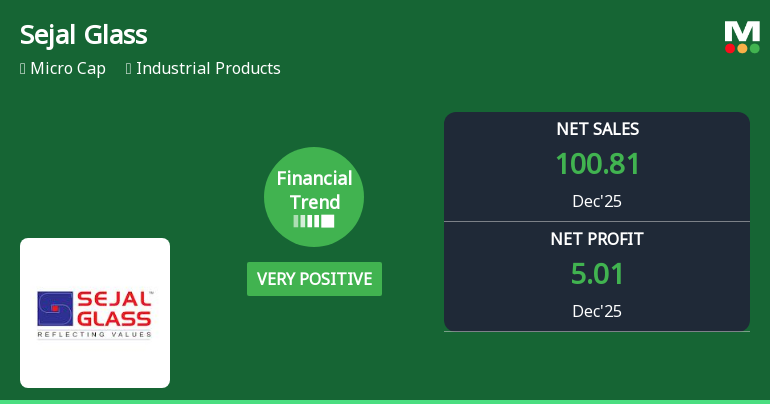

With a growth in Net Sales of 63.63%, the company declared Very Positive results in Dec 25

With ROCE of 13.4, it has a Expensive valuation with a 3.9 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Industrial Products

INR 839 Cr (Micro Cap)

40.00

20

0.00%

3.95

35.32%

15.94

Total Returns (Price + Dividend)

Latest dividend: 0.6 per share ex-dividend date: Sep-16-2008

Risk Adjusted Returns v/s

Returns Beta

News

Are Sejal Glass Ltd latest results good or bad?

Sejal Glass Ltd's latest financial results for the quarter ending December 2025 reveal a complex picture of growth and challenges. The company reported consolidated net profit of ₹5.01 crores, which reflects a notable year-on-year growth of 48.66% compared to the same quarter last year. However, this figure represents a decline of 37.61% on a quarter-on-quarter basis, indicating a significant drop in profitability from the previous quarter. Net sales for the same period reached ₹100.81 crores, marking a substantial year-on-year increase of 63.63%. This growth contrasts with a sequential decline of 3.06%, highlighting a potential softening in revenue after a period of strong performance. The profit after tax (PAT) margin decreased to 5.04%, down from 7.81% in the previous quarter, suggesting challenges in maintaining profitability amidst rising costs or competitive pressures. The nine-month performance for...

Read full news article

Sejal Glass Ltd Reports Very Positive Quarterly Financial Performance Amid Margin and Revenue Growth

Sejal Glass Ltd has demonstrated a marked improvement in its financial performance for the quarter ended December 2025, with robust revenue growth and margin expansion signalling a very positive shift in its financial trend. The company’s recent quarterly results reveal significant gains in key metrics such as net sales, profit before tax, and return on capital employed, positioning it favourably within the industrial products sector despite some headwinds from rising interest expenses.

Read full news article

Sejal Glass Ltd is Rated Hold

Sejal Glass Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 22 July 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 03 February 2026, providing investors with an up-to-date view of its fundamentals, returns, and market standing.

Read full news article Announcements

Board Meeting Outcome for Outcome Of Board Meeting Held On Monday February 02 2026

02-Feb-2026 | Source : BSESejal Glass Limited has informed the Exchange about Outcome of Board Meeting held on 02nd February 2026.

Clarification With Respect To Prior Intimation Of Board Meeting Dated January 27 2026.

28-Jan-2026 | Source : BSEWe wish to inform you that due to inadvertent typographical error The Company had mentioned Audited Standalone Financial Results along with Audit Report for the Quarter and Nine Months ended 31st December 2025 instead of Unaudited Standalone Financial Results along with Limited Review Report for the quarter and nine months ended 31st December 2025 This is for your information and records.

Board Meeting Intimation for Approval Of Quarterly Financial Results For The Period Ended December 31 2025 & Proposal For Issuance Of Equity Shares On Preferential Basis.

27-Jan-2026 | Source : BSESejal Glass Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 02/02/2026 inter alia to consider and approve 1) Audited Standalone Financial Results along with Audit Report for the Quarter and Nine Months ended 31st December 2025. 2) Unaudited Consolidated Financial Results along with Limited Review Report for the Quarter and Nine Months ended 31st December 2025. 3) Proposal for issuance of equity shares on a preferential basis to Non -Promoters Group for consideration other than cash

Corporate Actions

No Upcoming Board Meetings

Sejal Glass Ltd has declared 6% dividend, ex-date: 16 Sep 08

Sejal Glass Ltd has announced 10:1 stock split, ex-date: 09 Nov 11

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

0.1571

Held by 0 Schemes

Held by 2 FIIs (0.21%)

Trushti Enterprises Llp (32.18%)

Nitin Siddamsetty (1.55%)

24.52%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 63.63% vs 30.50% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 48.66% vs 233.66% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 58.45% vs 71.09% in Sep 2024

Growth in half year ended Sep 2025 is 223.76% vs 93.43% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 60.26% vs 54.28% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 141.81% vs 140.80% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 48.71% vs 252.79% in Mar 2024

YoY Growth in year ended Mar 2025 is 231.12% vs -57.83% in Mar 2024