Compare Skipper with Similar Stocks

Dashboard

Healthy long term growth as Net Sales has grown by an annual rate of 29.37% and Operating profit at 40.56%

With a growth in Net Profit of 39.67%, the company declared Very Positive results in Dec 25

With ROCE of 20.8, it has a Very Attractive valuation with a 2.4 Enterprise value to Capital Employed

Despite the size of the company, domestic mutual funds hold only 1.64% of the company

Stock DNA

Heavy Electrical Equipment

INR 4,116 Cr (Small Cap)

23.00

34

0.03%

0.58

13.59%

3.21

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-16-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Skipper Ltd latest results good or bad?

Skipper Ltd's latest financial results for Q2 FY26 present a mixed picture of operational performance. The company reported net sales of ₹1,261.79 crores, reflecting a year-on-year growth of 13.70%, which indicates sustained revenue momentum despite a modest sequential growth of 0.63%. This suggests that while Skipper is managing to maintain its market presence, the pace of expansion may be moderating as the fiscal year progresses. On the profitability front, net profit for the quarter was ₹37.03 crores, which shows a year-on-year increase of 12.45%. However, it experienced a sequential decline of 18.18%, raising concerns about earnings quality and sustainability. The PAT margin compressed to 2.93% from 3.61% in the previous quarter, primarily due to rising interest costs and a significant drop in other income, which decreased to ₹4.07 crores from ₹9.07 crores in the prior quarter. The operating margin, h...

Read full news article

Skipper Ltd Q2 FY26: Growth Momentum Meets Margin Pressure

Skipper Limited, the Kolkata-based heavy electrical equipment manufacturer, reported consolidated net profit of ₹37.03 crores for Q2 FY26, marking a sequential decline of 18.18% from Q1 FY26's ₹45.26 crores but delivering a healthy year-on-year growth of 12.45% from ₹32.93 crores in Q2 FY25. The company, which commands a market capitalisation of ₹4,116 crores, saw its stock decline 0.94% to ₹360.00 following the results announcement, reflecting investor concerns about sequential margin compression despite sustained top-line momentum.

Read full news article

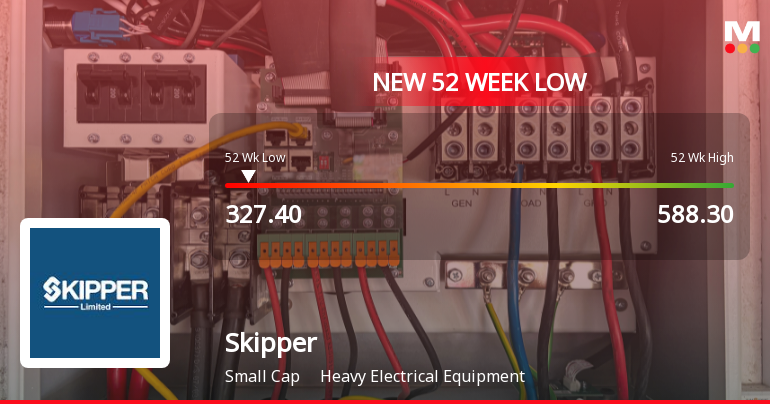

Skipper Ltd Stock Falls to 52-Week Low of Rs.331.35 Amid Market Underperformance

Skipper Ltd, a key player in the Heavy Electrical Equipment sector, touched a new 52-week low of Rs.331.35 today, marking a significant decline amid broader market movements and sectoral pressures. The stock has underperformed both its sector and the broader market indices over the past year, reflecting a challenging phase for the company’s share price.

Read full news article Announcements

Skipper Limited - Updates

14-Nov-2019 | Source : NSESkipper Limited has informed the Exchange regarding 'Newspaper Publication of Financial Results for the second quarter and half year ended 30 September 2019'.

Analysts\/Institutional Investor Meet\/Con. Call Updates

23-Sep-2019 | Source : NSE

| Skipper Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call UpdatesIn accordance to Regulation 30 of SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015, we hereby inform you that the Company??s executive will be attending Equirus MidCap Conference scheduled to be held on Tuesday, 24th September, 2019 at Mumbai.However the schedule is subject to change due to any exigencies. We request you to kindly take the above on record. |

Press Release

09-Sep-2019 | Source : NSE

| Skipper Limited has informed the Exchange regarding a press release dated September 09, 2019, titled "Skipper Limited emerges favourably placed in Project worth Rs. 524 Crores from PGCIL".This is to inform that the company has been favourably placed in a new turnkey project of Rs. 524 crores from Power Grid Corporation of India Limited (PGCIL) for Supply and Installation of 765kV, 190km Hexa Zebra Conductor Transmission Line from Fatehgarh2 to Bhadla2 under TBCB bidding conducted by PFC for Green Energy Corridor projects. A Press Release in this regard is attached herewith.Kindly take the same on record. |

Corporate Actions

No Upcoming Board Meetings

Skipper Ltd has declared 10% dividend, ex-date: 16 Sep 25

No Splits history available

No Bonus history available

Skipper Ltd has announced 1:10 rights issue, ex-date: 12 Jan 24

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 5 Schemes (0.55%)

Held by 51 FIIs (6.37%)

Skipper Plastics Limited (17.75%)

The Prudential Assurance Company Limited (2.07%)

16.64%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 20.73% vs 41.63% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 46.27% vs 76.31% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 14.27% vs 65.91% in Sep 2024

Growth in half year ended Sep 2025 is 25.91% vs 81.33% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 16.47% vs 56.76% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 33.15% vs 79.51% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 40.90% vs 65.73% in Mar 2024

YoY Growth in year ended Mar 2025 is 82.87% vs 129.60% in Mar 2024