Compare UCO Bank with Similar Stocks

Dashboard

Strong lending practices with low Gross NPA ratio of 2.41%

Strong Long Term Fundamental Strength with a 90.72% CAGR growth in Net Profits

Healthy long term growth as Net profit has grown by an annual rate of 90.72%

The company has declared Positive results for the last 7 consecutive quarters

With ROA of 0.7, it has a Very Attractive valuation with a 1.1 Price to Book Value

Majority shareholders : Promoters

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 0.3 per share ex-dividend date: May-09-2025

Risk Adjusted Returns v/s

Returns Beta

News

UCO Bank is Rated Hold by MarketsMOJO

UCO Bank is rated 'Hold' by MarketsMOJO, a rating that was last updated on 16 September 2025. However, the analysis and financial metrics discussed here reflect the bank's current position as of 11 February 2026, providing investors with the most up-to-date insight into the stock's fundamentals, valuation, financial trends, and technical outlook.

Read full news article

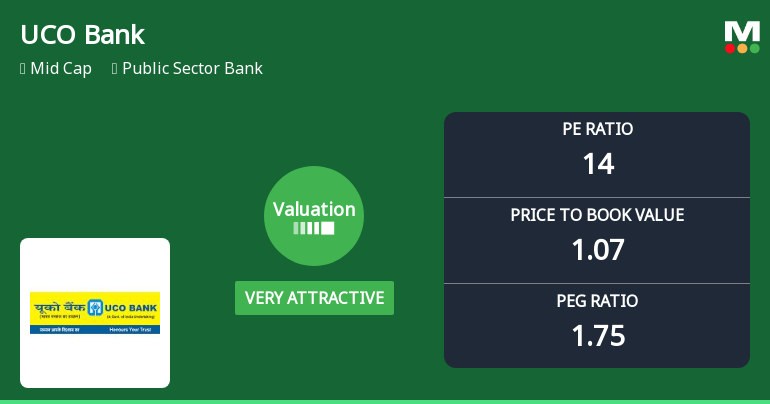

UCO Bank Valuation Shifts to Very Attractive Amid Mixed Market Performance

UCO Bank’s valuation metrics have undergone a significant transformation, shifting from merely attractive to very attractive territory, as reflected in its price-to-earnings (P/E) and price-to-book value (P/BV) ratios. This recalibration comes amid a challenging macroeconomic backdrop and mixed sectoral performance, prompting investors to reassess the bank’s price attractiveness relative to its peers and historical benchmarks.

Read full news article

UCO Bank is Rated Hold by MarketsMOJO

UCO Bank is rated 'Hold' by MarketsMOJO, a rating that was last updated on 16 September 2025. However, the analysis and financial metrics discussed here reflect the bank’s current position as of 31 January 2026, providing investors with an up-to-date perspective on its fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Strikes /Lockouts / Disturbances

11-Feb-2026 | Source : BSENotice of Strike by AIBEA BEFI and AIBOA

Announcement under Regulation 30 (LODR)-Interest Rates Updates

10-Feb-2026 | Source : BSEUpdate on Benchmark Rates of the Bank

Convening Of Extraordinary General Meeting (EGM) And Notice Of Specified/Cut-Off Date For Election Of Shareholder Director

07-Feb-2026 | Source : BSEConvening of EGM and Notice of Cut-off date for election

Corporate Actions

No Upcoming Board Meetings

UCO Bank has declared 3% dividend, ex-date: 09 May 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 20 Schemes (0.25%)

Held by 18 FIIs (0.13%)

President Of India (90.95%)

Life Insurance Corporation Of India (2.31%)

4.08%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 1.75% vs 1.57% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 19.32% vs 2.03% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 7.2% vs 15.89% in Sep 2024

Growth in half year ended Sep 2025 is 6.37% vs 84.55% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 7.11% vs 14.55% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 9.72% vs 58.92% in Dec 2024