Compare Garden Reach Sh. with Similar Stocks

Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 20.10%

- Healthy long term growth as Net Sales has grown by an annual rate of 40.34% and Operating profit at 72.90%

- Company has a low Debt to Equity ratio (avg) at 0 times

The company has declared Positive results for the last 4 consecutive quarters

With ROE of 30, it has a Very Expensive valuation with a 12 Price to Book Value

Falling Participation by Institutional Investors

Stock DNA

Aerospace & Defense

INR 27,840 Cr (Small Cap)

40.00

44

1.09%

-1.36

30.01%

12.17

Total Returns (Price + Dividend)

Latest dividend: 7.1 per share ex-dividend date: Feb-03-2026

Risk Adjusted Returns v/s

Returns Beta

News

Garden Reach Shipbuilders & Engineers Ltd Faces Bearish Momentum Amid Technical Downgrade

Garden Reach Shipbuilders & Engineers Ltd (GRSE), a key player in the Aerospace & Defense sector, has recently experienced a notable shift in its technical momentum, moving from a mildly bearish stance to a more pronounced bearish trend. This change is reflected across multiple technical indicators including MACD, RSI, moving averages, and Bollinger Bands, signalling a cautious outlook for investors amid a 3.27% decline in the stock price on 6 Feb 2026.

Read full news article

Garden Reach Shipbuilders & Engineers Ltd is Rated Hold

Garden Reach Shipbuilders & Engineers Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 13 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

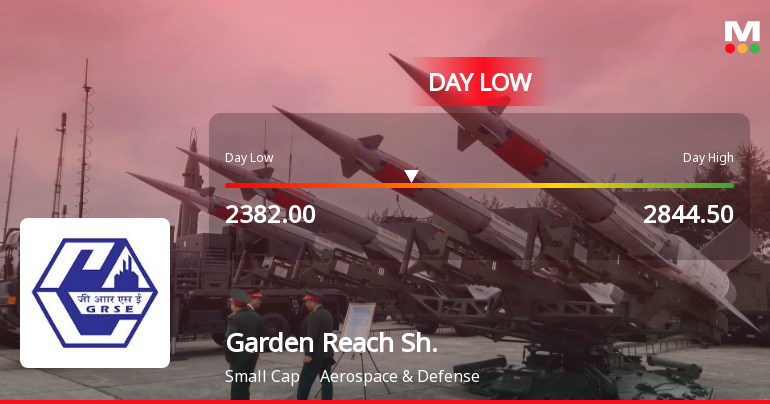

Garden Reach Shipbuilders & Engineers Ltd Hits Intraday Low Amid Price Pressure

Shares of Garden Reach Shipbuilders & Engineers Ltd experienced a notable decline on 1 Feb 2026, hitting an intraday low of Rs 2,589.75 as the stock faced significant price pressure amid a broader market downturn and sector weakness.

Read full news article Announcements

Garden Reach Shipbuilders & Engineers Limited - Analysts/Institutional Investor Meet/Con. Call Updat

05-Dec-2019 | Source : NSEGarden Reach Shipbuilders & Engineers Limited Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates.

Garden Reach Shipbuilders & Engineers Limited - Other General Purpose

13-Nov-2019 | Source : NSEGarden Reach Shipbuilders & Engineers Limited has informed the Exchange regarding Disclosure of related party transactions for the half year ended September 30, 2019.

Garden Reach Shipbuilders & Engineers Limited - Outcome of Board Meeting

31-Oct-2019 | Source : NSEGarden Reach Shipbuilders & Engineers Limited has informed the Exchange regarding Board meeting held on October 31, 2019.áIn terms of Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, please find enclosed herewith the following:

Corporate Actions

No Upcoming Board Meetings

Garden Reach Shipbuilders & Engineers Ltd has declared 71% dividend, ex-date: 03 Feb 26

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 22 Schemes (1.44%)

Held by 110 FIIs (2.96%)

The President Of India (74.5%)

None

18.36%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 13.01% vs 28.06% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 11.04% vs 27.97% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 38.13% vs 30.77% in Sep 2024

Growth in half year ended Sep 2025 is 48.11% vs 17.50% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 42.21% vs 33.25% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 57.06% vs 15.26% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 41.28% vs 40.27% in Mar 2024

YoY Growth in year ended Mar 2025 is 47.62% vs 56.61% in Mar 2024