Compare GMM Pfaudler with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 16.43%

Healthy long term growth as Net Sales has grown by an annual rate of 39.37%

With ROCE of 14.6, it has a Very Attractive valuation with a 2.8 Enterprise value to Capital Employed

High Institutional Holdings at 34.03%

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Industrial Manufacturing

INR 4,424 Cr (Small Cap)

38.00

31

0.20%

0.49

9.76%

3.74

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Nov-17-2025

Risk Adjusted Returns v/s

Returns Beta

News

GMM Pfaudler Ltd Technical Momentum Shifts Amid Bearish Trends

GMM Pfaudler Ltd, a key player in the industrial manufacturing sector, has experienced a notable shift in its technical momentum, reflecting a complex interplay of bearish and mildly bullish signals. Despite a modest day gain of 0.30%, the stock’s broader technical indicators reveal a cautious outlook, with several key metrics signalling a transition from bearish to mildly bearish trends.

Read full news article

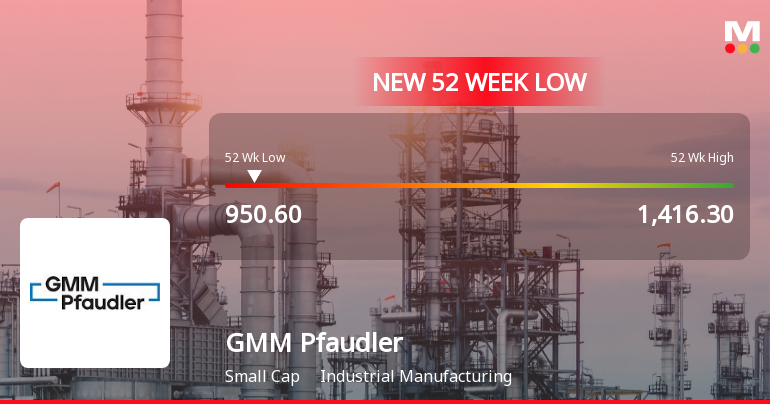

GMM Pfaudler Ltd Stock Falls to 52-Week Low of Rs.950.6 Amidst Market Pressure

GMM Pfaudler Ltd’s stock touched a fresh 52-week low of Rs.950.6 today, marking a significant decline amid broader market fluctuations and sectoral pressures. This new low reflects ongoing challenges in the industrial manufacturing sector and the stock’s continued underperformance relative to key benchmarks.

Read full news article

GMM Pfaudler Ltd is Rated Hold by MarketsMOJO

GMM Pfaudler Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 02 Jan 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 27 January 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

30-Jan-2026 | Source : BSEEarnings call on financial results for the third quarter and nine months ended December 31 2025 is scheduled to be held on Friday February 6 2026 at 18.00 hrs

Board Meeting Intimation for Approval Of Unaudited Standalone & Consolidated Financial Results For The Quarter And Nine Months Ended December 31 2025.

23-Jan-2026 | Source : BSEGMM Pfaudler Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 06/02/2026 inter alia to consider and approve Unaudited Standalone & Consolidated Financial Results for the quarter and nine months ended December 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

15-Jan-2026 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulation 2018 for the quarter ended December 31 2025.

Corporate Actions

06 Feb 2026

GMM Pfaudler Ltd has declared 50% dividend, ex-date: 17 Nov 25

GMM Pfaudler Ltd has announced 2:10 stock split, ex-date: 20 Oct 06

GMM Pfaudler Ltd has announced 2:1 bonus issue, ex-date: 11 Jul 22

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 13 Schemes (14.06%)

Held by 114 FIIs (17.73%)

Millars Machinery Company Pvt Ltd. (9.7%)

Hdfc Small Cap Fund (9.66%)

25.67%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 12.03% vs -14.09% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 172.21% vs -77.72% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.68% vs -14.01% in Sep 2024

Growth in half year ended Sep 2025 is 23.66% vs -64.25% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -11.59% vs 17.05% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -43.18% vs 15.36% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -7.19% vs 8.46% in Mar 2024

YoY Growth in year ended Mar 2025 is -69.81% vs 7.32% in Mar 2024