Compare Kirl.Pneumatic with Similar Stocks

Dashboard

Low Debt Company with Strong Long Term Fundamental Strength

- Healthy long term growth as Operating profit has grown by an annual rate 46.19%

- Company has a low Debt to Equity ratio (avg) at 0 times

- The company has been able to generate a Return on Capital Employed (avg) of 26.65% signifying high profitability per unit of total capital (equity and debt)

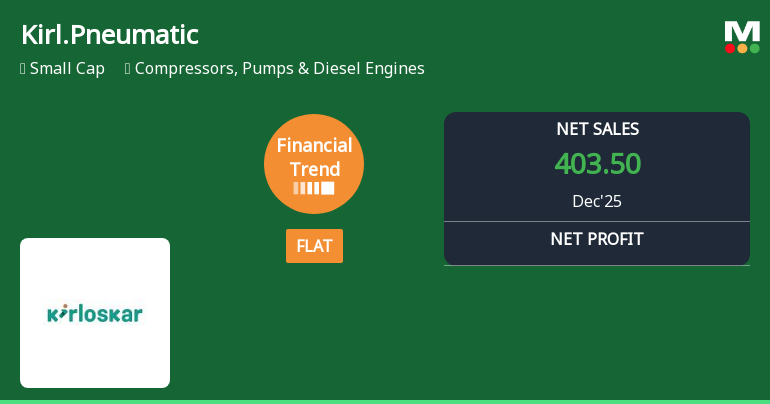

Flat results in Dec 25

With ROE of 18.5, it has a Very Expensive valuation with a 6.7 Price to Book Value

High Institutional Holdings at 35.03%

Stock DNA

Compressors, Pumps & Diesel Engines

INR 7,721 Cr (Small Cap)

36.00

30

1.17%

-0.38

18.52%

6.58

Total Returns (Price + Dividend)

Latest dividend: 3.5 per share ex-dividend date: Jan-30-2026

Risk Adjusted Returns v/s

Returns Beta

News

Kirloskar Pneumatic Company Ltd Reports Stabilised Financial Trend Amid Mixed Market Returns

Kirloskar Pneumatic Company Ltd has reported a flat financial performance for the quarter ended December 2025, signalling a stabilisation after a period of negative trends. The company’s recent quarterly results show a notable improvement in profitability metrics, with a 23.4% growth in profit before tax (PBT) excluding other income, while operational margins have remained steady. This development comes amid a broader market environment where the stock has experienced mixed returns compared to the Sensex over various time horizons.

Read full news article

Kirloskar Pneumatic Company Ltd is Rated Hold

Kirloskar Pneumatic Company Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 23 January 2026. While the rating was revised on that date, the analysis and financial metrics discussed here reflect the company’s current position as of 26 January 2026.

Read full news articleAre Kirloskar Pneumatic Company Ltd latest results good or bad?

Kirloskar Pneumatic Company Ltd's latest financial results for the quarter ending December 2025 reflect a mixed performance. The company reported net sales of ₹406.90 crores, marking an 18.77% increase year-on-year, which indicates strong demand across its product portfolio. Sequentially, net sales also grew by 5.31%, suggesting ongoing revenue momentum. However, the net profit for the same quarter was ₹42.20 crores, which represents a slight decline of 2.99% compared to the previous quarter, although it reflects a year-on-year growth of 15.93%. This decline in sequential profit is attributed to increased tax expenses, which rose significantly, impacting the overall profitability despite the revenue growth. Operating margins showed a marginal contraction, falling to 15.02% from 15.14% in the previous quarter, indicating persistent cost pressures likely due to raw material inflation and rising employee cos...

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

Kirloskar Pneumatic Company Ltd has declared 175% dividend, ex-date: 30 Jan 26

Kirloskar Pneumatic Company Ltd has announced 2:10 stock split, ex-date: 26 Sep 18

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 21 Schemes (26.74%)

Held by 101 FIIs (6.73%)

Rahul Chandrakant Kirloskar As Individual, As A Karta Of Rahul C Kirloskar Huf And As A Trustee Of C (11.54%)

Tata Mutual Fund - A/c Tata Small Cap Fund & Others (7.84%)

19.56%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 18.68% vs 10.20% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 19.72% vs 3.03% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.74% vs 25.61% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -12.27% vs 78.51% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period